Dow Jones Industrial Average trims lower during holiday-thinned session

- The Dow Jones shed weight on a quiet Thursday, declining on thin holiday volumes.

- The Juneteenth holiday has turned Thursday into an extended overnight session.

- The Trump administration is debating stepping directly into the Israel-Iran conflict.

The Dow Jones Industrial Average (DJIA) fell through an extended overnight session, with American markets shuttered for the Juneteenth holiday. However, off-market bids are still leaking through, and investors are facing growing trepidation about the Trump administration dragging American assets directly into a Middle East combat scenario.

According to a CBS reporter posting on the X (nee Twitter) social media platform, President Donald Trump may be considering an order for American military assets to target an Iranian nuclear production facility. If the Trump administration decides to go ahead with the reported proposal, it will be the first time the US has deployed military assets in a pre-emptive manner since the 2003 invasion of Iraq. Citing an Israeli government official, The Times of Israel reported that the Israeli government expects a final decision from the Trump administration within the next 24 to 48 hours.

Reports citing three separate diplomats have confirmed that personnel within the US administration, specifically US Special Envoy to the Middle East Steve Witkoff, has been in regular contact with his Iranian counterpart, helping to temper some of the emotional fallout striking off-market traders on Thursday. Iranian Foreign Minister Abbas Araghchi reportedly signaled to US Envoy Witkoff that the Iranian government is willing to be ‘flexible’ on its nuclear plans and resume talks, but only if Israel ceases its long-range missile strikes. Iranian Foreign Minister Araghchi stated that he will travel to Geneva on Friday to meet with his European counterparts as well.

The trading week will end on a quiet note as far as the economic data docket is concerned. The Federal Reserve (Fed) held interest rates steady this week, as investors broadly expected. However, a slight hopeful shift in Fed Chair Jerome Powell’s tone bumped trader hopes for a September rate cut slightly higher, albeit with the caveat that Fed officials want to see further progress on both inflation and the labor market before that decision can be made.

Read more stock news: After 600% rally, traders take stock in Circle Internet Group

Coming up next week: US economic data will again dominate investor sentiment in between geopolitical headlines. Business sentiment indicators are due early next week, followed by Fed Chair Powell’s testimony before Congressional and Senate financial committees. Next week will wrap up with key inflation metrics scheduled for release on Friday.

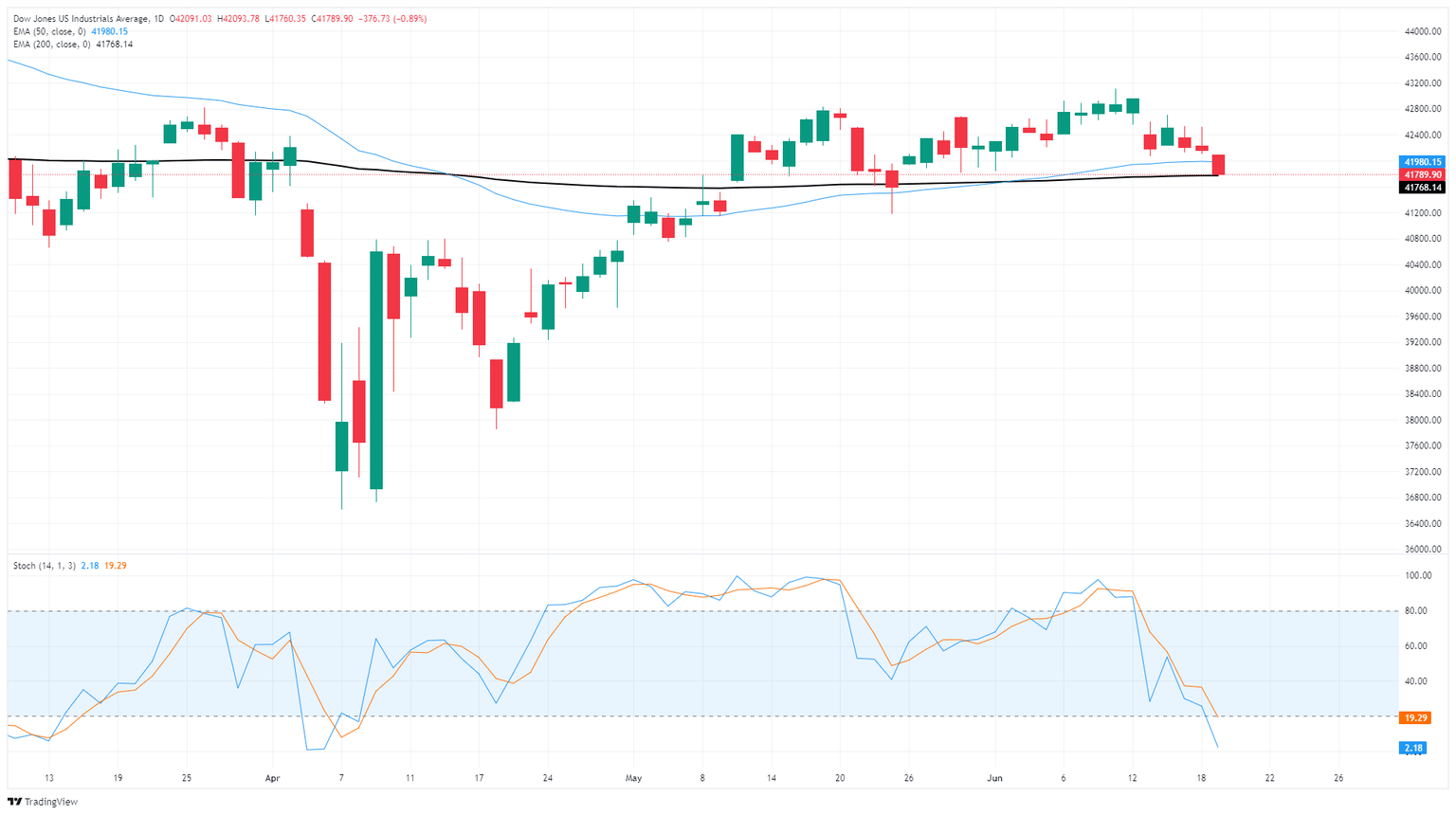

Dow Jones price forecast

Holiday trading hours and anemic trade volumes means Thursday’s price action should be taken with a grain of salt; however, the Dow Jones Industrial Average has fallen back to the 200-day Exponential Moving Average (EMA) near 41,800 as geopolitical concerns weigh on equity markets. Bullish momentum has fizzled over the past week after the DJIA flubbed a topside run at the 43,000 handle, but limited downside could see a fresh bullish bounce off of major technical averages when US markets kick back into action following the holiday.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.