EUR/GBP Price Forecast: Trades calmly near 0.8650 ahead of ECB’s monetary policy announcement

- EUR/GBP wobbles around 0.8650 ahead of the ECB’s interest rate decision.

- The ECB is expected to hold interest rates steady for the second straight meeting.

- Investors await UK GDP and factory data for July.

The EUR/GBP pair trades steadily around 0.8650 during the late Asian trading session on Thursday. The asset appears stable ahead of the European Central Bank’s monetary policy announcement at 12:15 GMT.

The ECB is expected to hold its Deposit Facility Rate steady at 2% again; therefore, investors will pay close attention to the monetary policy statement and President Christine Lagarde’s press conference for fresh cues on the interest rate outlook for the remainder of the year.

Market experts believe that the ECB will leave the door open for further monetary policy easing as downside risks to inflation have increased in the wake of a political crisis in the Eurozone’s second-largest economy, France, and escalating trade war risk since the imposition of tariffs by the United States (US) on its trading partners.

In the United Kingdom (UK), investors will focus on the Gross Domestic Product (GDP) and the factory data for July, which will be released on Friday. The Office for National Statistics (ONS) is expected to show that the economic growth remained stagnant on a monthly basis. In June, the UK economy expanded by 0.4%.

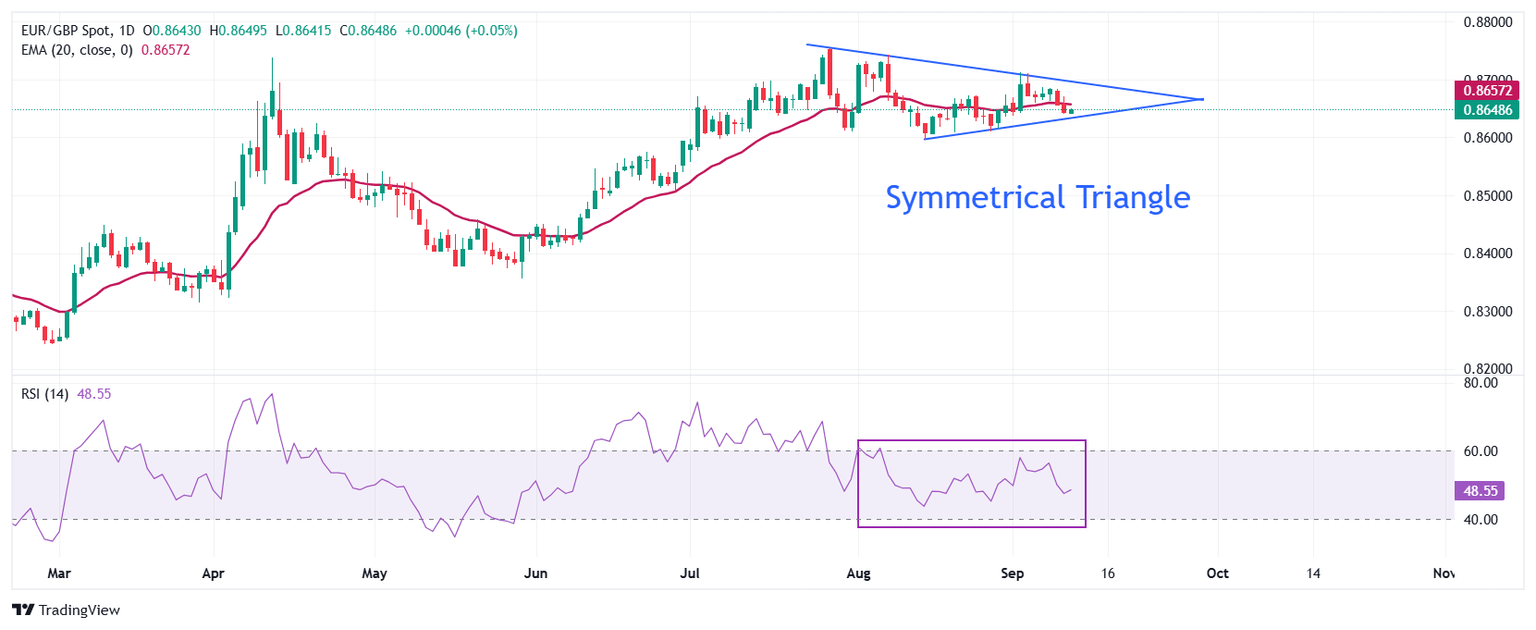

EUR/GBP trades in a Symmetrical Triangle formation for over six weeks, indicating a sharp volatility contraction. The pair remains sticky to the 20-day Exponential Moving Average (EMA), suggesting a sideways trend.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, indicating indecisiveness among investors.

The cross might witness fresh upside towards the July 28 high of 0.8754, and the round level figure of 0.8800, if it breaks above the September 2 high of 0.8713.

In an alternate scenario, a downside move by the pair below the August 27 low of 0.8610 would expose it towards the July 2 low of 0.8577, followed by the June 30 low of 0.8539.

EUR/GBP daily chart

Economic Indicator

ECB Rate On Deposit Facility

One of the European Central Bank's three key interest rates, the rate on the deposit facility, is the rate at which banks earn interest when they deposit funds with the ECB. It is announced by the European Central Bank at each of its eight scheduled annual meetings.

Read more.Next release: Thu Sep 11, 2025 12:15

Frequency: Irregular

Consensus: 2%

Previous: 2%

Source: European Central Bank

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.