EUR/CHF Price Forecast: Bulls eye breakout above 0.9430 as US tariffs weigh on Swiss Franc

- EUR/CHF holds steady above 0.9400, consolidating recent gains after rebounding from the lower boundary of a multi-month range around 0.9300.

- The Swiss Franc remains under pressure following US President Donald Trump’s announcement of a 39% tariff on Swiss imports.

- Price action remains capped below key resistance at 0.9430, the upper boundary of a horizontal range that has contained the pair since late April.

The EUR/CHF cross is trading flat but remains resilient above the 0.9400 level on Wednesday, consolidating its recent gains after a strong rebound from the lower end of its multi-month trading range. The pair has caught a bid in recent sessions as the Swiss Franc (CHF) came under pressure following US President Donald Trump's announcement of a 39% tariff on Swiss imports, triggering concerns over Switzerland’s trade exposure and weighing on safe-haven flows into the Franc.

At the time of writing, EUR/CHF trades near 0.9420, virtually unchanged during the American trading hours.

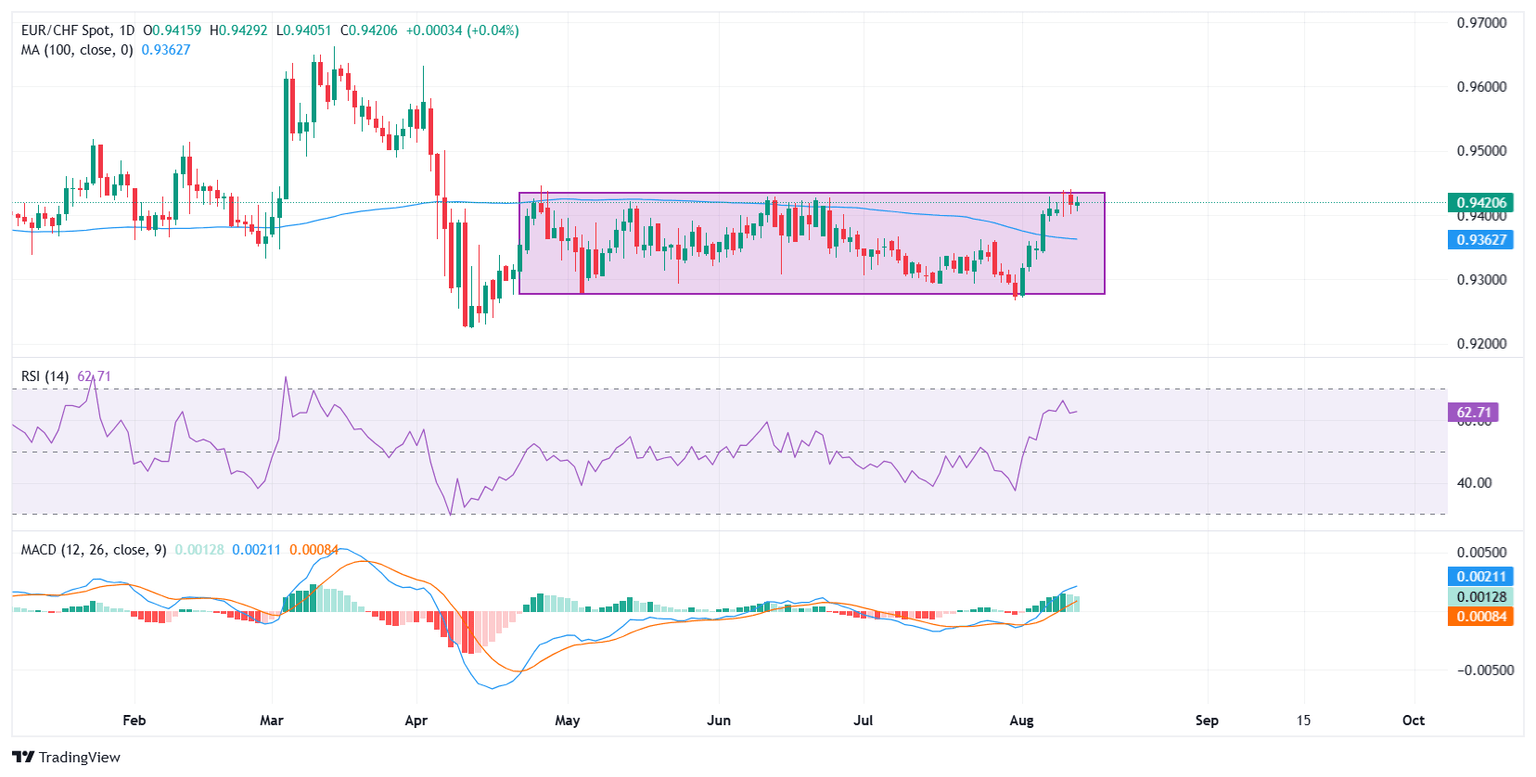

From a technical perspective, the pair is holding above key support at the 100-day Simple Moving Average (SMA), currently positioned near 0.9360, which has acted as a dynamic floor during recent dips. Price action remains confined within a well-defined horizontal range between 0.9300 and 0.9430, in place since mid-May. However, with EUR/CHF now pressing against the upper boundary of this range, a bullish breakout could be in the making if buyers manage a sustained daily close above the 0.9430 hurdle.

Momentum indicators support the bullish outlook. The Relative Strength Index (RSI) is hovering around 62, indicating building positive momentum without entering overbought territory.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator remains in bullish territory, with the MACD line holding above the signal line after a recent crossover earlier this month. However, a closer look at the histogram reveals that the last two bars have slightly narrowed, signaling a moderation in bullish momentum. While this doesn't yet threaten the overall bullish bias, it suggests that buying pressure may be losing some steam as the pair struggles to decisively clear the 0.9430 resistance zone.

