Dow Jones unable to beat the eight month trend line

Emini S&P September futures

Emini S&P could not quite reach the next target of 6460/64 where I did actually predict that a high for the day was possible... So I am still pretty happy with that call!!

If we continue higher look for 6476/78.

The close below Friday's high is a short term warning for bulls after the bullish breakaway opening gap.

It is definitely not a sell signal, but probably indicates a period of sideways consolidation is starting to relieve the overbought conditions.

Watch 1 month trend line support at 6410/6400 as a break below here is likely to take us to 6380/75 today but probably no further on the downside at this stage.

Of course if bulls want to regain control they will need to beat the new all time high set yesterday at 6457.75.

Nasdaq September futures

Emini Nasdaq - The break higher over night was a buy signal and we immediately hit my target of 23580/595, with a new all time high exactly here.

The market then kindly handed us a buying opportunity at level of 23476/23450 and we shot higher from 23436 to 23552.

On a break above 23580/595 we are now looking for 23685 & 23710/730.

Support again today at 23476/23450 for a buying opportunity with stop below 23400.

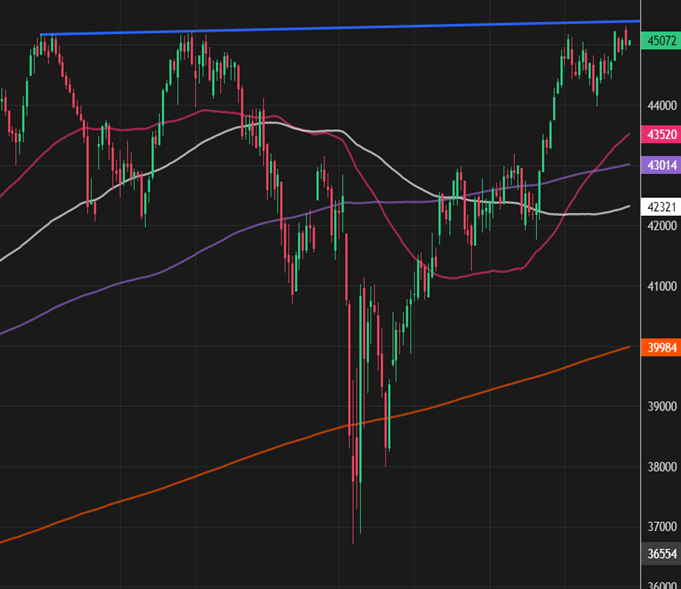

Emini Dow Jones September futures.

Emini Dow Jones could not quite test the trend line at 45410/430 reversing from 45312

A break above 45460 should be a buy signal targeting 45270/290 (hit already), 45360/390 & 45470/500.

Eventually 45570/610 is possible if we do manage to break above that trend line.

Longs at at 45130/45100 hit the stop below 45000.

Although we have not beaten the trend line I don't see this as a sell signal just yet will wait for further confirmation.

We should have good support today at 44850/44750.

Author

Jason Sen

DayTradeIdeas.co.uk