Dow Jones Industrial Average soars as equities rebound on tariff delay

- The Dow Jones soared 7.8% on Wednesday after the Trump administration delayed its lopsided “reciprocal” tariffs.

- A flat 10% across-the-board tariff is still in effect, and China tariffs are still going to 125%.

- Market sentiment has entirely reversed course, and rate cut bets are plummeting.

The Dow Jones Industrial Average (DJIA) skyrocketed on Wednesday, climbing nearly 3,000 points and reclaiming the 40,000 major price handle after the Trump administration announced it would once again pivot away from most of its recent tariff threats. According to social media posts by US President Donald Trump, lopsided “reciprocal” tariffs are being reduced to just 10% across the board for the next 90 days

US tariffs on China are still in effect, however, and are set to rise to 125% after China slapped a counter-retaliatory tariff of 84% on all goods imported from the US in a move that almost exclusively targets US agriculture. The US’s last-minute tariff pivot comes just after the European Union (EU) also approved its own retaliatory tariff package that would have seen a 25% import duty imposed on US goods.

Trump announces a 90-day pause on reciprocal tariffs

The Dow Jones soared over 10% bottom-to-top on Wednesday, rising 3,740 at its peak before settling to a more reasonable 6.2% single-day rebound. The Standard & Poor’s 500 (S&P) index rallied 375 points to climb 7.5%, while the Nasdaq Composite rose 1,400 points, netting 9.4% on Wednesday.

Read more stock news: NASDAQ spikes 10% after Trump pauses tariffs for 90 days

Rate cut bets are getting pummeled by the tariff delay news, and rate traders now expect far fewer rate cuts through the rest of 2025. According to the CME’s FedWatch Tool, interest rate swap traders now expect a total of 75 bps in interest rate cuts through the remainder of the year. A first Fed rate cut is still expected at the Fed’s June rate call meeting, but a first rate cut in July remains a firmer bet.

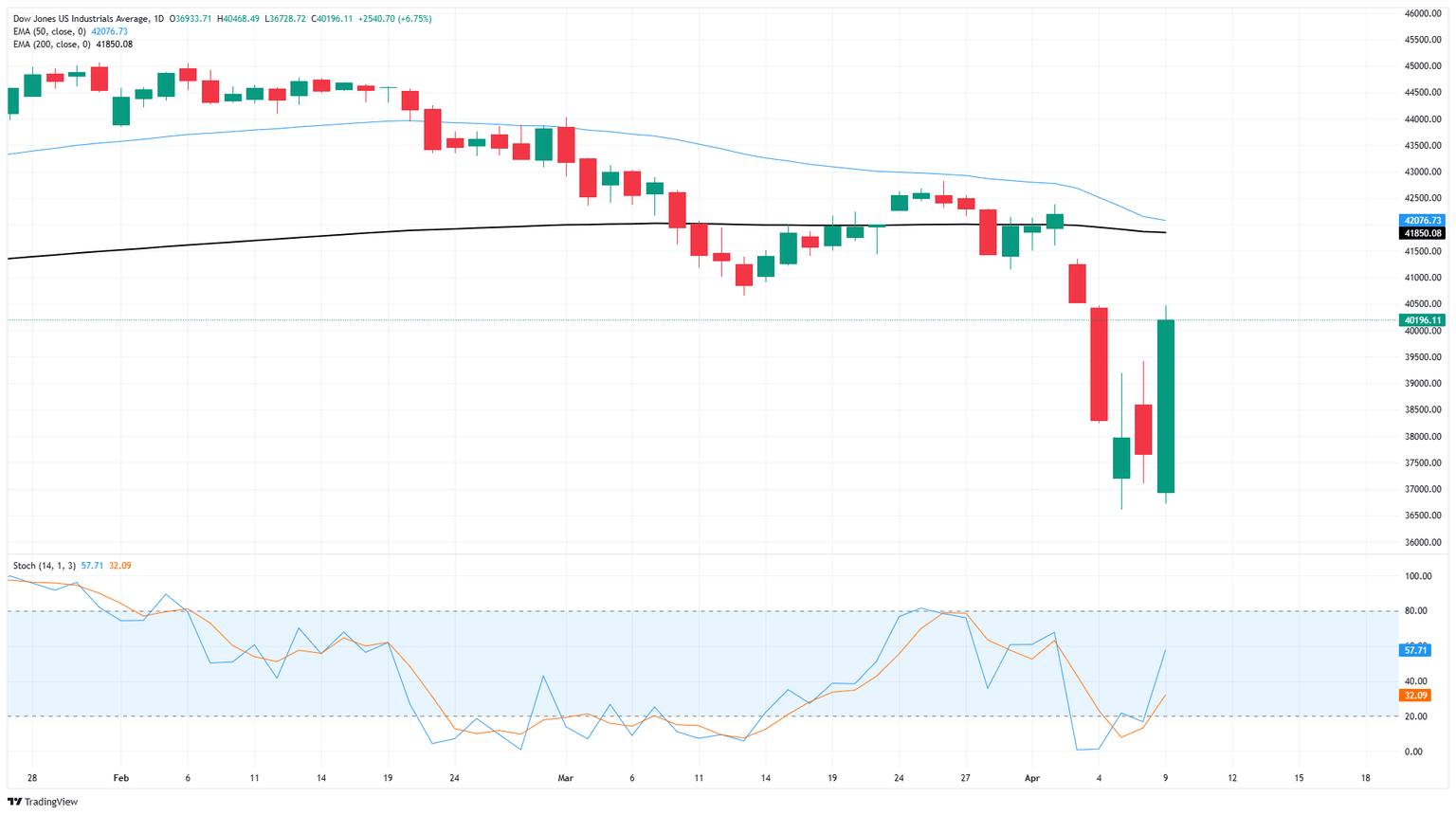

Dow Jones price forecast

Intraday price action has been decimated by more late-stage tariff policy pivots from the Trump administration, and the Dow Jones has gone from 37,000 to 40,000 within a single trading session. Significant technical resistance remains at the 200-day Exponential Moving Average (EMA) near 41,900, however bidders will first need to crack through a soft resistance zone from March’s swing low into 41,000.

Dow Jones daily chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.