Dow Jones Industrial Average climbs 360 points after NFP thumps forecasts

- The Dow Jones climbed into fresh 21-week highs on Thursday.

- US NFP job gains handily beat forecasts, thumping market fears of labor weakness.

- Markets are geared up for an early closure this week ahead of Friday’s US holiday.

The Dow Jones Industrial Average (DJIA) punched in firm gains on Thursday, testing its highest bids in five months after US Nonfarm Payrolls (NFP) showed more jobs were added in June on a seasonally-adjusted basis than markets feared. ADP job numbers earlier this week hinted at a contraction in overall US employment last month, sparking fresh investor fears that the US’s employment segment was beginning to show cracks in the foundation.

NFP beats the street as government hiring surges

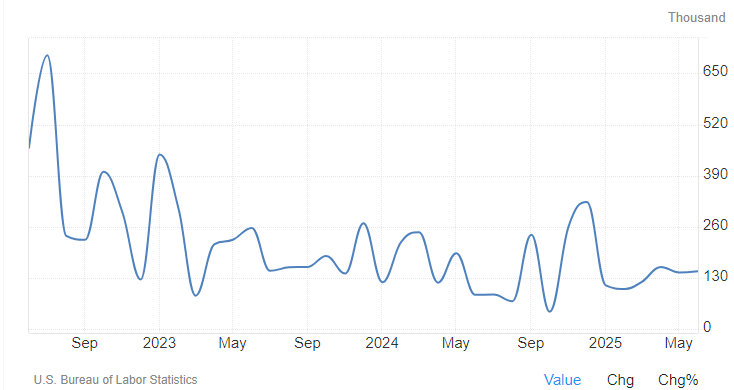

US NFP figures showed a net gain of 147K new jobs through June, beating the median market forecast of 110K. The previous month’s figure was also revised higher to 144K, functionally ending this week’s broad-market fears of sputtering job growth. However, not all is as rosy as it appears in the headlines: around half of all job gains posted in June came from state and local government hiring (+73K), closely followed by more job gains in health care services (+58.6K), with leisure and hospitality hiring coming up in third (+20K). With most government hiring taking place in the education sector, analysts are throwing up early warning signs that it is incredibly unlikely that state and local governments will be able to maintain this pace of job creation.

(source: tradingeconomics.com)

Business services (-7K), manufacturing (-7K), wholesale trade (-6.6K), and resource extraction, including mining and logging (-2K), all shed jobs through June. Most of the month’s job gains came from government expense roles, and with the shrinkage in ‘real’ economy jobs, June’s NFP beat, while strong, is nonetheless an expensive one.

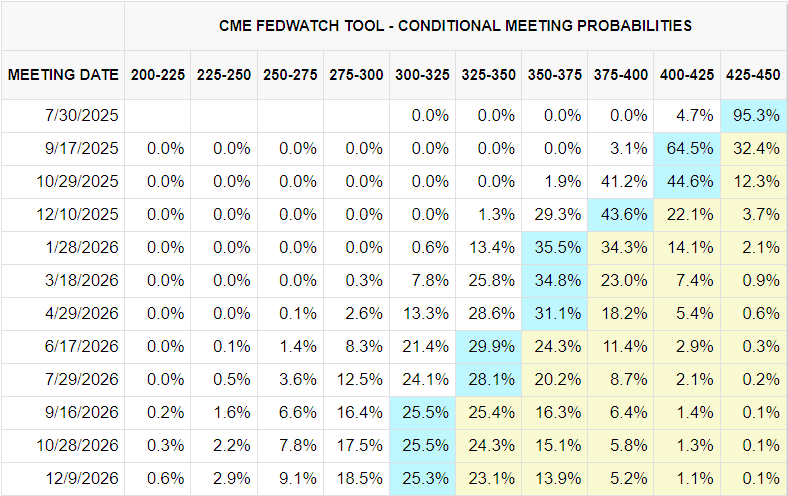

Strong gains on headline NFP net job gains have also pummeled broad-market rate cut hopes. June’s jobs beat has obliterated any market expectations for a rate cut at the Federal Reserve’s (Fed) upcoming rate call at the end of the month, and odds of three rate cuts before the end of the year have also been called into question.

US equity markets closed early on Thursday, going dark at 5:00 pm GMT/1 pm EST. Markets will remain shuttered through Friday for the US Independence Day holiday, and will return to the fold next week.

