EUR/GBP Price Analysis: Pair stabilizes at 0.8350, technical outlook remains bearish

- EUR/GBP retraced Monday’s sharp downward movements.

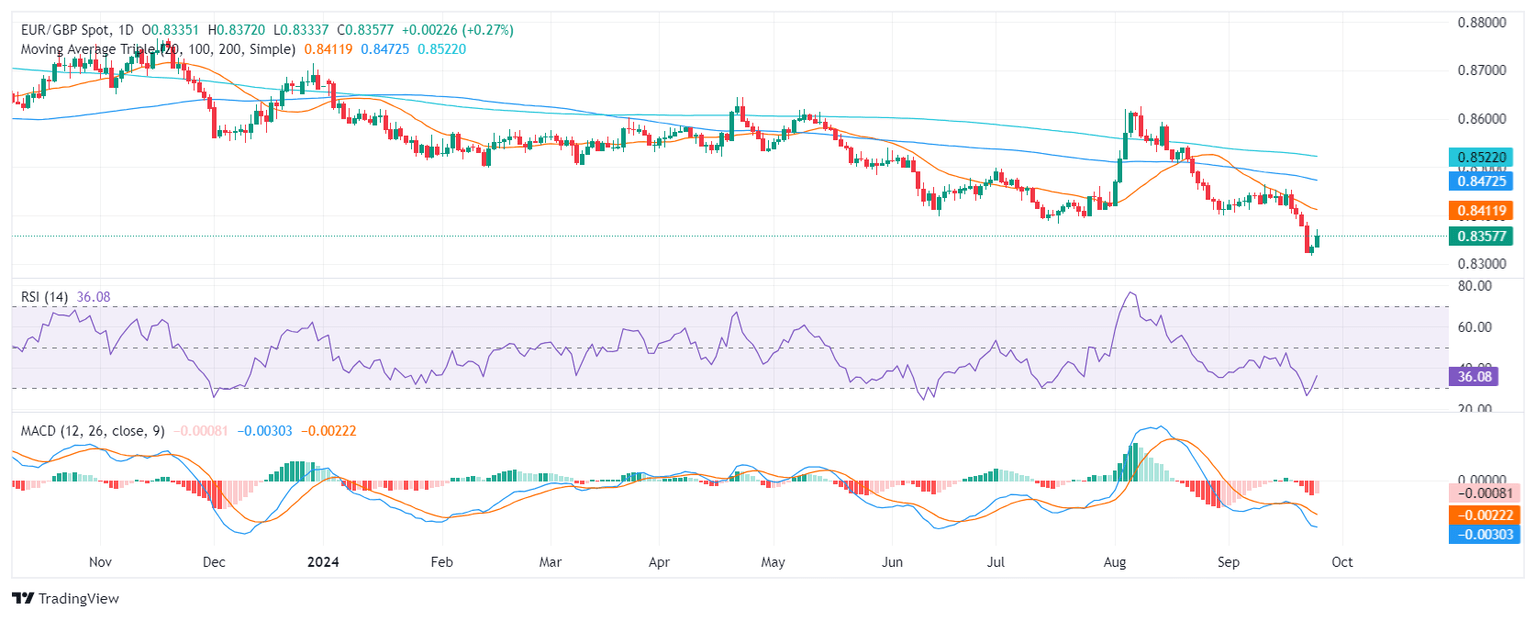

- The daily RSI and MACD signals a stabilizing selling pressure.

- The pair might extend its current sideways trend in the next sessions.

EUR/GBP rose to 0.8370 on Wednesday, displaying some volatility during the European trading session. Nevertheless, the pair failed to hold on to gains, and it currently trades at 0.8350. The cross seems to be consolidating the start of the week’s sharp downward movements with sellers taking a breather.

The Relative Strength Index (RSI) on the daily chart stands at 37, suggesting that buyers are starting to take control after Monday’s selloff, and the RSI is gradually increasing. However, the RSI is still below the midline, indicating that the market is in a negative trend. The Moving Average Convergence Divergence (MACD) is flat, with the signal line above the MACD line, suggesting that selling is losing steam.

EUR/GBP daily chart

Based on the current technical picture, the EUR/GBP pair is likely to remain in a consolidation phase in the near term. With the pair in lows since 2022, the bears seem to have already done their part and they might step away to consolidate their movements. In the meantime, the bullish traction gained on Wednesday continues to be weak so the current bearish scenario isn’t threatened.

Support levels: 0.8315, 0.8330, 0.8340

Resistance levels :0.8400, 0.8430, 0.8440

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.