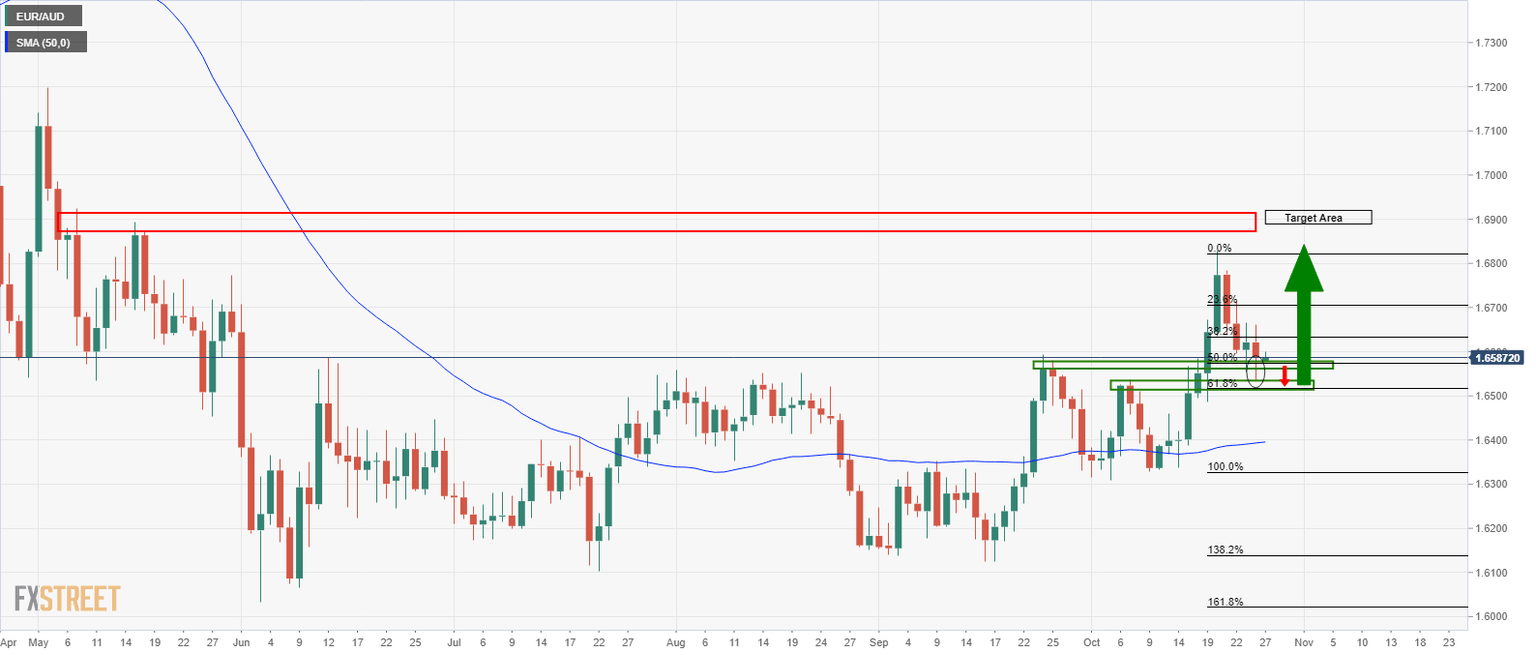

EUR/AUD Price Analysis: Price shifting towards a bullish environment

- EUR/AUD has made a strong retracement to the downside in longer-term demand territory.

- The weekly chart offers a bullish outlook as does the daily time-frame.

Bulls are seeking an entrance as the price pulls-back in a significant Fibonacci retracement.

There is still a way to go yet, but there could be an opportunity in the next series of 4-hour price movements.

The following is a top-down analysis, from a swing trading perspective, that illustrates where the next high-probability bullish setup could evolve from.

Weekly chart

The weekly chart is moving out of bearish and towards bullish territory according to MACD with price testing the 21-week moving average.

The weekly wick is expected to be filled in from a daily extension.

Daily chart

Bulls are seeking a break higher from significant Fibonacci retracements.

The daily wick is an upside correction in the 4-hour time frame which may still need to be filled in, to the downside.

4-hour chart

The price is not in a bullish environment yet, according to the MACD and while trading below the 21 moving average.

There is still room to the downside as far as structure goes and as far as the daily wick is concerned.

However, a break above the resistance bock, MACD will be above zero, the price will be able the 21 moving average and on a restest of the structure, a discount could be on offer.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637393504805096707.png&w=1536&q=95)

-637393510515233997.png&w=1536&q=95)