EUR/CHF rises on speculation of SNB intervention, but EU–US trade risks cap gains

- EUR/CHF edges higher amid speculation of intervention from the Swiss National Bank in currency markets.

- EU–US trade talks stall ahead of August tariff deadline, fueling market uncertainty and limiting EUR/CHF gains.

- EUR/CHF tests key Fibonacci resistance as downtrend holds, while bearish momentum fades.

The Euro (EUR) is edging higher against the Swiss Franc (CHF). On Monday, fundamental dynamics are increasingly shaping the trajectory of EUR/CHF.

With recent data pointing to possible intervention by the Swiss National Bank (SNB), the pair has recovered to trade above 0.9330 at the time of writing.

Swiss Franc under pressure as SNB deposits spike, lifting EUR/CHF off key support

According to a Reuters report on Monday, commercial banks lodged CHF 11.2 billion more in overnight balances with the SNB last week. This lifted total sight deposits to CHF 475.3 billion, their highest level since April 2024.

Traders often see a jump in deposits as a sign the central bank is either easing policy or stepping in to prevent further currency appreciation. However, the report also indicated that the SNB declined to comment on the allegations.

A weaker Franc helps ease deflationary pressures and supports Switzerland’s export sector, making potential SNB action a key theme for traders.

EU–US trade talks stall ahead of August tariff deadline, fueling market uncertainty

For the Euro side, sentiment remains fragile amid renewed EU–US trade tensions. With the August tariff deadline looming, officials are struggling to finalize a framework for a trade deal.

With trade between the EU and the US totaling $1.96 trillion in 2024, US President Donald Trump intends to impose a baseline tariff of 15%-20% EU imports.

Investors are growing uneasy over the lack of progress, particularly as discussions surrounding agricultural access and industrial subsidies remain contentious.

This reinforces expectations that the European Central Bank (ECB) will maintain a cautious stance at its upcoming rate decision on Thursday, potentially signaling a cut later this year.

Rising uncertainty is dampening sentiment toward the Euro and keeping EUR/CHF under pressure.

