EUR/GBP climbs as Trump’s tariff threats stir markets

- EUR/GBP bounces off daily lows as investors favor the Euro over the Pound.

- The US proposes 10% EU-wide tariffs, excluding aircraft and spirits.

- German trade surplus beats forecasts, adding to Euro’s tailwinds.

The Euro (EUR) recovers some ground against the Pound Sterling (GBP) on Tuesday, rising by over 0.22%, as the US Dollar pressures both currencies. The trade war is back after US President Donald Trump unveiled tariffs on 14 countries, sparking fears that these measures could be expanded to the largest trading partners. EUR/GBP trades at 0.8626 after bouncing off daily lows of 0.8600.

EUR/GBP climbs above 0.8625 as trade war fears resurface and German data supports the shared currency

The market mood remains downbeat, yet it favors the shared currency over its UK counterpart. Reports of Politico revealed that the US offered a 10% tariff to the European Union (EU) on all goods with “some exceptions for sensitive sectors such as aircraft and spirits.” Negotiations appear to remain fluid, although the approval of the framework ultimately lies with Trump.

Data revealed that the German Trade Balance printed a surplus of 18.4 billion Euros, exceeding expectations of 15.5 billion Euros.

In the UK, the news flow is light, though traders are awaiting the release of Gross Domestic Product (GDP) figures on Friday.

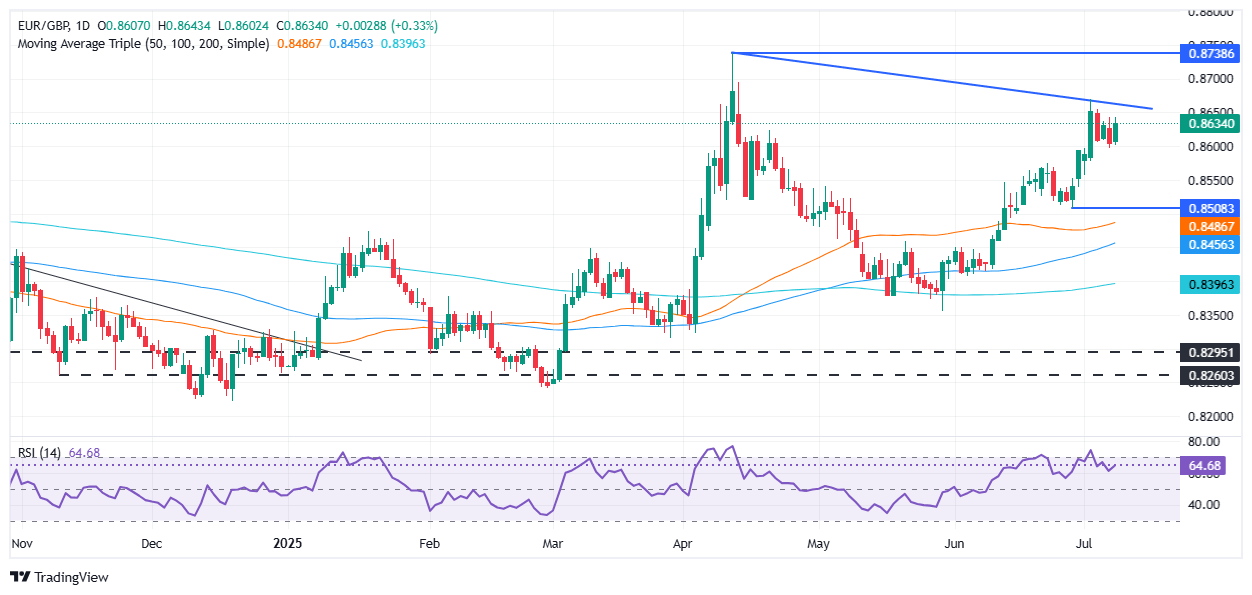

EUR/GBP Price Forecast: Technical Outlook

Price action in the EUR/GBP pair remains sideways, albeit slightly tilted to the upside, with the 50, 100, and 200-day SMAs remaining below the current exchange rate. From a momentum standpoint, further gains are evident, with the Relative Strength Index (RSI) remaining bullish and trending upwards.

The EUR/GBP first area of interest would be the July 2 high at 0.8670. A breach of the latter will expose the 0.8700 figure. Conversely, if the cross-pair tumbles below 0.8600, the first support would be the 20-day SMA at 0.8561. On further weakness, the June 27 low emerges as the following line of defense for bulls at 0.8508.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.79% | 0.82% | 1.89% | 0.66% | 0.70% | 1.32% | 0.55% | |

| EUR | -0.79% | 0.05% | 0.89% | -0.15% | -0.02% | 0.53% | -0.24% | |

| GBP | -0.82% | -0.05% | 0.82% | -0.17% | -0.06% | 0.49% | -0.42% | |

| JPY | -1.89% | -0.89% | -0.82% | -1.00% | -0.97% | -0.36% | -1.28% | |

| CAD | -0.66% | 0.15% | 0.17% | 1.00% | 0.06% | 0.67% | -0.25% | |

| AUD | -0.70% | 0.02% | 0.06% | 0.97% | -0.06% | 0.65% | -0.34% | |

| NZD | -1.32% | -0.53% | -0.49% | 0.36% | -0.67% | -0.65% | -0.90% | |

| CHF | -0.55% | 0.24% | 0.42% | 1.28% | 0.25% | 0.34% | 0.90% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.