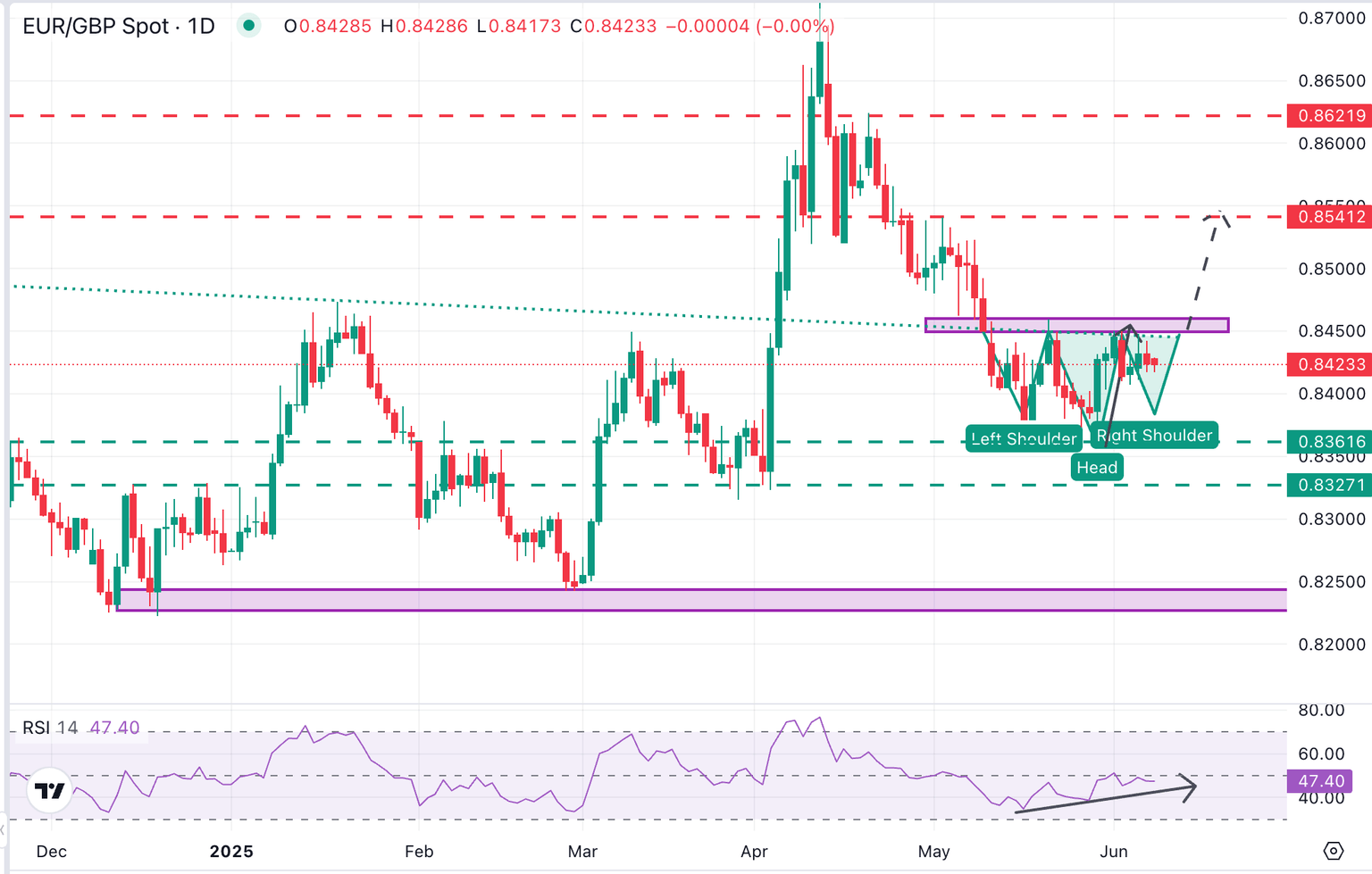

EUR/GBP Price Forecast: Signs of a potential bottom at 0.8350

- The EUR/GBP is trading sideways, but technical indicators suggest a potential trend shift.

- Comments from ECB's Kazimir have provided some fundamental support to the Euro.

- EUR/GBP: Key resistance is at the 0.8460 area.

The Euro is trading practically flat, right above the 0.8400 round level for the fourth consecutive day on Monday. The 4-Hour RSI is flat at the 50 level, but a potential bullish Head & Shoulders pattern, coupled with the bullish divergence on the RSI, suggests that the negative cycle from April 10 highs might be over.

In the absence of relevant macroeconomic figures, comments by the ECB’s official, Peter Kazimir, have echoed the hawkish tone of President Lagarde after last week’s meeting, casting doubts about further easing this year. This is likely to provide some support to the Euro.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.17% | -0.22% | -0.38% | -0.12% | -0.42% | -0.61% | -0.12% | |

| EUR | 0.17% | -0.06% | -0.21% | 0.09% | -0.22% | -0.45% | 0.04% | |

| GBP | 0.22% | 0.06% | -0.06% | 0.12% | -0.14% | -0.38% | 0.11% | |

| JPY | 0.38% | 0.21% | 0.06% | 0.26% | -0.10% | -0.29% | 0.13% | |

| CAD | 0.12% | -0.09% | -0.12% | -0.26% | -0.33% | -0.50% | -0.02% | |

| AUD | 0.42% | 0.22% | 0.14% | 0.10% | 0.33% | -0.22% | 0.26% | |

| NZD | 0.61% | 0.45% | 0.38% | 0.29% | 0.50% | 0.22% | 0.49% | |

| CHF | 0.12% | -0.04% | -0.11% | -0.13% | 0.02% | -0.26% | -0.49% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Technical Analysis: EUR/GBP faces a key resistance at 0.8460

From a technical perspective, the mentioned bullish divergence suggests that bears are losing steam, although the pair should breach 0.8450-0.8460 to confirm a significant correction. This is a previous support, now turned resistance, and the neckline of an inverted H&S Pattern.

the

If that level gives way, the measured target of the H&S formation is at the April 25, 30 and May 2 highs, in the area of 0.8540. Then, the April 21 high, at 0.8620.

On the downside, a bearish reaction below 0.8360 cancels this view and increases pressure towards 0.8325 (April 3 low) and the key 0.8245 year-to-date low.

EUR/GBP Daily Chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.