EUR/GBP finds resistance at 0.8625 ahead of the Trump-Putin meeting

- The Euro is correcting higher against the Pound amid hopes of a peace deal in Ukraine.

- The broader trend remains bearish after having depreciated nearly 1.4% in one week.

- A bearish move below the 0.8600 area would confirm a double top at 0.8740-0.8750.

The Euro is posting minor gains against the British Pound on Monday, correcting higher after having depreciated nearly 1.4% over the last week. The pair, however, remains capped below Thursday’s high, at 0.8625.

The pair is drawing some support from the moderate optimism about the outcome of a meeting between US President Donald Trump and Russia’s leader, Vladimir Putin, who will try to find a way to end the war in Ukraine.

It is unlikely that today’s summit will bring any breakthrough, but investors will welcome a second meeting, including Ukrainian President Zelenskyy, as a positive outcome. So far, Trump has sounded confident about a positive outcome of today’s encounter, which keeps investors hopeful

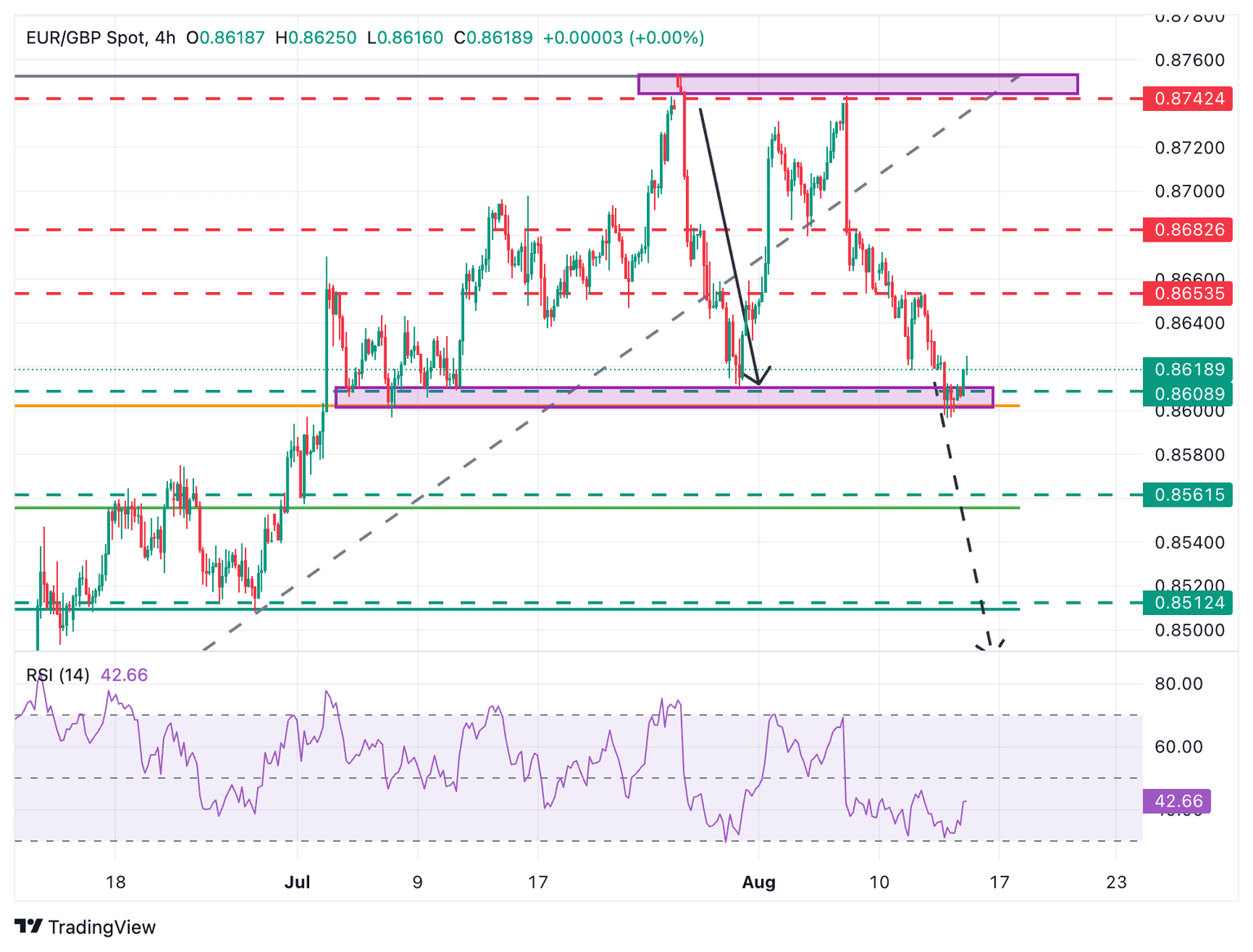

Technical Analysis: Potential double top at 0.8740-0.8750

From a technical perspective, the EUR/GBP pair maintains its near-term bearish trend intact. Price action is testing a key support area at 0.8610, which would activate a Double Top at the 0.8740-08750 area. This is a common figure from trend shifts, and might signal a deeper correction from the June-July rally.

The Double-top figure would be confirmed on a successful move below the July 7 low, at 0.8595. Further down, the 0.8560-0.8570 area (June 23 highs-July 1 lows) might provide some support. The DT’s measured target is at the 0.8500 area.

On the upside, the pair needs to extend gains beyond the mentioned Thursday’s high, at 0.8625, to clear the way towards the August 12 high of 0.8655, and the August 5 low, at 0.8680.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.35% | -0.22% | -0.66% | -0.20% | -0.34% | -0.20% | -0.24% | |

| EUR | 0.35% | 0.12% | -0.19% | 0.16% | -0.01% | 0.15% | 0.12% | |

| GBP | 0.22% | -0.12% | -0.36% | 0.03% | -0.14% | 0.02% | -0.01% | |

| JPY | 0.66% | 0.19% | 0.36% | 0.37% | 0.22% | 0.42% | 0.31% | |

| CAD | 0.20% | -0.16% | -0.03% | -0.37% | -0.10% | -0.01% | -0.04% | |

| AUD | 0.34% | 0.01% | 0.14% | -0.22% | 0.10% | 0.09% | 0.13% | |

| NZD | 0.20% | -0.15% | -0.02% | -0.42% | 0.00% | -0.09% | -0.03% | |

| CHF | 0.24% | -0.12% | 0.00% | -0.31% | 0.04% | -0.13% | 0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.