Emini S&P March shorts at first resistance at 6055/6060 worked perfectly

-

Emini S&P March shorts at first resistance at 6055/6060 worked perfectly as we collapsed from 6067 to 5995 The low & high for the last session were 5995 - 6067.

-

(To compare the spread to the contract you trade).

-

Emini Nasdaq March made a high for the day exactly at first resistance at 21800/900 before prices collapsed to 21408. Last session high & low for the last session were: 21408 - 21813.

-

Emini Dow Jones March made a high for the day exactly at first resistance at 43750/850 before prices collapsed again to 43420. Last session high & low for the last session were: 43420 - 43825.

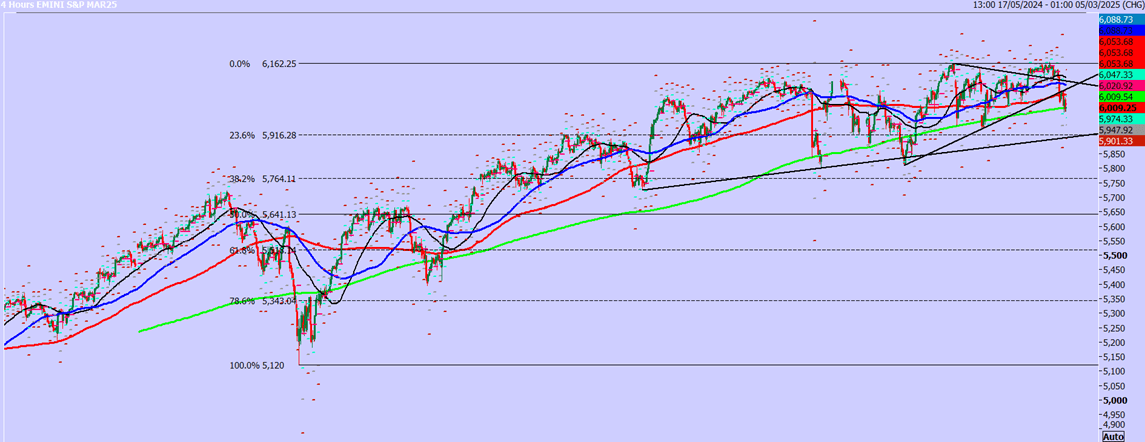

Emini S&P March futures

-

Emini S&P recovered to the sell opportunity at 6055/6060 & shorts worked perfectly as we collapsed to 5994.

-

The break below 6010 did not work the first time yesterday but we are now likely to head for the 100 day moving average at 5978/74.

-

A low for the day is possible here as we become oversold but longs need stops below 5965.

-

A break lower targets 5940/35 & even a test of strong support at 5920/10 is possible.

-

Longs need stops below 5900.

-

Again, gains are likely to be limited with first resistance at 6030/40. Shorts need stops above 6045. Targets: 6015, 5995.

-

Strong resistance at 6055/65 & shorts need stops above 6075.

- Targets: 6040, 6020.

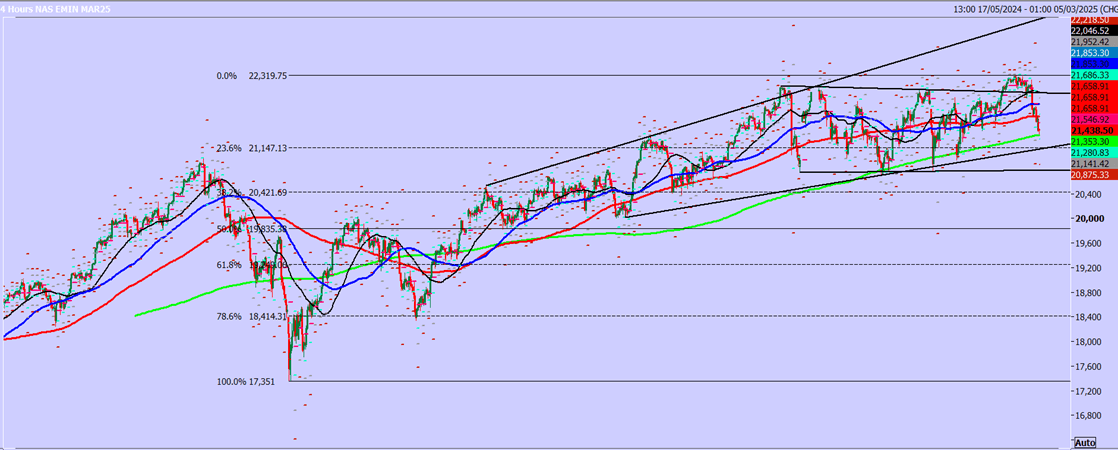

Nasdaq March futures

-

Emini Nasdaq we wrote: Further losses are expected targeting 21550. Target was hit.

-

However eventually this week we could fall as far as a buying opportunity at 21200/100. Longs need stops below 20950.

-

Targets:

-

Gains are likely to be limited with first resistance at 21700/800 & shorts need stops above 21900.

-

Targets: 21500, 21400, 21300.

Emini Dow Jones March futures

-

Further losses are expected to the 16 month ascending trend line at 43100/43000.

-

A bounce from here is possible but longs need stops below 42850.

-

Gains are likely to be limited with first resistance again at 43750/850 & shorts need stops above 44000.

Author

Jason Sen

DayTradeIdeas.co.uk