Dow Jones Industrial Average struggles as fizzling tech rally drags equities lower

- The Dow continues to grapple with the 45,000 region heading through the midweek.

- Tech stocks saw fresh declines early on Wednesday as investors reconsidered sky-high valuations.

- Policymaker sentiment will take a front seat heading into the annual Jackson Hole central banking summit.

The Dow Jones Industrial Average (DJIA) faced fresh bearish pressures on Wednesday, with the major equity index getting dragged lower in early trading as tech stocks saw further profit-taking. The Dow recovered most of its footing through the midweek market session, but investors remain tightly wound ahead of a large swath of central bank jawboning and business sentiment figures set to kick off on Thursday.

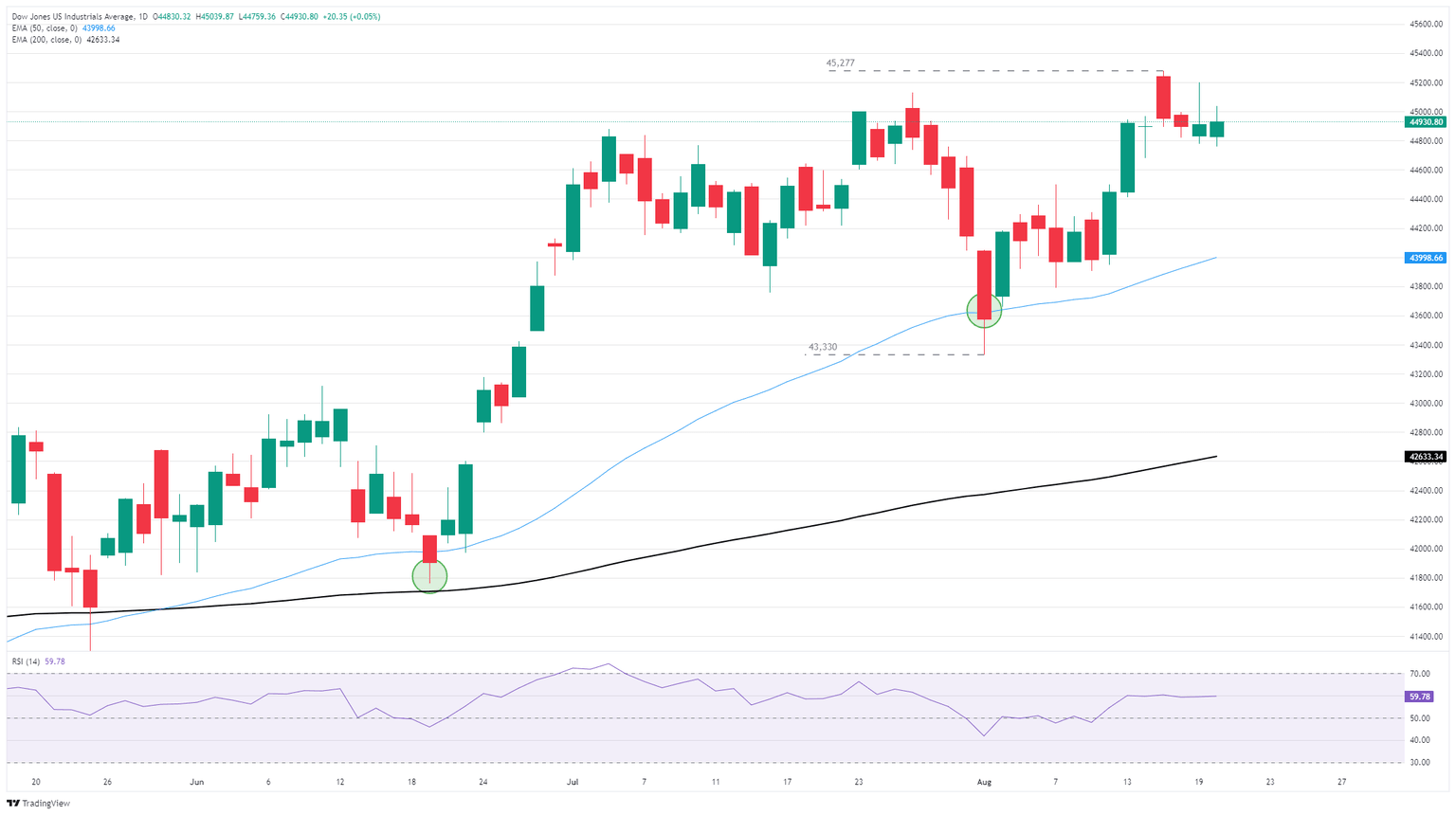

The Dow Jones is still struggling to pick a direction, tussling with the 45,000 price handle through most of this week. On an intraday level, the Dow is continuing to test record highs north of 45,200, but definitive closes above those levels remain elusive. Despite near-term downside pressure, the Dow Jones is holding firmly on the high side, and continuing technical pressure into all-time peaks above last week’s 45,277 should be expected.

Cracks are beginning to show in the surface of the global equity market’s AI-obsessed tech sector rally. Eye-watering levels of concentration in a small handful of key equities were the showcase early on Wednesday after a sharp decline in tech darling Nvidia (NVDA) dragged broader indexes lower on the day. Palantir (PLTR) also saw further declines, testing $153 per share at the time of writing, while self-admitted AI laggard Intel (INTC) stumbled another 7%, falling to $23.50 per share.

Read more: Palantir stock opens lower on Wednesday in what could be a sixth-straight loss

Fed officials continue to come under fire

US President Donald Trump is back on the prowl, looking for ways to replace the Federal Reserve’s (Fed) pool of voting Board of Governors members with allies who will vote in favor of potentially reckless interest rate cuts. The light bulb appears to have gone off within the Trump administration that replacing Fed Chair Jerome Powell will not be enough to lower interest rates at a pace that President Trump will find satisfactory. Fed Board member Lisa Cook was accused of falsifying mortgage details on Wednesday by William Pulte, the Trump-appointed head of the US Federal Housing Finance Agency. President Trump once again showed his cards before they’ve even been dealt, posting to social media early Wednesday that Lisa Cook should “resign immediately”, giving Donald Trump another free pick of a seat replacement on the Fed Board.

Broader market expectations are still calling for the Fed to deliver a quarter-point interest rate cut on September 17, and investors will be paying close attention to Fed Chair Jerome Powell’s speech at the Jackson Hole Economic Symposium, which kicks off on Thursday. Fed Chair Powell will make his grand appearance on Friday, but the event itself runs for several days and will give markets plenty of opportunities to take a fresh reading of where Fed officials sit in terms of rate cut expectations. Many investors expect Fed Chair Powell to tilt toward a September rate cut, however, some analysts are cautioning that Powell may opt to continue his secretive stance toward rate adjustments this week. Considering the current political climate, it will certainly be difficult for Fed officials to convey any opinions in favor of a faster pace of interest rate cuts without appearing like a political stooge.

US Purchasing Managers Index (PMI) sentiment survey results for August are also due on Thursday. The aggregated sentiment index is expected to pare back slightly on both the Services and Manufacturing components.

Dow Jones daily chart

Economic Indicator

S&P Global Services PMI

The S&P Global Services Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US services sector. As the services sector dominates a large part of the economy, the Services PMI is an important indicator gauging the state of overall economic conditions. The data is derived from surveys of senior executives at private-sector companies from the services sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the services economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity among service providers is generally declining, which is seen as bearish for USD.

Read more.Next release: Thu Aug 21, 2025 13:45 (Prel)

Frequency: Monthly

Consensus: 54.2

Previous: 55.7

Source: S&P Global

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.