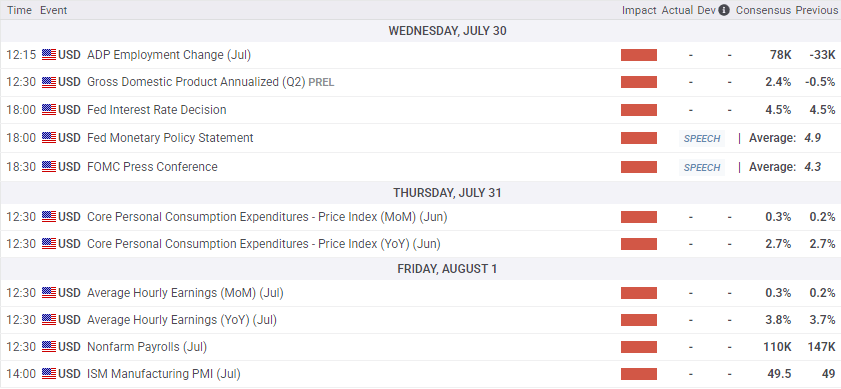

Dow Jones Industrial Average retreats ahead of Fed rate call

- The Dow Jones stepped lower on Tuesday as investors brace for a hectic week.

- The latest Fed rate call is due on Wednesday, crimping risk appetite.

- A hefty round of key US economic data is also weighing on the week.

The Dow Jones Industrial Average (DJIA) softened on Tuesday, falling back for a second straight day as bullish-prone equity markets pivot into a defensive stance ahead of the latest interest rate decision from the Federal Reserve (Fed). A raft of key United States (US) economic data is stuffing the chute through the rest of the week, with Gross Domestic Product (GDP), US Personal Consumption Expenditure Price Index (PCE) inflation, and the latest Nonfarm Payrolls report.

