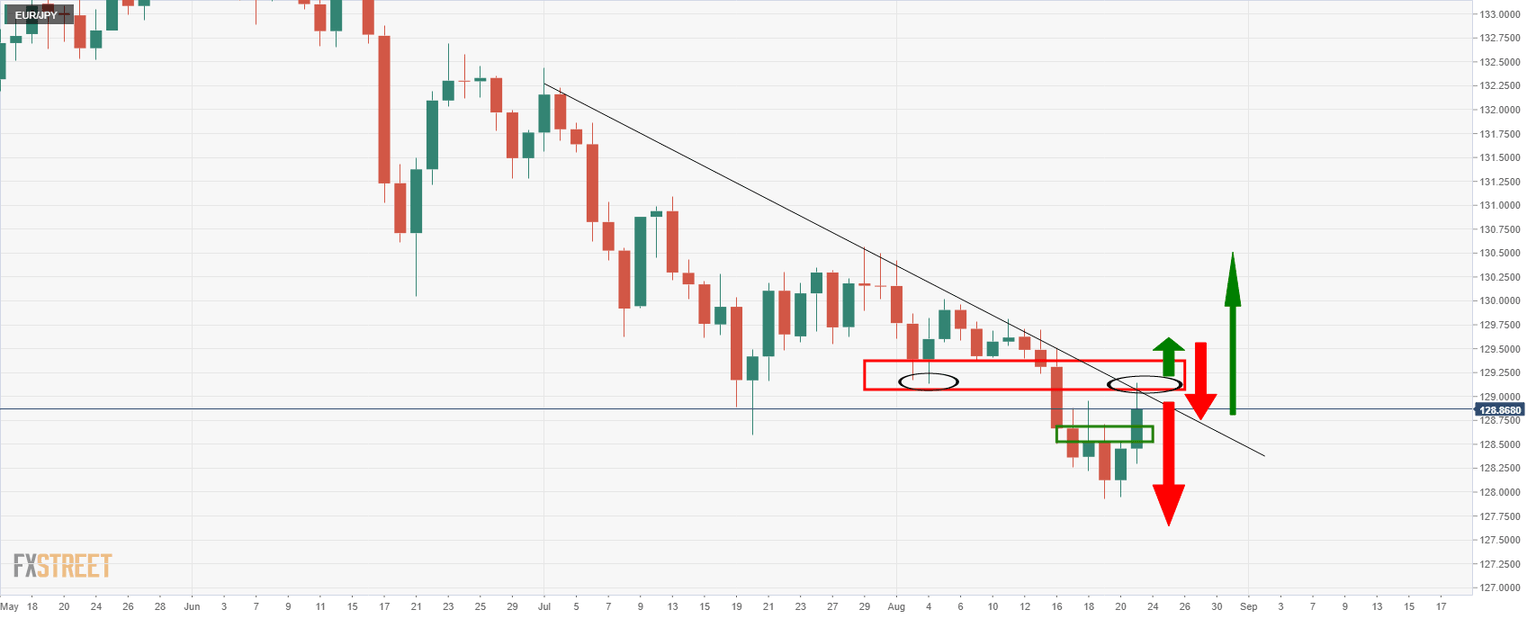

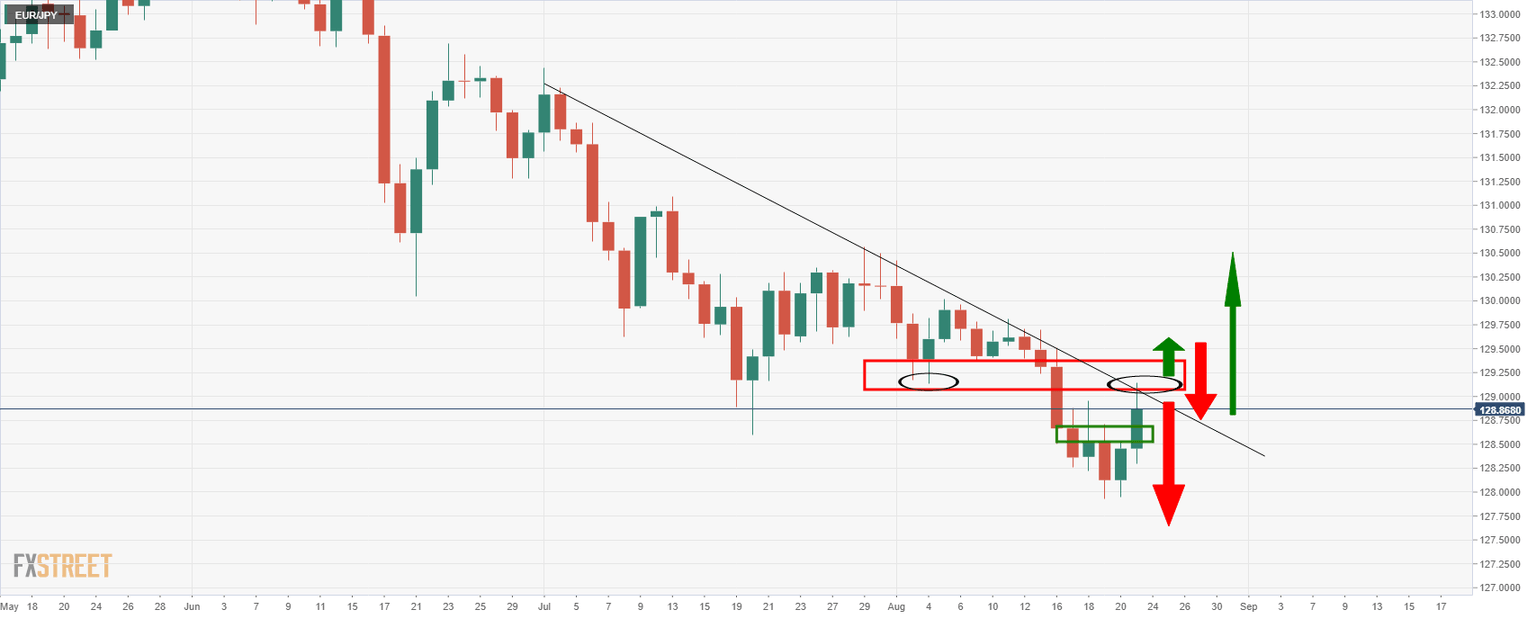

EUR/JPY bulls seeking a break of trendline resistance

- EUR/JPY is testing the critical trendline resistance near 129.20 as risk sentiment improves.

- Markets are discounting a Fed taper announcement this Friday.

- Equities are recovering on the back of sentiment for slower lift-off timings from Fed.

EUR/JPY is currently trading at 128.86 and is higher by some 0.34% after recovering from the lows of 128.28 and reaching a high of 129.14.

The markets are better bid following Friday's reaction to Dallas Federal Reserve President Robert Kaplan's comments

Kaplan who is among the US central bank's most forceful supporters for starting to reduce support for the economy said on Friday that he may need to adjust that view if the Delta variant of the coronavirus slows economic growth materially.

Prior to his comments, a vast number of investors were in high anticipation of an imminent taper announcement from the Federal Reserve's chairman at this week's Jackson Hole.

Kaplan's comments have stripped the US dollar from high speculative positioning which has enabled risk currencies such as the euro, to rally.

EUR/JPY is correlated to equities which too have rallied, and in the case of the S&P 500, scoring fresh all-time highs.

If the economy plays out as he expects, Kaplan said he'd still support announcing a reduction in the Fed's $120 billion in monthly asset purchases next month and begin actually doing so in October.

The caveat, he said, is the highly contagious Delta variant.

It's "a good thing" there's still a month to watch it before the Fed's next policy-setting meeting, he said.

EUR/JPY technical analysis

The price is bearing down the doors of the horizontal and dynamic resistance near the highs of the day so far.

A break there would be expected to lead to a stronger bullish correction following a restest of the counter trendline.

Failing that, the price will be subject to either consolidation or a downside continuation within the broader bear trend.

Much will depend on the trajectory of risk sentiment and the performance of the US dollar.

Bull will wish to see a break of 93.50 and a clean close above there this week ad at month-end for prospects of an immanently stronger US dollar:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.