(source: cmegroup.com)

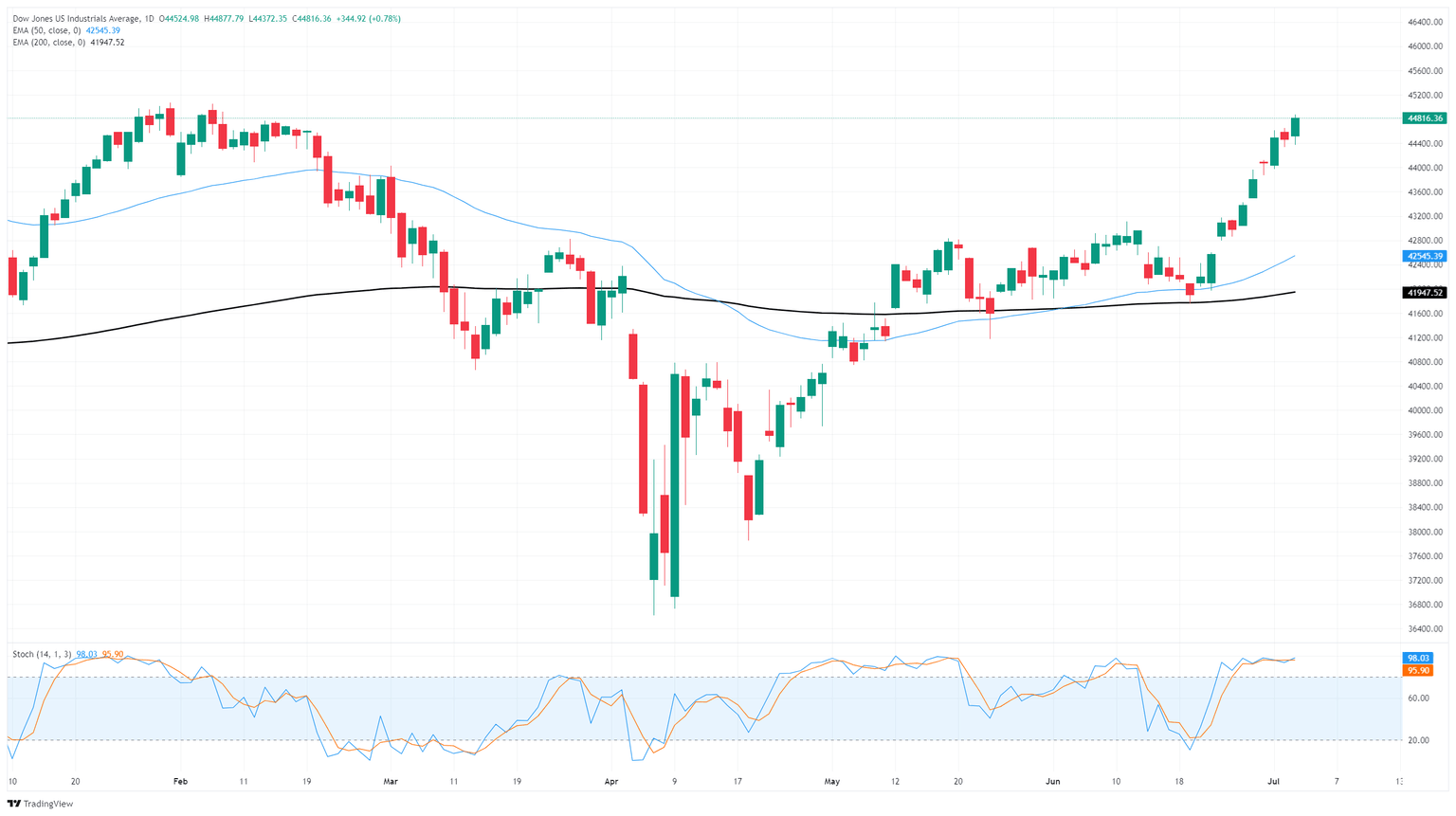

Dow Jones price forecast

June just started, and the Dow Jones Industrial Average is already on pace to chalk in a third straight month of gains. The Dow Jones is up over 22% from its post-tariff announcement lows near 36,600, testing the 44,800 region and on pace to rechallenge all-time highs just above 45,000.

The Dow Jones has gained ground for all but two of the last nine consecutive sessions. Price action remains firmly pinned to the high end, keeping technical oscillators buried in overbought territory. A downside correction will help blow off tightly-packed bullish pressure, and it will take a significant decline in daily bids to bring the Dow back down to the 200-day Exponential Moving Average (EMA) near the 42,000 handle.

Dow Jones daily chart

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Thu Jul 03, 2025 12:30

Frequency: Monthly

Actual: 147K

Consensus: 110K

Previous: 139K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.