Elliott Wave view: Amazon short term may see further upside [Video]

![Elliott Wave view: Amazon short term may see further upside [Video]](https://editorial.fxsstatic.com/images/i/Economic-Indicator_PMI-5_XtraLarge.png)

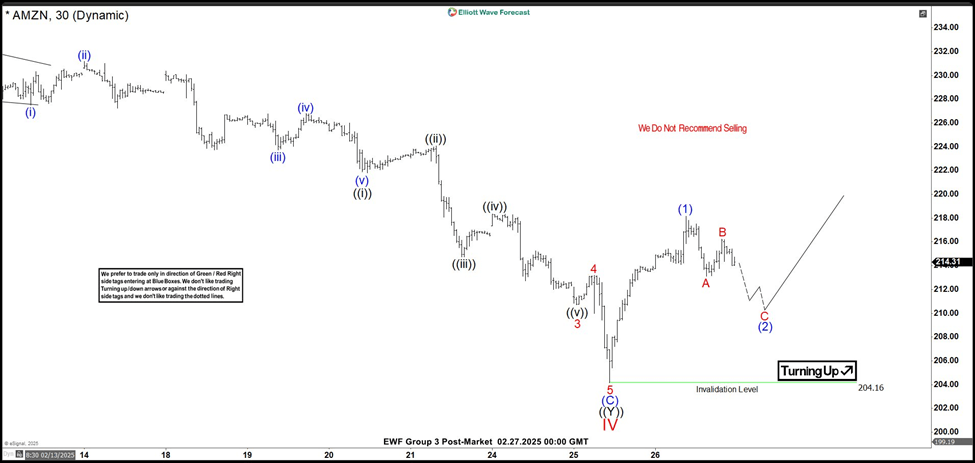

Short Term Elliott Wave View in Amazon (AMZN) suggests that rally to 242.52 on 2.5.2025 high ended wave III. The stock then did a double three Elliott Wave correction ((W))-((X))-((Y)). Wave ((W)) ended at 221.77 and wave ((X)) ended at 234.81. Wave ((Y)) lower unfolded as a zigzag Elliott Wave structure. Down from wave ((X)), wave (A) ended at 225 and wave (B) ended at 234.81. Wave (C) lower subdivided into 5 waves impulse.

AMZN (AMZN) 30 minutes Elliott Wave chart

Down from wave (B), Wave 1 ended at 228.06 and wave 2 ended at 233.92. The stock then resumed lower in wave 3 towards 210.7 and wave 4 ended at 213.18. Final wave 5 lower ended at 204.16 which completed wave (C) of ((Y)) of IV in higher degree as the 30 minutes chart below shows. The stock has turned higher in wave V. Up from wave IV, wave (1) ended at 218.16. Pullback in wave (2) is now in progress to correct cycle from 2.26.2025 low before the stock resumes higher. Near term, as far as pivot at 204.16 low stays intact, expect dips to find buyers in 3, 7, or 11 swing for further upside.

AMZN [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com