EUR/JPY Price Analysis: Bearish divergence hints at further weakness

- EUR/JPY is showing acute bearish divergence on the weekly chart compared to 2023.

- This indicates the potential for a pullback on the horizon.

- A negative close next week would provide further evidence of a correction forming.

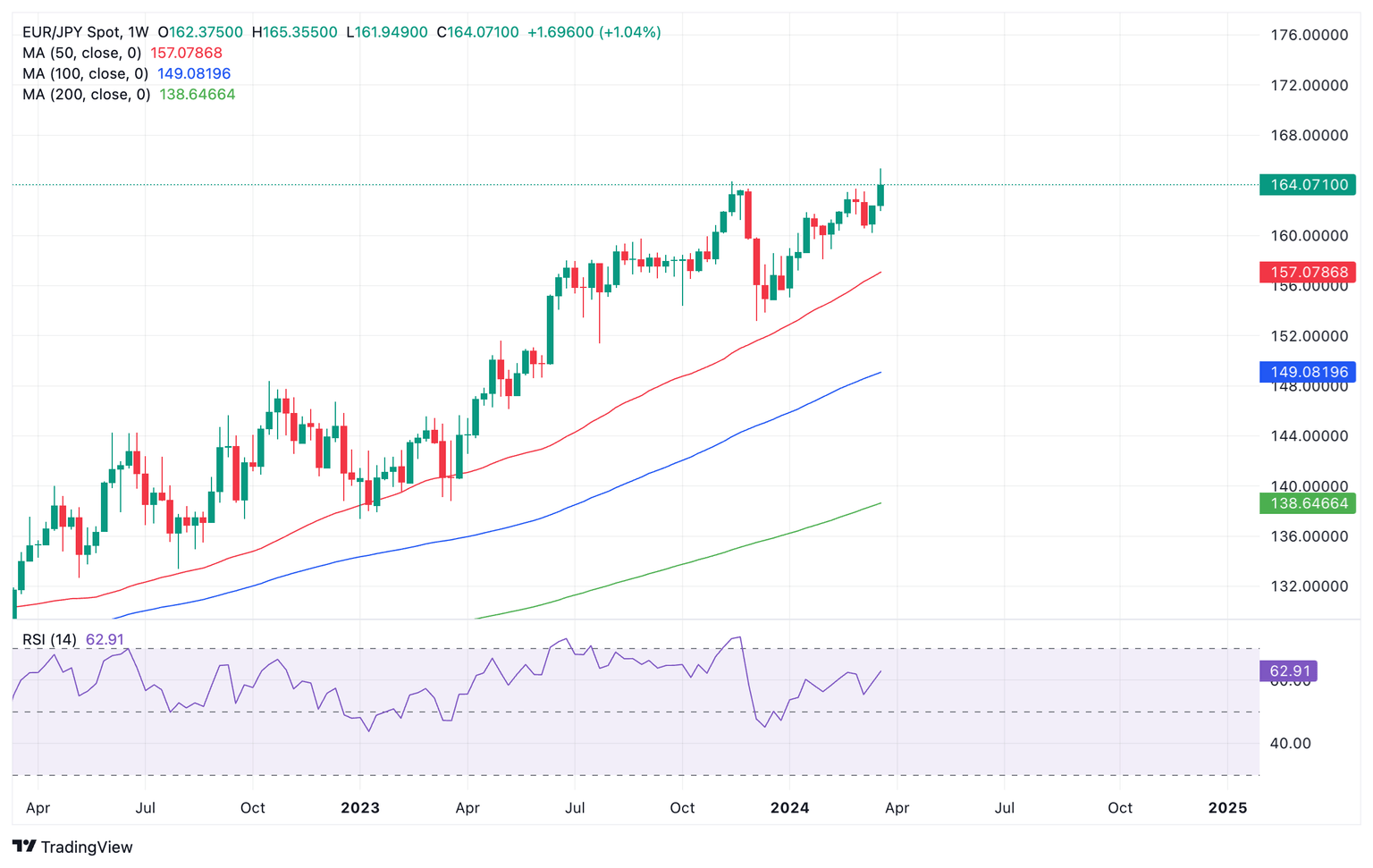

EUR/JPY is in a long-term uptrend distinguished by the rising peaks and troughs in price on the weekly chart.

The pair’s price has formed a bearish divergence with the Relative Strength Index (RSI) in the current week when compared with the similar high in November 2023.

Euro versus Japanese Yen: Weekly chart

Divergence occurs when price reaches a higher high but the RSI fails to follow. It is a sign of underlying weakness in the asset price and a precursor to a possible correction. In the case of EUR/JPY the new multi-year high reached this week was not accompanied by a higher high in the RSI when compared with the high in November 2023.

The divergence is quite acute suggesting a stronger possibility it could indicate a subsequent bearish pullback in price.

A natural target for a pullback if it develops would be the red 50-week Simple Moving Average (SMA) at 157.080.

If the next week is bearish that would add credence to the view there will be a correction signaled by the divergence.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.