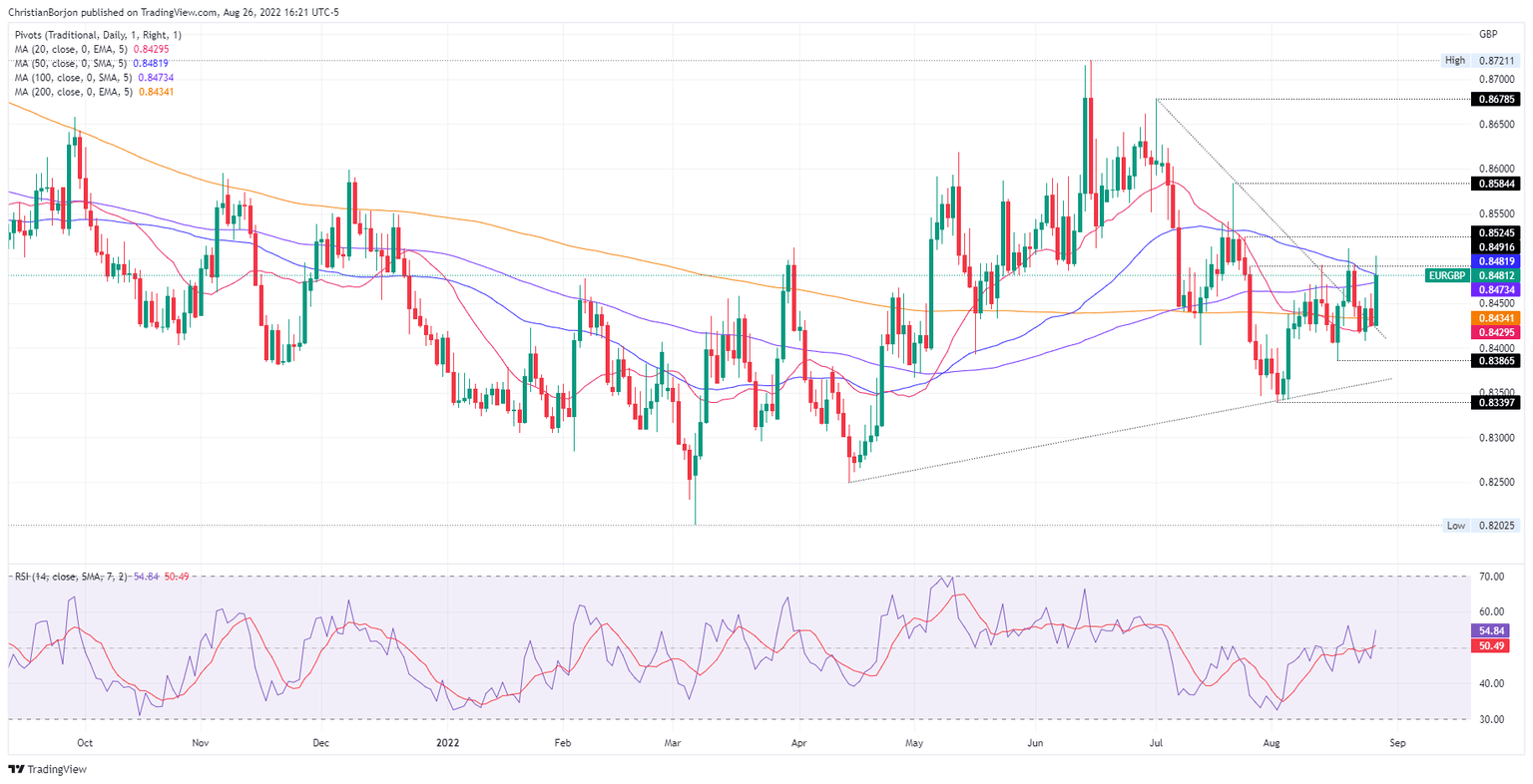

EUR/GBP Price Analysis: Climbs towards weekly highs above 0.8500, but finishes around 0.8480s

- EUR/GBP prepares to finish the week almost flat, compared to last week’s marginally down 0.06%.

- The cross-currency pair is range-bound in the 0.8400-0.8490 area, though risks are skewed to the upside.

- A EUR/GBP break of 0.8500 could put a re-test of the YTD high into play.

The EUR/GBP advances to fresh weekly highs, above the 100-DMA, erasing Thursday’s losses as Wall Street finishes the week in the green, falling between 3% and 4.10%, on Fed’s Chair Powell’s remarks, on Friday. At the time of writing, the EUR/GBP is trading at 0.8481.

EUR/GBP Price Analysis: Technical outlook

During the week, the cross-currency pair dropped towards its weekly low at 0.0407, below the 20-day EMA on Tuesday, though it achieved a comeback, and the pair reclaimed the 200-day EMA. Friday’s price action, broad euro strength, lifted the pair towards its weekly highs above the 0.8500 figure, but lack of impetus sent the cross towards the 50-day EMA at 0.8481.

The EUR/GBP bias is neutral-to-upwards. Through August, the pair achieved a successive series of higher highs/lows and might be closing with gains in the monthly chart, but unless the EUR/GBP breaks the 0.8500 mark, the pair will remain trading in the 0.8400 handle for a foreseeable period.

If the EUR/GBP clears the 0.8500 psychological level, their next resistance would be the July 21 high at 0.8584. Once cleared, the psychological 0.8600 will be the next supply zone, ahead of a test of the YTD high at 0.8721.

On the flip side, the EUR/GBP first support would be the 0.8400 figure. Break below will expose essential demand zones, like the August 17 daily low at 0.8386, followed by the MTD lows at 0.8339.

EUR/GBP Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.