Dow Jones Industrial Average churns after mixed NFP and unemployment prints

- The Dow Jones dipped to fresh lows before rebounding after NFP data print.

- The US added less jobs than expected in February while unemployment ticked higher.

- Previous wages, unemployment, and NFP net job gains were all revised lower.

The Dow Jones Industrial Average (DJIA) struggled on Friday, falling to a fresh seven-week low below 42,200 before staging a mild recovery to the 42, 800 region. The Dow Jones is still sharply lower on the week, falling 2.6% from Monday’s opening bids as trade war concerns weigh on investor sentiment, as well as middling data prints that hint at cracks developing in the US economic landscape.

US Nonfarm Payrolls (NFP) showed a net increase of 151K net new jobs in February’s preliminary print. The figure rose from January’s revised print of 125K, but still came in below the median market forecast of 160K. The US Unemployment Rate also rose slightly, ticking up to 4.1% from the previous 4.0%, and investors were hoping for a steady hold at the previous figure.

US Average Hourly Earnings drew a complicated picture: headline annualized wages grew to 4.0% YoY, but only after January’s yearly earnings were revised down to 3.9% from 4.1%. Markets were expecting earnings to come in at 4.1% in February.

US President Donald Trump continues to twist the screws on his quantum-state tariffs that both exist and do not exist. The Trump administration caved on tariffs that went into effect at the beginning of the week, pivoting to extensions for the automotive industry, and then a wider cut of goods covered under the USMCA. Less then 24 hours after granting tariff concessions, Donald Trump again hit the wires, musing about possibly giving the go-ahead on his “reciprocal” tariffs on Canada, as soon as Friday, but perhaps Monday or even Tuesday.

Dow Jones news

Despite Friday’s early dump, the Dow Jones is recovering, with two-thirds of the equity index posting gains for the day. Boeing (BA) is still in the red for the day, down 3.0% and falling below $154 per share as tariff threats are enough to damage suppliers exposed to cross-border transaction costs.

Strong earnings and positive insider activity is continuing support International Business Machines (IBM), which rose 4.35% to $260 per share on Friday. The tech giant beat the street on its recent earnings reports, bolstering the hardware and software producer. According to reporting, IBM board member David Farr has been adding to his personal stockpile of IBM shares, prompting some investors to follow suit.

