Palantir stock opens lower on Wednesday in what could be a sixth-straight loss

- Palantir stock is trading lower for its sixth-straight session on Wednesday.

- PLTR shares are down over 9% at the time of writing.

- Citron Research short report suggests price tag of no more than $40 per share.

- PLTR RSI reads 35 after print at 75 on August 12.

Palantir (PLTR), the Peter Thiel-backed final boss of the AI revolution, traded over 3% lower out of the gate on Wednesday in what could be its sixth-straight losing session. Shares have drifted from the August 12 all-time high of $190 down to $143 on Wednesday, nearly 9% lower at the time of writing, and some observers think this is the beginning of a major pop in the long AI rally that began with Nvidia in 2022.

The market is also disgruntled with Target (TGT), down over 8%, which announced a surprise new CEO in tandem with Q2 earnings before the open that showed a 2% decline in comparable sales.

US Treasury yields are falling again on Wednesday as nervous traders pile into longer maturities ahead of the Federal Reserve's Meeting Minutes from July that are expected in the afternoon. The market is worried that more hawkish comments in the Minutes bode poorly for Chair Jerome Powell's speech at Jackson Hole on Friday.

Palantir stock news

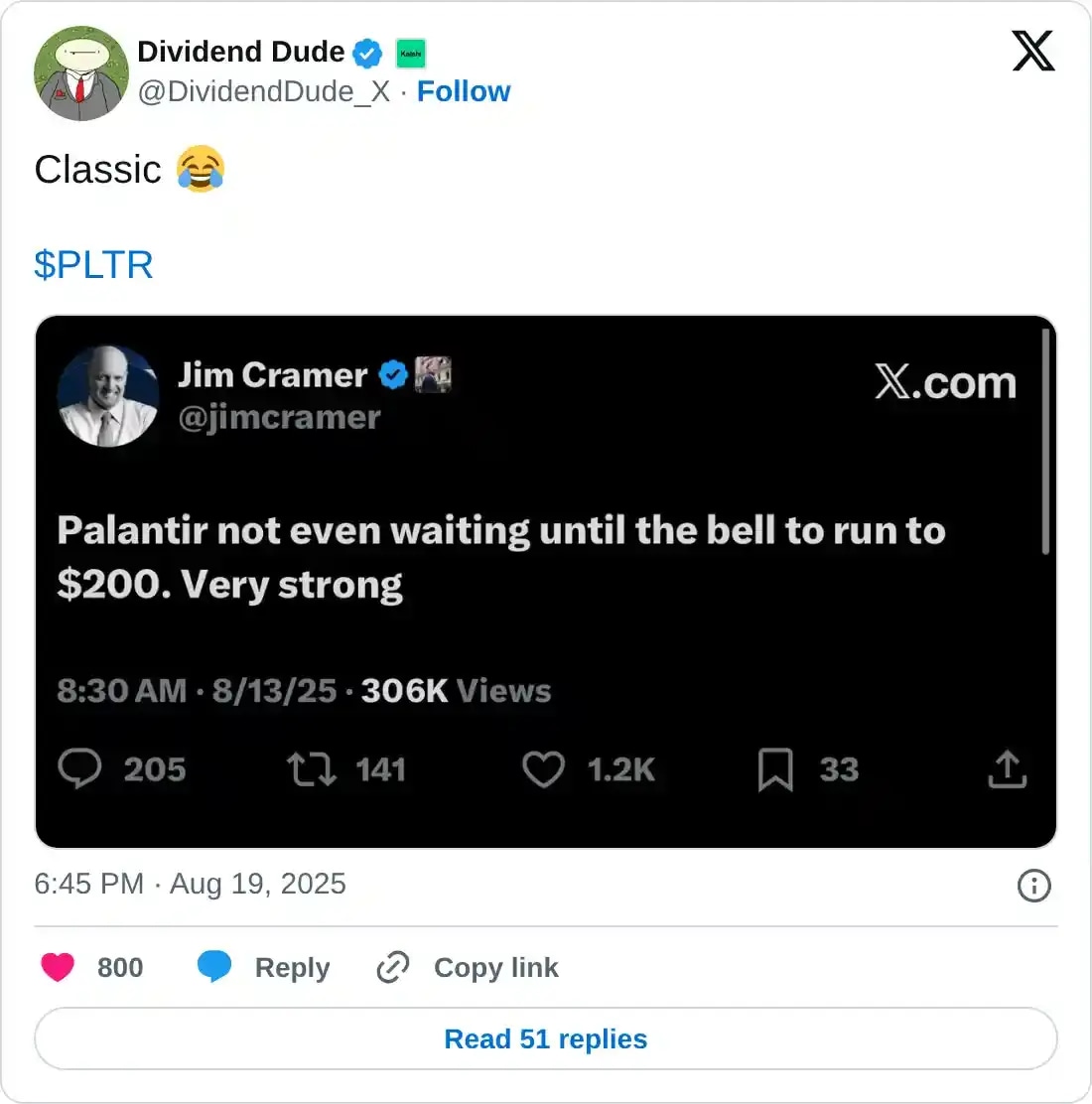

Many traders are posting with glee that CNBC's Jim Cramer, who has a history of poorly-timed calls, posted the following tweet on X right at the beginning of the present pullback for PLTR stock.

A quote tweet of Jim Cramer's X.com post from August 13

Then, on Monday, noted short-seller Andrew Left's Citron Research published a short call on Palantir in which it claimed that PLTR is worth no more than $40 per share.

It did so by pointing out that Sam Altman's OpenAI, which launched the generative AI industry via its ChatGPT platform, is currently valued at about 17 times 2026 revenue. OpenAI just raised $6 billion at that market cap. Meanwhile, Palantir was trading north of 90 times 2026 revenue one week ago. If it were to trade at 17 times 2026 revenue of $5.6 billion, that market cap of $95 billion would confer a ~$40 share price.

Calling Palantir "a company now detached from fundamentals and analysis, ironically the very services it claims to offer," Citron argues that OpenAI should trade at a higher multiple regardless since its total addressable market (TAM) is much higher than Palantir, which relies on slower growing enterprise and government contracts that directly place it in competition with Microsoft (MSFT) and Databricks.

Citron projects OpenAI's 2030 TAM at $700 billion, while suggesting Palantir will have a TAM between $130 billion and $200 billion at the end of the decade.

Still, many bulls are planning to buy the dip on PLTR. They saw how it conked out at $125 in mid-February and traded all the way back to $66.12 on April 7 only to rally to $190 over the next five months.

Palantir stock forecast

Palantir stock slightly gapped down on Wednesday, easily skating beneath the 50-day Simple Moving Average (SMA). This tells us that the bottom is unlikely to be near. The July 1 pullback near $130 is a possible level to watch as it sits close to the 100-day SMA.

Additionally, the former resistance-turned-support level of $125 is a noteworthy cause for trust since it offers plenty of historical volume. If PLTR breaks that level, the 200-day SMA near $105 is also in close proximity to February's $100 support shelf.

Either way, the Relative Strength Index (RSI) at 35 is already below the April 4 reading of 36, which tells us that the current selling pressure is unusually swift. On August 12, it was showing an overbought 75 reading. At this rate, dip buyers will wait until the RSI registers a concrete oversold reading below 30.

PLTR daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.