Dow Jones Industrial Average sinks amid renewed tariff threats

- The Dow Jones tumbled around 340 points on Friday.

- According to the White House, reports of a delay in tariffs is false.

- US PCE inflation met expectations, and trade tariffs are inbound this weekend.

The Dow Jones Industrial Average (DJIA) broke to the bearish side toward the tail end of the US trading session on Friday. Equities backslid after a spokesperson for US President Donald Trump reaffirmed that trade tariffs against Canada, Mexico, and China will be implemented this Saturday.

Pre-market reports suggested that President Trump’s team would be kicking the tariff can down the road, and the White House would be instituting exemption policies that US trade partners would be able to use to soften the blow of tariffs on key industries. The reports were enough to keep investor sentiment buoyed, with analysts from JPMorgan pivoting to expect a “base case” of no tariffs at all. However, White House Press Secretary Karoline Leavitt crushed those hopes, reiterating that import tariffs of 25% on Canada and Mexico and a 10% tariff on all Chinese goods would be implemented beginning February 1.

President Trump amended the White House statements after the fact in a closed-door meeting with specific reporters, noting that US tariffs on Canadian Crude Oil would be brought down to 10%, but further noting that there is nothing China, Mexico, or Canada can do to forestall tariffs. President Trump also reiterated his campaign promise to "take back the Panama Canal". President Trump capped off the statements hinting that additional tariffs on steel, aluminum, and "chips" in reference to microprocessors, would be coming this month or next.

White House: Earlier reports are wrong, tariffs are coming February 1

Further cold water was splashed on investor sentiment after Press Secretary Leavitt confirmed that, while President Trump is ‘exploring’ an exemption mechanism and an exemption specifically for the Canadian Crude Oil industry, nothing is currently on the books. The US economy heavily relies on Canadian Crude Oil imports, with most US refineries geared to process heavy Crude Oil products from Canada and Mexico, not the light sweet crude oil products produced by US pumpjacks.

US President Donald Trump: I will impose tariffs on the EU

US Personal Consumption Expenditures Price Index (PCEPI) inflation came in exactly as expected on Friday, showing that key core inflation metrics are holding stubbornly higher than the Federal Reserve’s (Fed) 2% annual target, making it difficult for the US central bank to deliver rate cuts in a timely manner. US PCE inflation held steady at 2.8% YoY in December.

Dow Jones news

Almost the entire Dow Jones equity board fell into the red on Friday, with a few tech giants managing to hold onto thin gains for the day. Amazon (AMZN) held 1.6% above Friday’s opening bids near $240 per share, followed by Cisco Systems (CSCO), which gained 0.4% on the day to cross $60 per share.

Chevron (CVX) fell to the bottom of the Dow Jones, sinking 4.5% and falling below $150 per share. US energy companies are largely exposed to possible trade tariffs that may include Canadian Crude Oil sources. Chevron also reported a miss in its earnings per share in its pre-market earnings update, citing lower margins on refined products.

