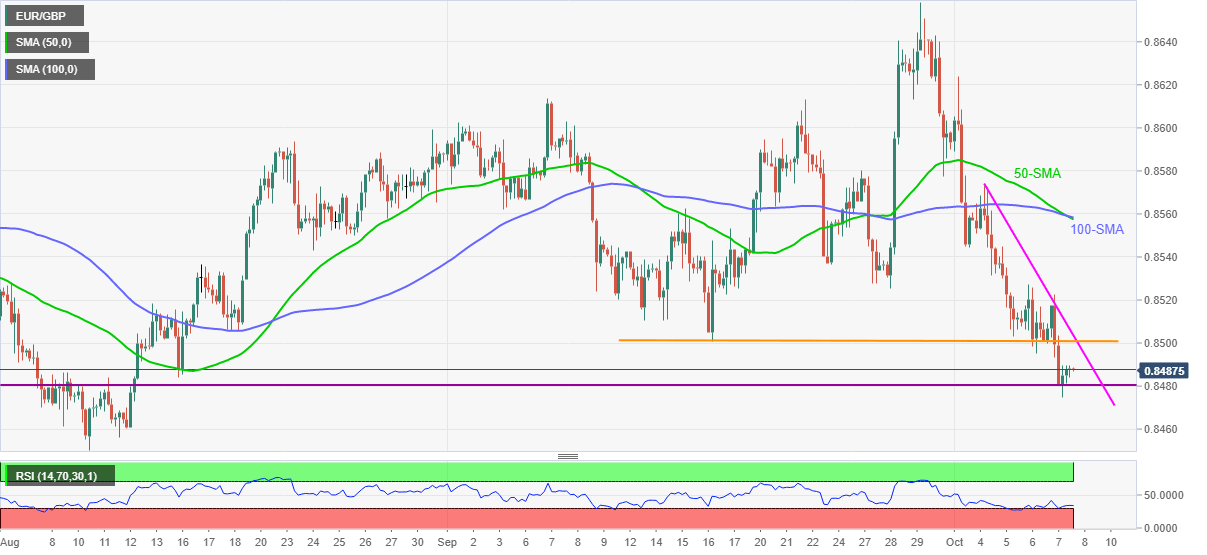

EUR/GBP Price Analysis: Corrective pullback lacks momentum below 0.8500

- EUR/GBP consolidates weekly losses near two-month low, sidelined of late.

- Three-week-old horizontal hurdle, weekly resistance line guard immediate upside, oversold RSI conditions question bears.

EUR/GBP seesaws around 0.8490, up 0.08% intraday as bears lick their wound ahead of Friday’s European session.

The cross-currency pair dropped to the lowest since early August the previous day while breaking short-term horizontal support, now resistance. However, the oversold RSI conditions triggered the quote’s bounce off a two-month-old support line.

Even so, the momentum remains sluggish and the pair stays below the key resistance, which in turn keeps sellers hopeful.

That said, the support-turned-resistance line near the 0.8500 threshold precedes the weekly descending trend line close to 0.8505 to challenge the EUR/GBP rebound.

It’s worth observing that a convergence of the 50-SMA and 100-SMA near 0.8560 becomes a tough nut to crack for the pair buyers should they wish to keep reins past 0.8505.

Meanwhile, pullback moves may retest the two-month support line close to 0.8480 before the August month’s low of 0.8450 lures the EUR/GBP bears.

In a case where the quote remains bearish below 0.8450, February 2020 bottom near 0.8280 will gain the market’s attention.

EUR/GBP: Four-hour chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.