EUR/JPY Price Analysis: Above 144.00 comes the 2022 high

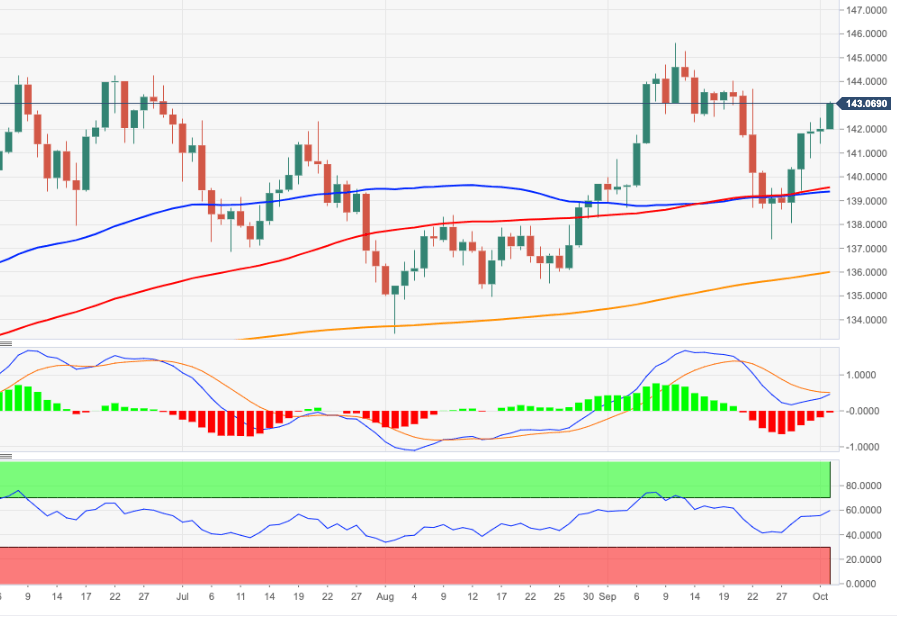

- EUR/JPY extends the sharp bounce beyond the 143.00 mark.

- The breakout of 144.04 should open the door to the YTD high.

EUR/JPY remains well bid and trades in multi-session peaks above the 143.00 yardstick on Tuesday.

The continuation of the rebound from last week’s lows remains well in place for the time being. That said, if the cross breaks above the weekly top at 144.04 (September 20), it could then challenge the 2022 peak at 145.63 (September 12).

In the meantime, while above the key 200-day SMA at 135.97, the constructive outlook for the cross should remain unchanged.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.