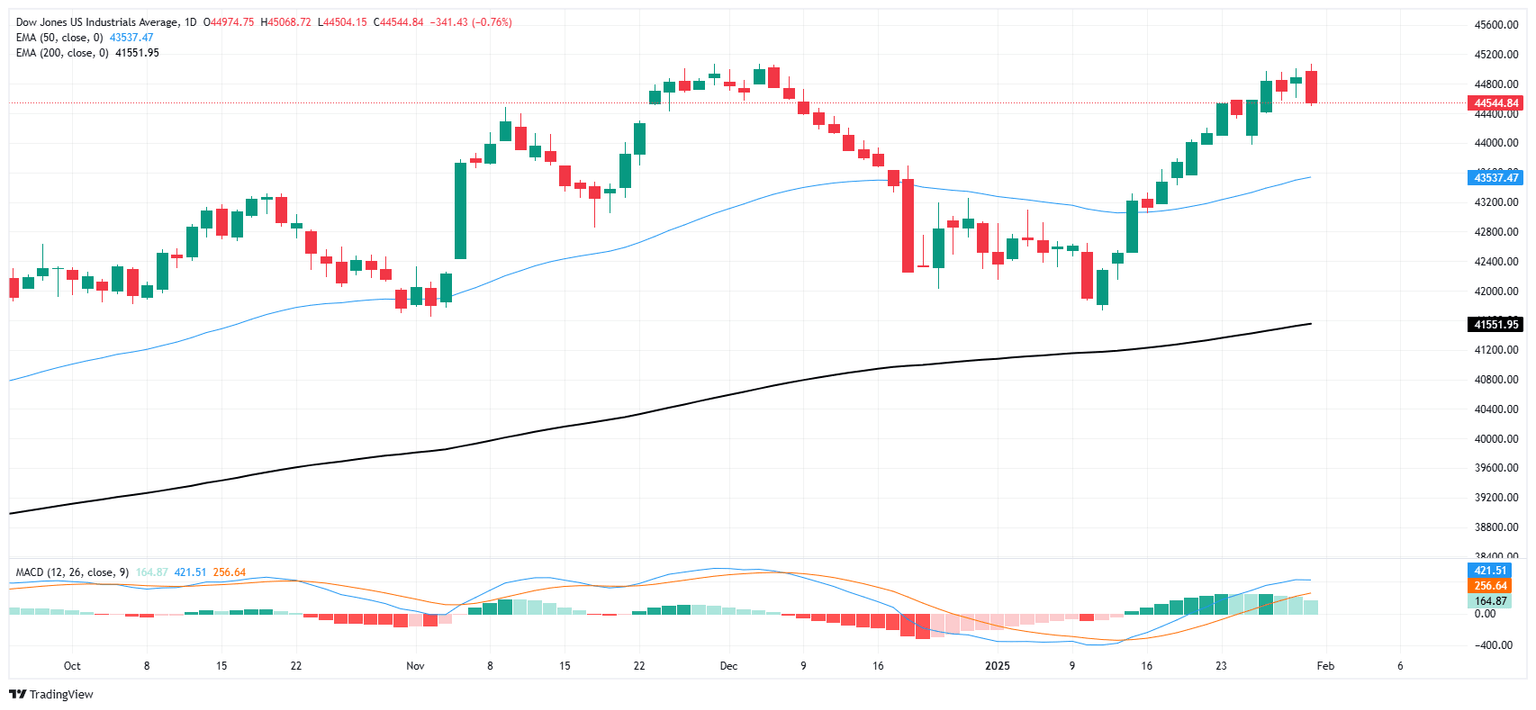

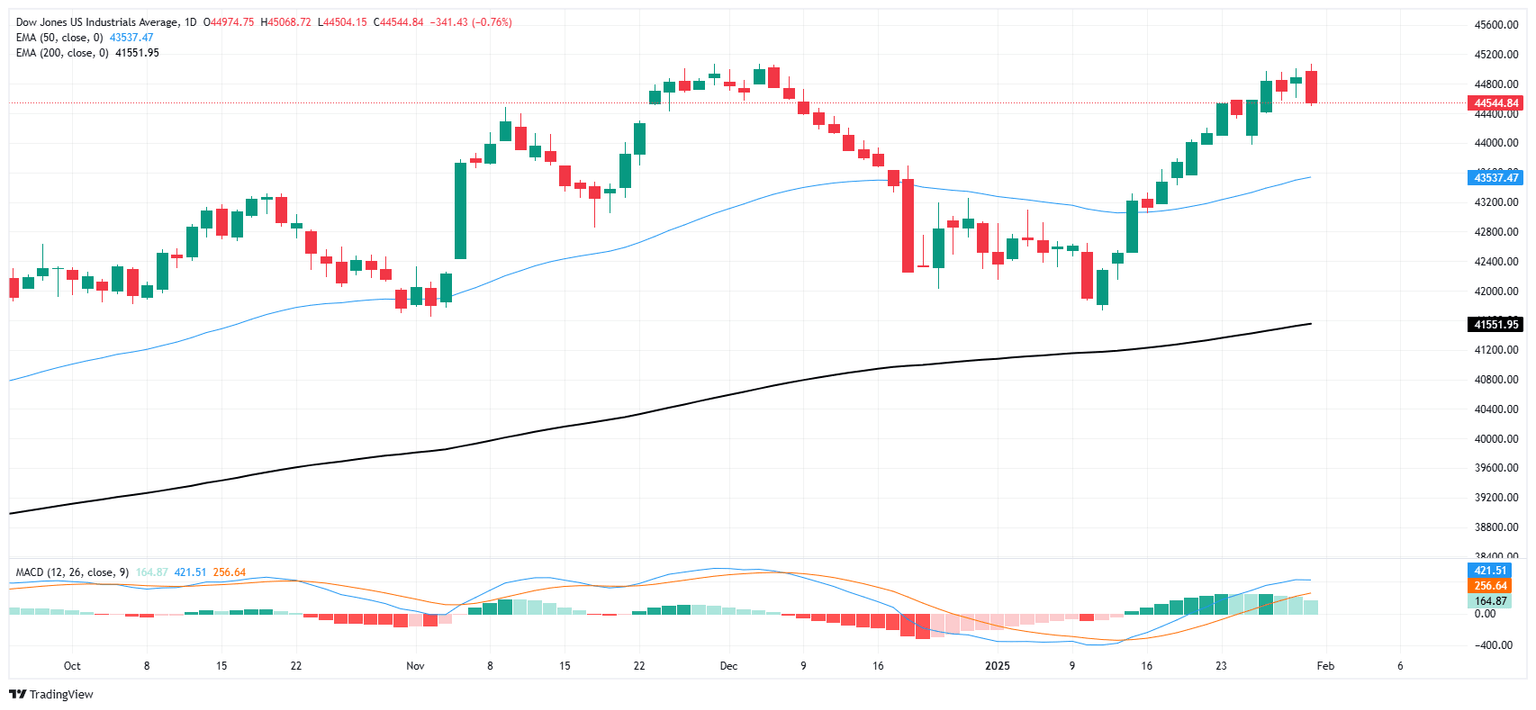

Dow Jones price action

The Dow Jones’ bearish price action on Friday sent bids back below 44,800, crimping chances for a bullish recapture of record highs above 45,000. The major equity index is now testing back into the 44,600 region, and the DJIA’s recent bull run appears to be evaporating.

Dow Jones daily chart

Economic Indicator

Core Personal Consumption Expenditures - Price Index (YoY)

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures." Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri Jan 31, 2025 13:30

Frequency: Monthly

Actual: 2.8%

Consensus: 2.8%

Previous: 2.8%

Source: US Bureau of Economic Analysis

After publishing the GDP report, the US Bureau of Economic Analysis releases the Personal Consumption Expenditures (PCE) Price Index data alongside the monthly changes in Personal Spending and Personal Income. FOMC policymakers use the annual Core PCE Price Index, which excludes volatile food and energy prices, as their primary gauge of inflation. A stronger-than-expected reading could help the USD outperform its rivals as it would hint at a possible hawkish shift in the Fed’s forward guidance and vice versa.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.