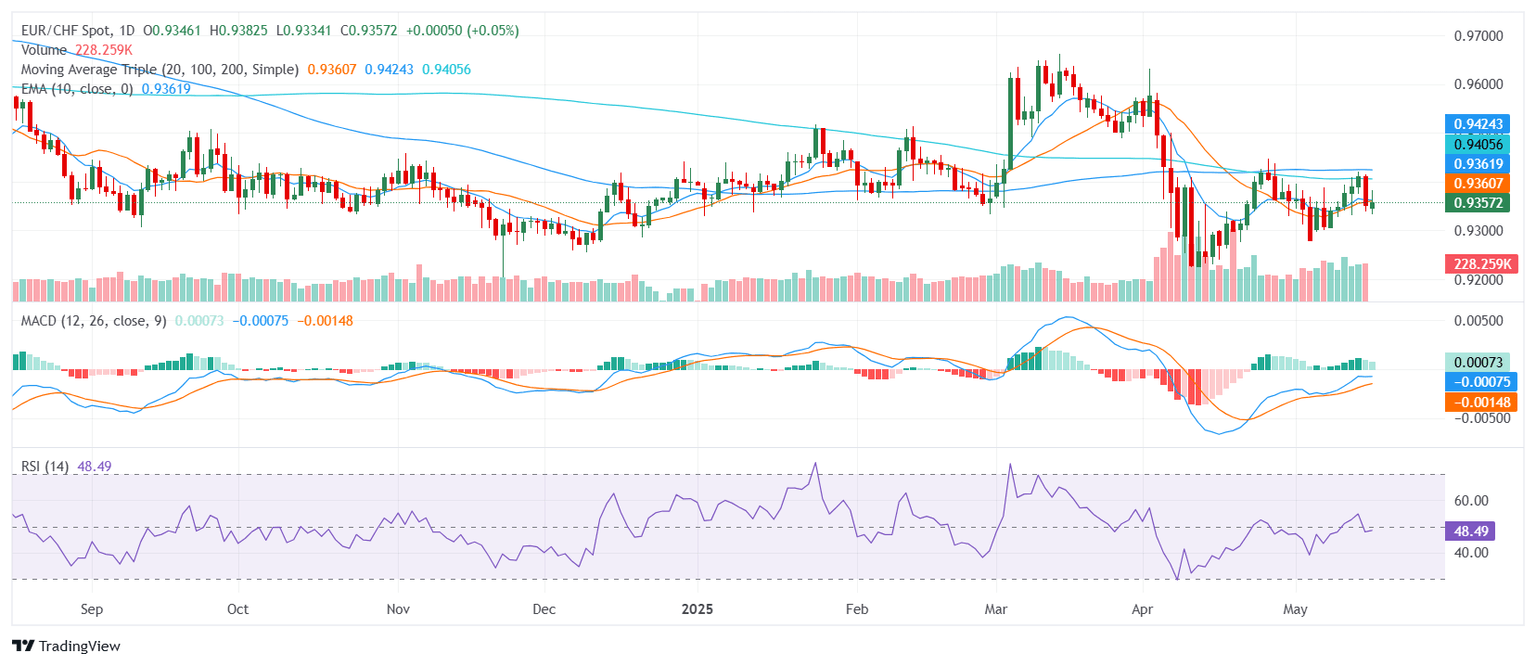

EUR/CHF price analysis: Cross struggles amid mixed technical signals

- EUR/CHF was seen around the 0.94 zone on Friday, with minor gains.

- The cross maintains a bearish bias despite mixed technical signals.

- Key support is clustered below the 0.9350 level, with resistance near 0.9360.

The EUR/CHF pair is navigating a cautious tone on Friday, hovering around the 0.94 zone with modest gains. Despite the slight recovery, the broader technical outlook remains tilted to the downside, reflecting persistent selling pressure that has kept the pair within a tight range in recent sessions. Mixed signals from momentum indicators suggest a complex short-term outlook, reinforcing the cautious sentiment among traders.

EUR/CHF continues to exhibit a bearish overall structure, as suggested by the alignment of its 20, 100, and 200-day Simple Moving Averages (SMAs), which all point to downward pressure. These longer-term trend indicators confirm the broader selling bias. The Relative Strength Index (RSI) remains in the 40s, reflecting neutral conditions that align with the current sideways price action. Meanwhile, the Moving Average Convergence Divergence (MACD) signals a slight buy momentum, contrasting with the prevailing bearish sentiment.

Adding to the mixed technical landscape, the Momentum (10) indicator hovers around the 0 level, suggesting mild buying interest, while both the Ultimate Oscillator (7, 14, 28) and the Stochastic %K (14, 3, 3) rest in the 50s, indicating a largely neutral stance. This combination of signals underlines the current indecision in the market, as traders weigh the potential for a near-term rebound against the longer-term bearish trend.

For now, immediate support is expected around 0.9353, with additional layers at 0.9341 and 0.9334. On the upside, resistance is likely to emerge around 0.9362, followed closely by 0.9363 and 0.9364, potentially capping any recovery attempts in the near term.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.