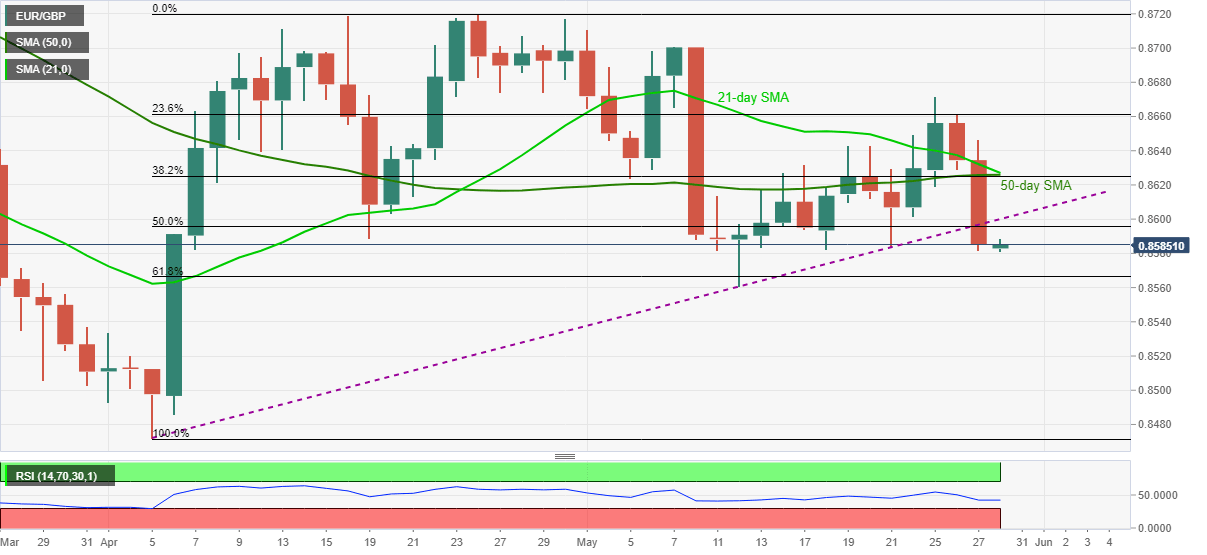

EUR/GBP Price Analysis: Consolidates biggest losses in three weeks below 0.8600

- EUR/GBP bears take a breather around 12-day bottom, keeps downside break of two-month-old rising trend line.

- Sellers tease bearish crossover around 0.8625, 61.8% Fibonacci retracement offers immediate support.

EUR/GBP struggles to recover from a two-week low while taking rounds to 0.8585 during Friday’s Asian trading session. In doing so, the cross-currency pair keeps the previous day’s downside break of an ascending trend line from early April.

Given the downward sloping RSI and the sustained support break, EUR/GBP can extend the latest fall towards 61.8% Fibonacci retracement of April’s upside, near 0.8565.

With this, the quote will be able to confirm the bearish crossover between 21-day SMA and 50-day SMA, which in turn could help the sellers to attack the monthly bottom around 0.8560.

Meanwhile, a corrective pullback beyond the stated support line, now resistance close to 0.8600, will have a tough time cracking the 0.8625 confluence including the stated SMAs and 50% Fibonacci retracement level.

In a case where the EUR/GBP prices rally beyond 0.8625, bulls can the latest swing high of 0.8670 will be crossed in search of the 0.8700 threshold.

EUR/GBP daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.