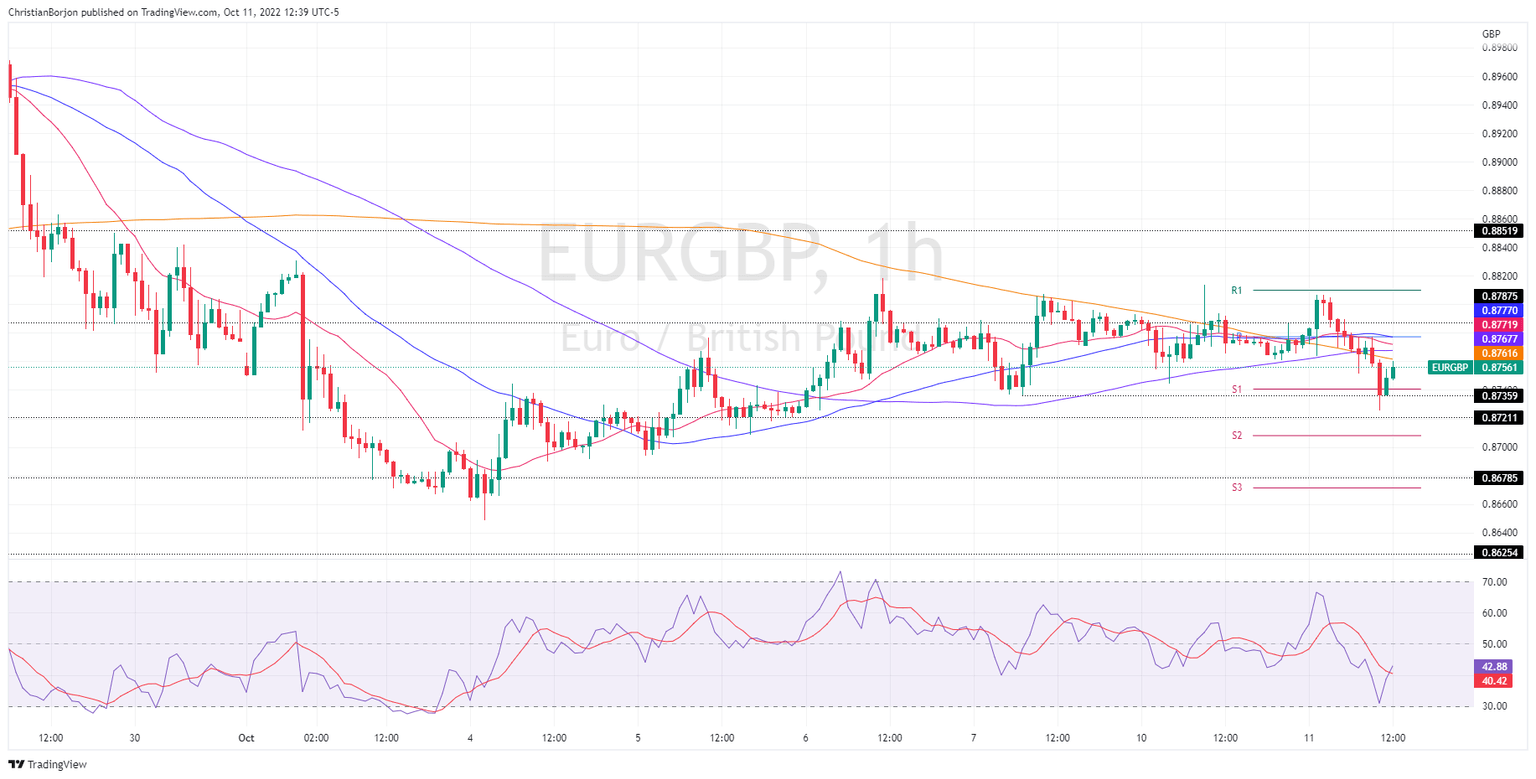

EUR/GBP Price Analysis: Oscillates around 0.8750s on a strong pound

- EUR/GBP drops below the 20-day EMA, aiming to extend the downtrend towards 0.8700.

- If the EUR/GBP breaks below 0.8744, it will expose crucial supports at around 0.8736, 0.8700, and the S3 pivot at 0.8671.

The EUR/GBP is on the defensive, dropping for the first time in the last six days amid a risk-on impulse weighing on the shared currency. At the time of writing, the EUR/GBP is trading at 0.8756, below its opening price, after hitting a daily high of 0.8807.

EUR/GBP Price Forecast

The EUR/GBP daily chart shows the pair faced solid resistance at the 20-day EMA at 0.8783, which was briefly broken, though, the pair retreated, and it’s trading at around October 10 lows. Therefore, the EUR/GBP is range-bound, with price action contained between the high/low of yesterday, but as it printed a fresh 3-day low, the path of least resistance is downwards. A break below 0.8744 could tumble the pair towards 0.8725, ahead of the 0.8700 mark.

The one-hour time frame illustrates the EUR/GBP as range-bound, even though price action it’s below the 20, 50, 100, and 200-EMAs, with all trapped in the 0.8760-0.8777 range. Traders should be aware that even though the Relative Strength Index (RSI) is below the 50-midline unless the EUR/GBP decisively breaks below 0.8736, October 7 daily low, it would likely remain subdued.

If the above scenario plays out, the EUR/GBP next support would be 0.8700, followed by the S3 daily pivot at 0.8671.

EUR/GBP Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.