EUR/CHF tests key Fibonacci resistance as downtrend continues

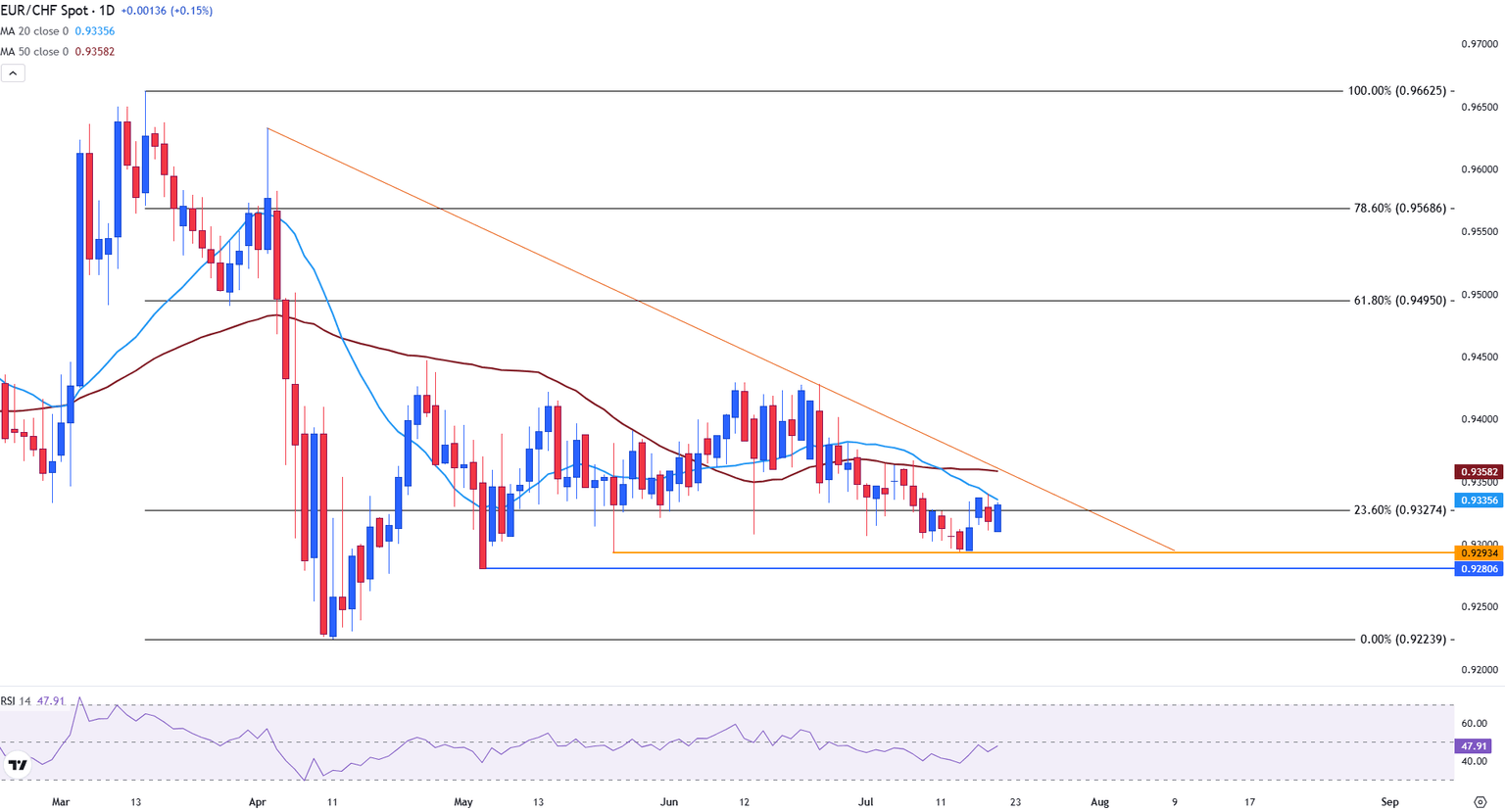

From a technical standpoint, the daily chart reflects a clearly established downtrend, marked by a consistent sequence of lower highs and lower lows.

As the pair continues to trade within the confines of a descending triangle, immediate support can be seen at the base of the triangle near 0.9293, with a break below this level opening the door for the May low of 0.9280.

With EUR/CHF currently testing the 23.6% Fibonacci retracement level of the March-April decline at 0.9327, the falling trendline from the April rally remains intact, reinforcing a broader bearish bias.

EUR/CHF daily chart

On the upside, there is a confluence area where the descending trendline intersects the 20-day Simple Moving Average (SMA) at 0.9336 and the 50-day SMA at 0.9358.

A move above this zone could then open the door for bullish continuation toward the 0.9400 psychological level.

With the Relative Strength Index (RSI) above 48, bullish momentum has started to pick up, pushing the pair closer to neutral territory.

SNB FAQs

The Swiss National Bank (SNB) is the country’s central bank. As an independent central bank, its mandate is to ensure price stability in the medium and long term. To ensure price stability, the SNB aims to maintain appropriate monetary conditions, which are determined by the interest rate level and exchange rates. For the SNB, price stability means a rise in the Swiss Consumer Price Index (CPI) of less than 2% per year.

The Swiss National Bank (SNB) Governing Board decides the appropriate level of its policy rate according to its price stability objective. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame excessive price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

Yes. The Swiss National Bank (SNB) has regularly intervened in the foreign exchange market in order to avoid the Swiss Franc (CHF) appreciating too much against other currencies. A strong CHF hurts the competitiveness of the country’s powerful export sector. Between 2011 and 2015, the SNB implemented a peg to the Euro to limit the CHF advance against it. The bank intervenes in the market using its hefty foreign exchange reserves, usually by buying foreign currencies such as the US Dollar or the Euro. During episodes of high inflation, particularly due to energy, the SNB refrains from intervening markets as a strong CHF makes energy imports cheaper, cushioning the price shock for Swiss households and businesses.

The SNB meets once a quarter – in March, June, September and December – to conduct its monetary policy assessment. Each of these assessments results in a monetary policy decision and the publication of a medium-term inflation forecast.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.