A clean break above 0.9430 could open the door for further upside toward the next resistance at 0.9500, the high from April 7, followed by 0.9582, which marks the April 3 peak. On the flip side, immediate support is seen at 0.9400, with additional downside cushioning at the 100-day Simple Moving Average (SMA) near 0.9360. A break below that level could expose the lower end of the range at 0.9300.

Swiss economy FAQs

Switzerland is the ninth-largest economy measured by nominal Gross Domestic Product (GDP) in the European continent. Measured by GDP per capita – a broad measure of average living standards –, the country ranks among the highest in the world, meaning that it is one the richest countries globally. Switzerland tends to be in the top spots in global rankings about living standards, development indexes, competitiveness or innovation.

Switzerland is an open, free-market economy mainly based on the services sector. The Swiss economy has a strong export sector, and the neighboring European Union (EU) is its main trading partner. Switzerland is a leading exporter of watches and clocks, and hosts leading firms in the food, chemicals and pharmaceutical industries. The country is considered to be an international tax haven, with significantly low corporate and income tax rates compared with its European neighbors.

As a high-income country, the growth rate of the Swiss economy has diminished over the last decades. Still, its political and economic stability, its high education levels, top-tier firms in several industries and its tax-haven status have made it a preferred destination for foreign investment. This has generally benefited the Swiss Franc (CHF), which has historically kept relatively strong against its main currency peers. Generally, a good performance of the Swiss economy – based on high growth, low unemployment and stable prices – tends to appreciate CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

Switzerland isn’t a commodity exporter, so in general commodity prices aren’t a key driver of the Swiss Franc (CHF). However, there is a slight correlation with both Gold and Oil prices. With Gold, CHF’s status as a safe-haven and the fact that the currency used to be backed by the precious metal means that both assets tend to move in the same direction. With Oil, a paper released by the Swiss National Bank (SNB) suggests that the rise in Oil prices could negatively influence CHF valuation, as Switzerland is a net importer of fuel.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.