EUR/JPY advances slightly after Japanese data

- EUR/JPY rises after GDP in Q1 for Japan surprisingly contracted by 0.3%.

- Current Account showed a surplus and Trade Balance deficit in April.

- Eyes on Eurozone GDP data on Thursday.

At the beginning of Thursday’s Asian session the EUR/JPY rose after Japan reported strong Current Account data but a Trade Balance deficit. In addition, the Q1 Gross Domestic Product (GDP) unexpectedly contracted. As a reaction, the EUR/JPY increased slightly to the 149.88 area. For the rest of the session, GDP data from the Eurozone (EZ) may have a further impact on the pair.

Japan released mixed economic data

The Cabinet Office from Japan reported that the Gross Domestic Product (GDP) contracted by 0.3% (QoQ) in Q1 while the markets expected a 0.5% expansion from the previous 0.4% quarterly reading. However, the annualized rate showed an expansion of 2.7% from its previous 1.6%. In addition, the Ministry of Finance reported a ¥1,895B Current Account surplus but a ¥113.1B Trade Balance deficit, which came better than the consensus.

On Thursday, the EZ will report GDP data from Q1, which is expected to have stagnated in the quarterly reading and a slight deceleration in the annualized rate from 1.3% to 1.2%.

Levels to watch

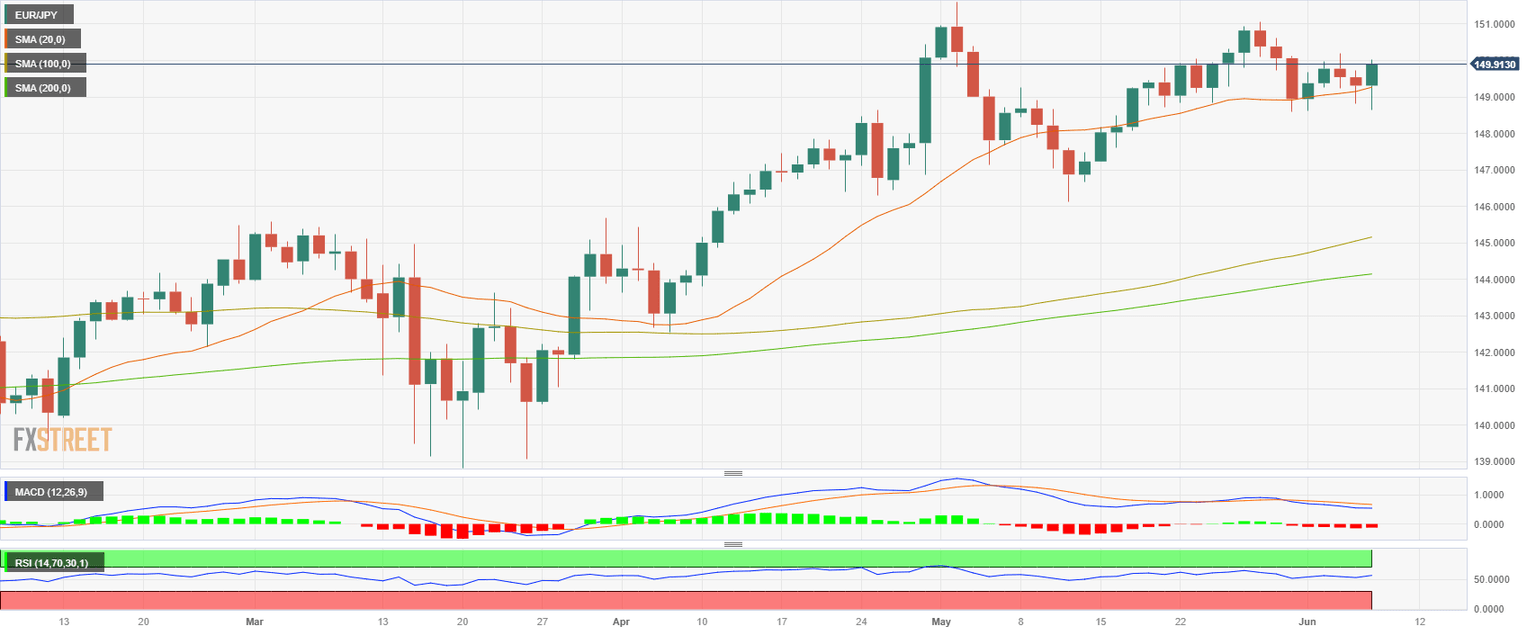

According to the daily chart, the EUR/JPY exchange rate holds a neutral to bullish outlook for the short term as the market enters a period of consolidation. However, technical indicators remain positive, indicating that the market may be preparing for another leg up.

If EUR/JPY manages to move higher, the next resistances to watch are at the 149.80 zone, followed by the 150.00 area and the 150.50 level. On the other hand, The 20-day Simple Moving Average (SMA) at the 149.40 level is key for EUR/JPY to maintain its upside bias. If it is breached, a more pronounced decline towards the 148.50 area and 148.00 zone could come into play.

EUR/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.