EUR/GBP Price Analysis: Bulls await a sustained move beyond 0.8800 confluence hurdle

- EUR/GBP gained traction for the second consecutive session on Friday.

- Mixed technical indicators warrant caution for aggressive bullish traders.

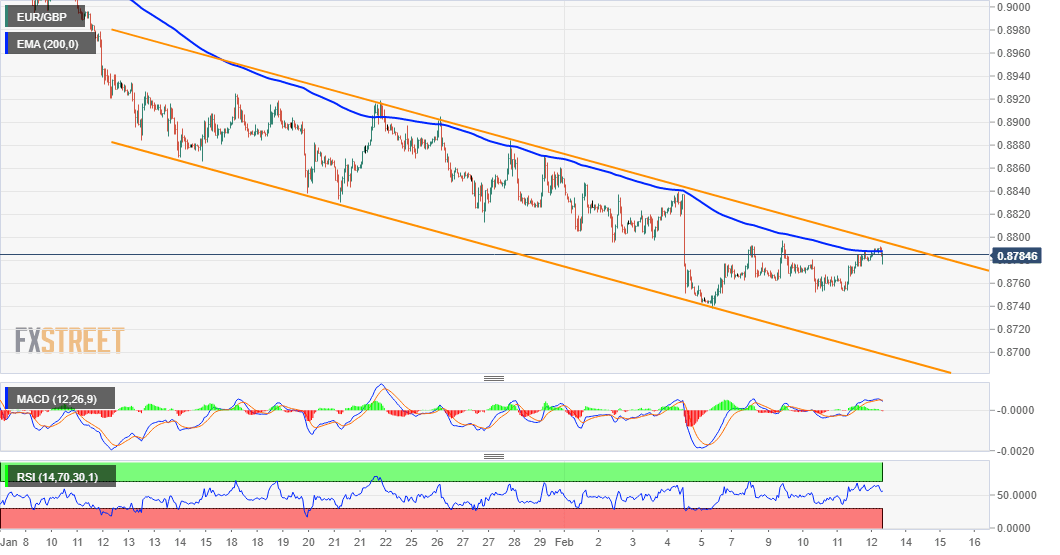

The EUR/GBP cross climbed to the top end of its weekly trading range, with bulls still awaiting a sustained move beyond the 0.8900 round-figure mark. The mentioned level marks 200-hour EMA and coincides with a near one-month-old descending trend-channel resistance.

Meanwhile, technical indicators on hourly charts have been gaining positive traction and support prospects for additional gains. However, oscillators on the daily chart are still holding deep in the negative territory and warrant some caution for aggressive bullish traders.

Hence, it will be prudent to wait for a sustained move beyond the trend-channel resistance before positioning for any further appreciating move. A convincing breakthrough might trigger a short-covering rally and push the EUR/GBP cross further towards the 0.8835-40 resistance.

The momentum could further get extended towards the 0.8880 supply zone, above which bulls are likely to aim to reclaim the 0.8900 round-figure mark.

On the flip side, the 0.8755 region now seems to have emerged as immediate support ahead of multi-month lows, around the 0.8740-35 zone. Failure to defend the mentioned support levels might drag the EUR/GBP cross to test sub-0.8700 levels, or the trend-channel support.

EUR/GBP 1-hourly chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.