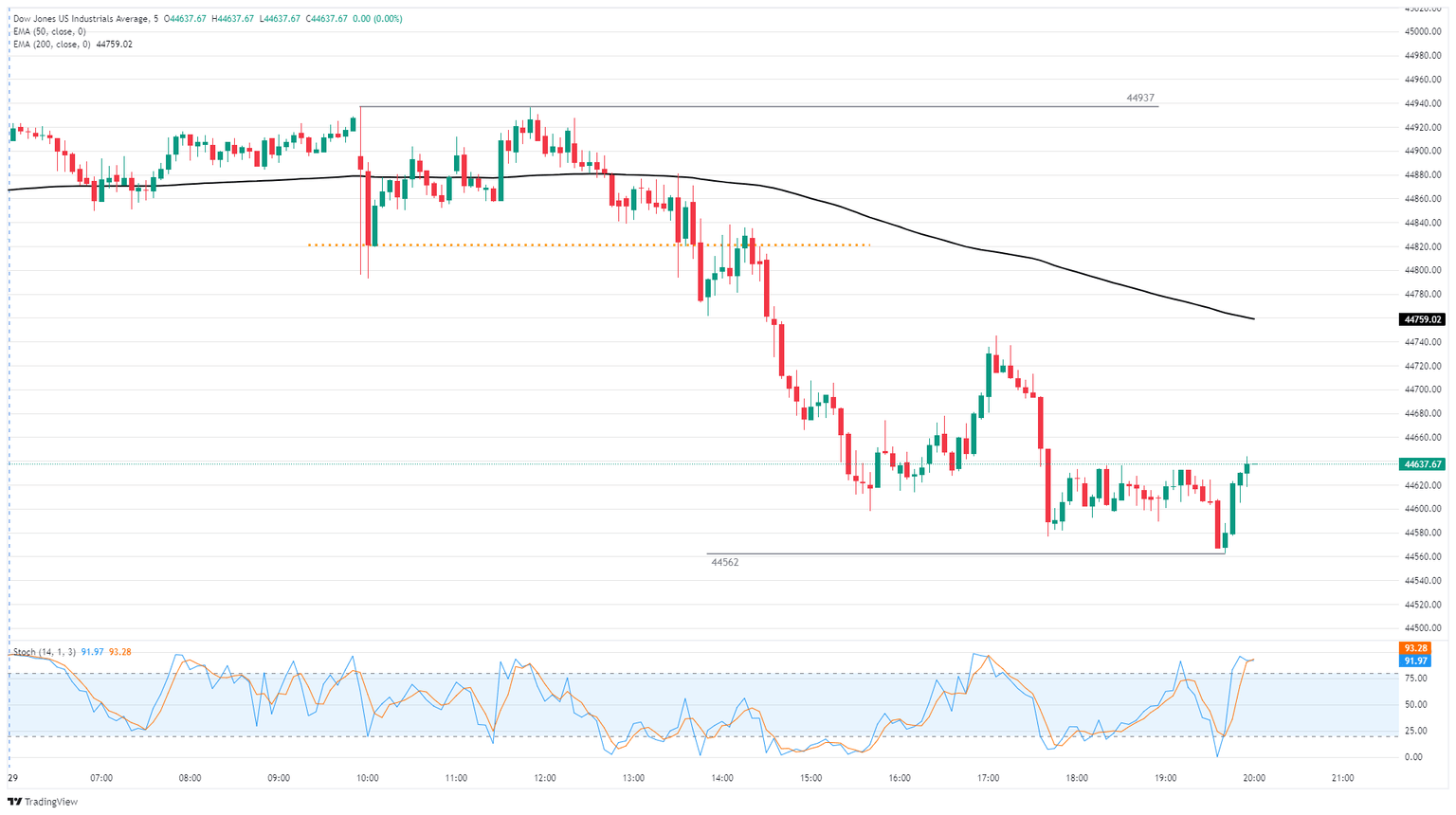

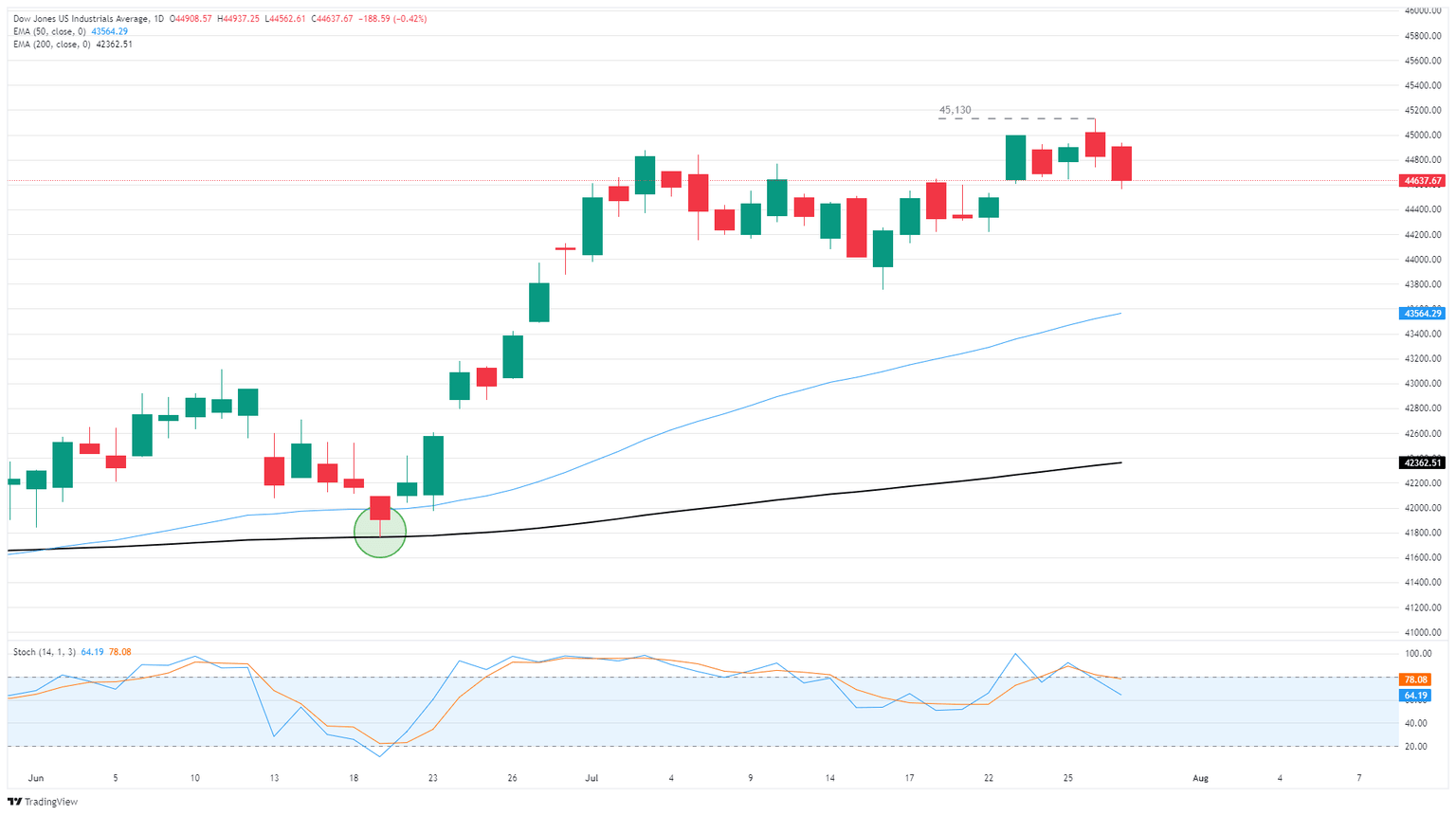

The Dow Jones slipped back below 44,800, shedding around 200 points and backsliding four-tenths of one percent on the day. Bearish pressure continues to build overhead, crimping further upside after the Dow posted a record intraday high of 45,130 earlier this week. Charts are still catching technical support from a messy congestion zone north of 44,000, but traders should expect price action to be driven by headlines this week.

Mag7 earnings, Fed rate call in the barrel for Wednesday

Adding further pressure to equity markets, four of the “Magnificent 7” will be publishing their latest quarterly earnings on Wednesday and Thursday. Meta Platforms (META), Microsoft (MSFT), Apple (AAPL) and Amazon (AMZN) will all be posting their quarterly results during the midweek, and investors will be hoping for signs of ongoing expansion and accelerating profit growth from key stocks that represent the well-stuffed top echelons of corporate valuations.

With a combined market capitalization of $11.17T, the four key earnings names this week account for over a fifth of the market cap of the entire Standard & Poor’s 500 (SP500) major equity index.

The Fed’s latest interest rate decision is slated for Wednesday and is expected to draw plenty of investor attention. The US central bank is broadly expected to keep interest rates on hold in the 4.25-4.5% range this week, but traders will be looking for signs that the Fed is still on track to deliver a fresh quarter-point rate trim at its next meeting on September 17.

US GDP, PCE inflation, and NFP job gains all on the docket this week

Besides an interest rate call from the most powerful central bank in the world, investors will also be contending with a US GDP update early Wednesday. Quarterly US GDP growth last clocked in at a disappointing -0.5% in Q1, and markets are hoping for a sharp recovery to 2.4% in annualized growth in Q2.

US PCE inflation, due on Thursday, is expected to accelerate slightly, with analysts anticipating an uptick to 0.3% MoM in June compared to the previous month’s 0.2%. A resurgence of inflationary pressure is the last thing investors want, as it could spell doom for ongoing rate cut expectations.

Friday’s NFP jobs report could add further fuel to rate hold fears. July’s NFP net employment gains report is expected to hold in positive territory after seasonal adjustments. However, the figure is expected to ease to 110K from June’s 147K.

Read more stock news: UnitedHealth stock spirals after missing quarterly EPS

Dow Jones five-minute chart

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.