EUR/GBP Price Forecast: A correction or a reversal of the trend?

- EUR/GBP recovers from multi-year lows but then pulls back down.

- Is the pair about to reverse trend higher or is it still overall bearish?

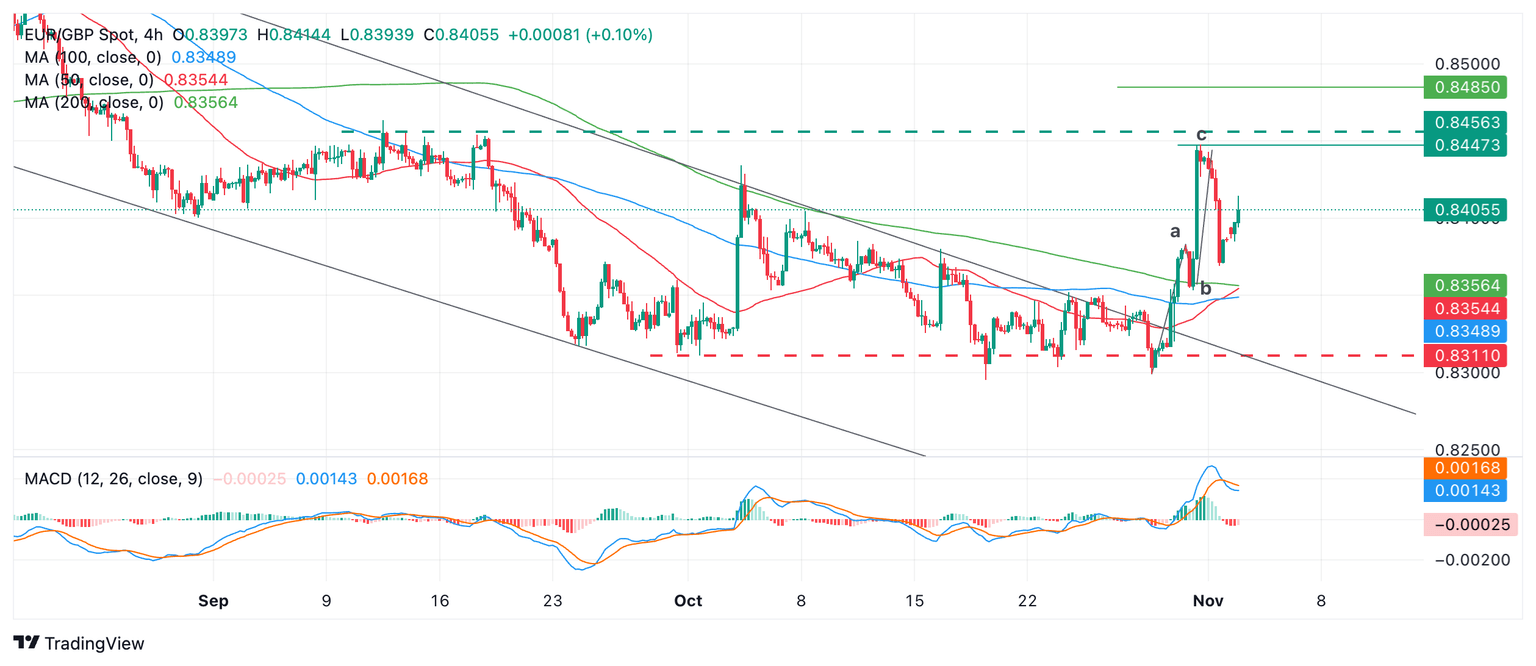

EUR/GBP gaps higher at the open on Monday and starts climbing again. The pair had been pulling back since the completion of a three-wave, zig-zag-shaped pattern last Thursday. This pattern has been drawn on the chart below with the waves labeled a,b and c.

EUR/GBP 4-hour Chart

In the very near-term the pair might fall to fill the open gap left after price jumped higher on Monday. Technical analysis theory argues that gaps have a greater tendency of being closed.

The abc pattern could be either a correction of the overall downtrend or the start of a new short-term uptrend.

If it is just a correction, the price will probably continue falling in line with the medium and longer-term downtrend, with a target at the 0.8311 multi-year lows.

If price manages to break above the high of wave c, however, it will have formed a third higher high, thereby establishing a new sequence of rising peaks and troughs. This is a strong indicator of a new uptrend. Give the technical analysis principle that “the trend is your friend” the odds would then favor further upside to come.

The steepness of the abc pattern strengthens the case of this being a reversal rather than a correction.

A failure to pierce above the top of wave c would indicate the pair is probably not reversing.

It would suggest EUR/GBP will probably remain trapped oscillating within the red and green dashed lines on the chart at 0.8311 and 0.8456 respectively.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.