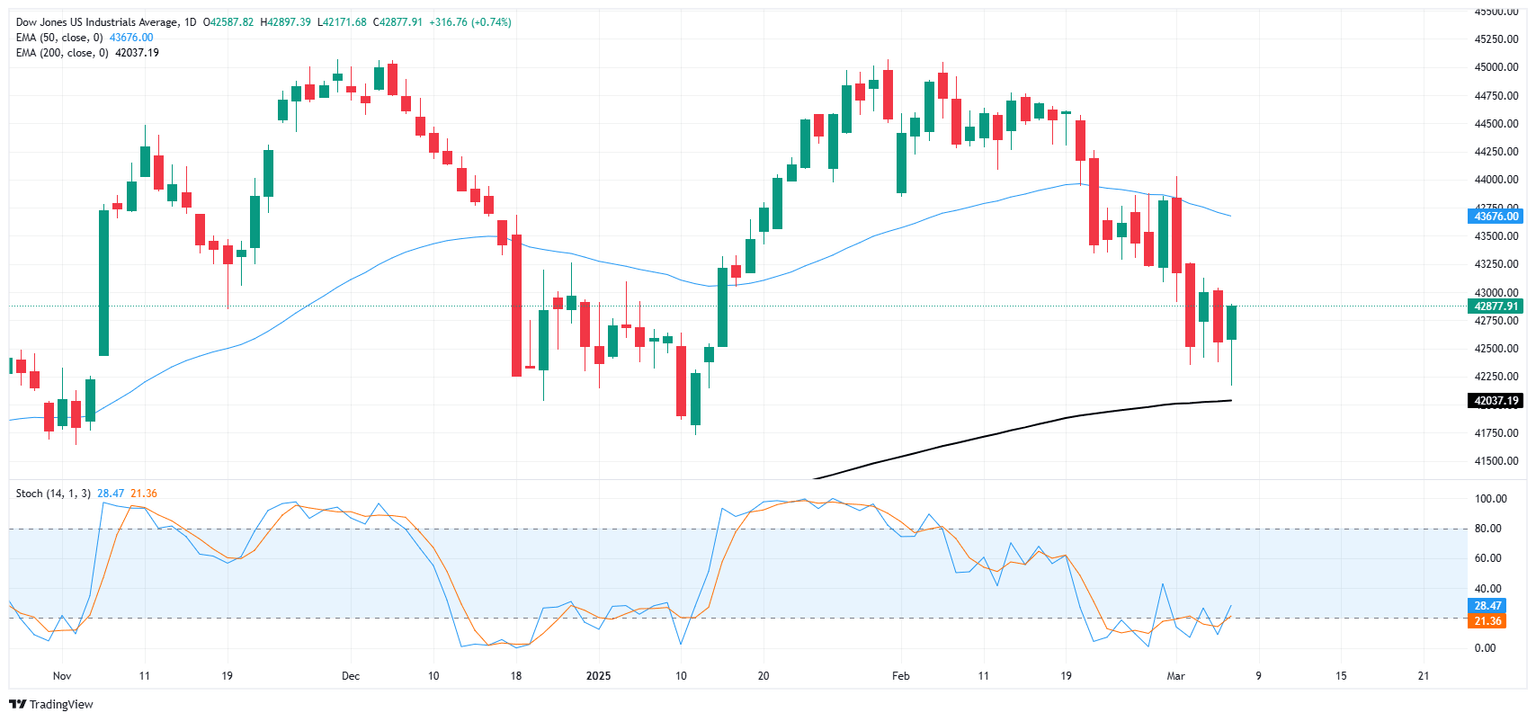

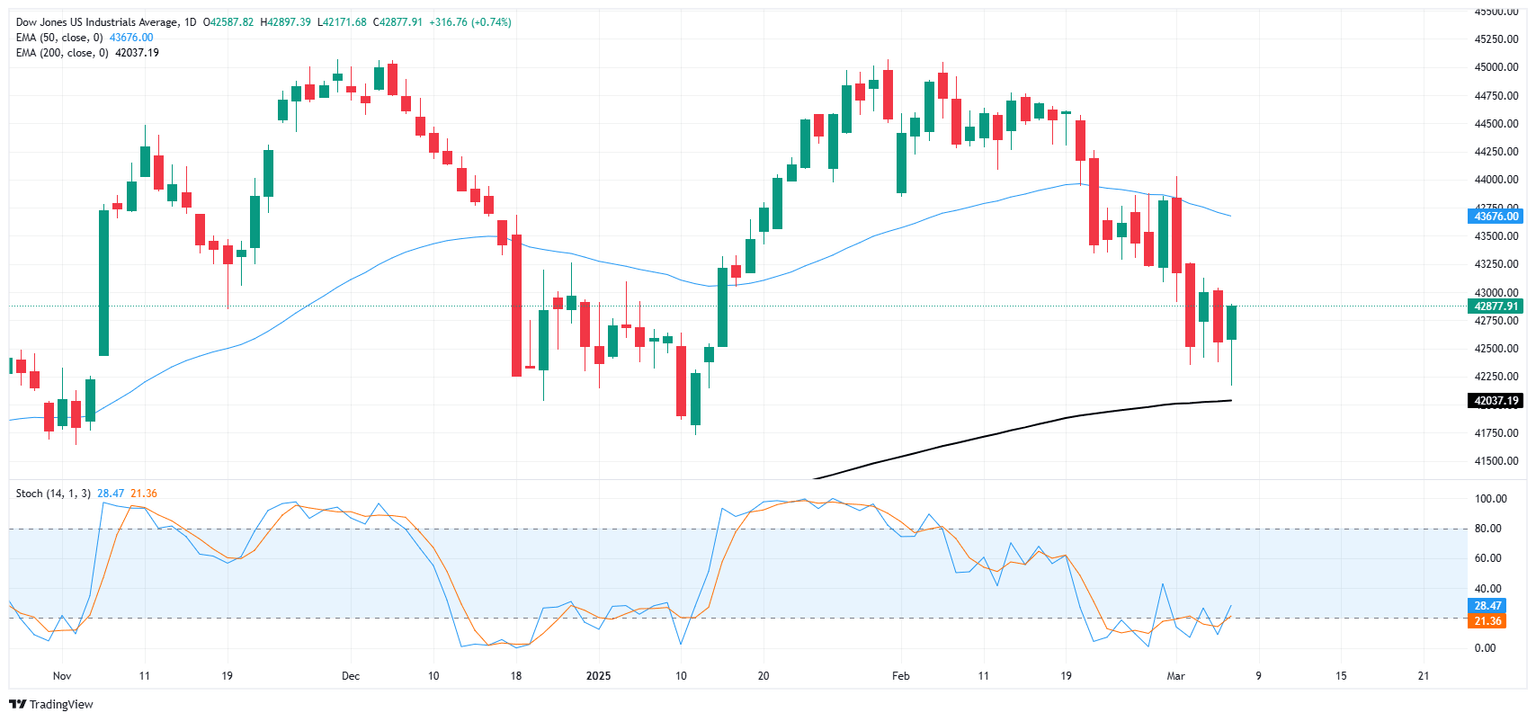

Dow Jones price forecast

The Dow Jones caught some selling pressure early Friday before recovering its stance, wrestling with the 42,800 handle. The major equity index is still down for the week after falling from the 44,000 handle, but the downside remains limited and bearish pressure is facing stiff resistance.

Price action is getting dangerously close to the 200-day Exponential Moving Average (EMA) just below the 42,000 major price level. One more push into the low side will end the Dow Jones’ 16-month trend of outpacing its own major moving average.

Dow Jones daily chart

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Mar 07, 2025 13:30

Frequency: Monthly

Actual: 151K

Consensus: 160K

Previous: 143K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.