Dow Jones Industrial Average loses some ground as Trump and Musk clash

- The Dow Jones is holding steady as markets await Friday’s NFP report.

- Despite an overall upbeat tone to equities, market sentiment remains hobbled.

- The US is heading into trade talks with China, which Trump staffers historically lack the patience for.

The Dow Jones Industrial Average (DJIA) held steady on Thursday, chugging quietly near the previous day’s closing bids. Investors are braced for this week’s Nonfarm Payrolls (NFP) jobs report, slated to release on Friday, and the Trump administration is hard at work barreling into trade talks with China and exchanging barbs over budget bills with billionaires. However, steep losses

Jobs are the headline datapoint for investors this week. ADP job postings sank in May, causing investors to moderate their expectations for this week’s NFP official follow-up. May’s NFP jobs data report is expected to show a net gain of 130K employment positions over the reference period, down from the previous month’s 177K.

Also in markets: Fed officials still concerned about tariff impacts on inflation

President Trump’s former right-hand hatchet man, Elon Musk, has been lobbing potshots at Trump’s ‘big beautiful budget bill’ this week via social media. Posting to the social media platform that he owns, Musk has been openly deriding the Trump budget that he had a hand in creating.

Musk is ostensibly incensed that the Trump budget codifies functionally none of the federal spending cuts that he swiftly executed without Congressional oversight at the beginning of Trump’s second term. The relationship between two of the most prominent people in the country is souring quickly as the two exchange barbs over social media platforms or through statements to media personnel.

Shares of Tesla (TSLA) were down 17% at their lowest on Thursday, slipping below $305 per share after Elon Musk openly claimed that Donald Trump would have lost the federal election without his “involvement”. Earlier this week, Elon Musk also threatened to primary Congressional lawmakers who support the Trump administration’s deficit-heavy spending bill.

The Trump team is racing toward trade talks with China following a call between President Trump and Chinese President Xi Jinping. According to statements by Donald Trump on Thursday, the two had a productive phone call, and tariff negotiations are expected to continue. However, Donald Trump himself and most of his retinue have a poor track record of maintaining their composure when dealing with Chinese trade officials. Trump and Xi exchanged barbs as recently as this week over trade, with both sides accusing each other of violating pre-deal trade terms agreed upon in Geneva, Switzerland, in early May.

Read more stock news: Circle Internet Group stock spikes 235% on IPO debut

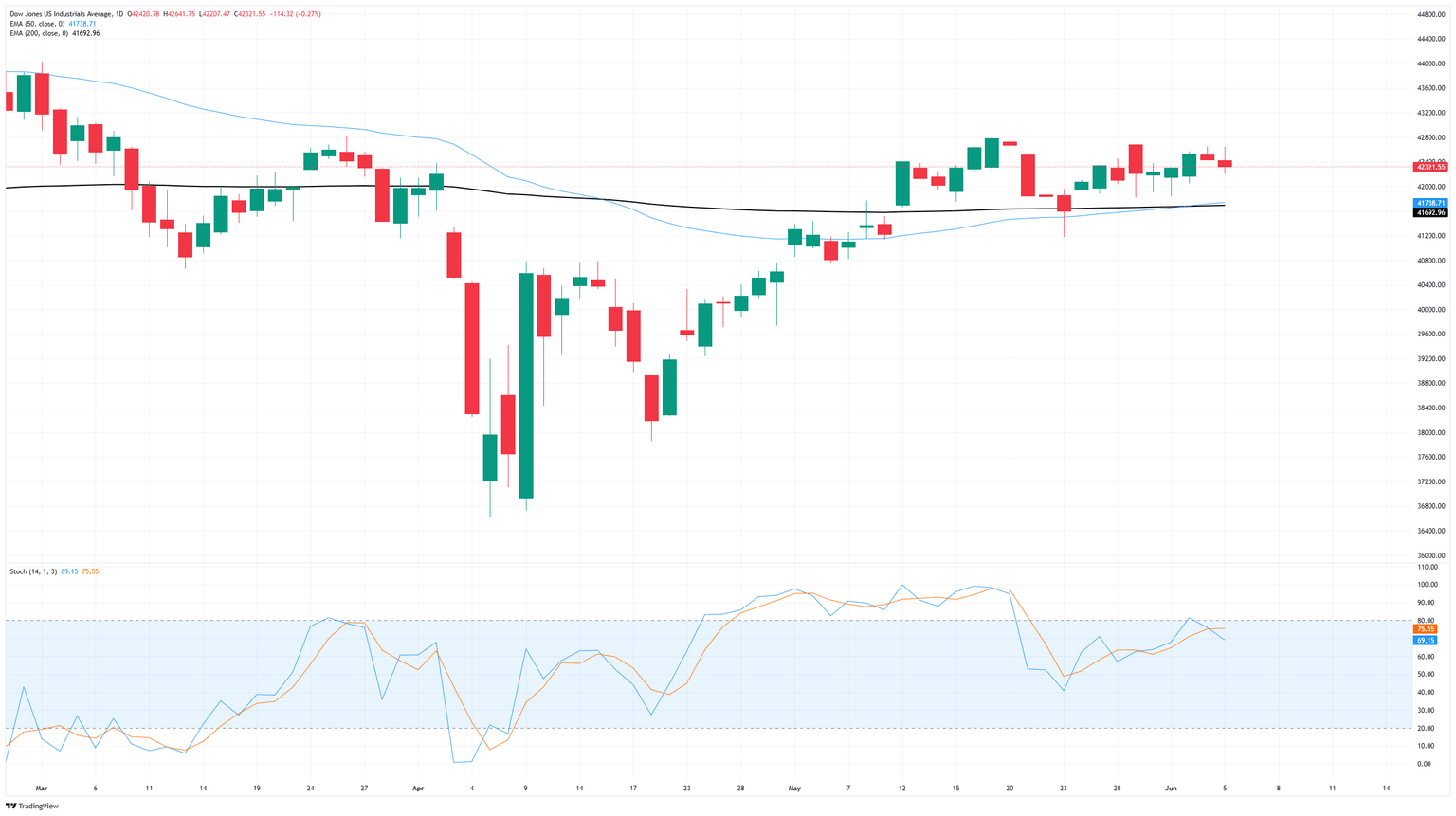

Dow Jones price forecast

The Dow Jones Industrial Average remains trapped in a consolidation zone. Investors are awaiting a fundamental shift in either direction, and a routine of nerve-fraying headlines on trade and tariffs has significantly widened the scope of intraday technical signals.

The Dow Jones is pinned to the 42,500 region, with bullish price action firmly capped below the 43,000 handle. However, downside pressure remains firmly subdued, with bids strung along the north side of the 200-day Exponential Moving Average (EMA) near 41,600.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.