Dow Jones Industrial Average grinds through Thursday with limited moves

- The Dow Jones tested higher on Thursday, but remains hobbled by 42,000.

- Equity markets lurched higher after better-than-expected housing figures before settling again.

- US Intitial Jobless Claims came in under their four-week average, and manufacturing sentiment fell less than expected.

The Dow Jones Industrial Average (DJIA) continued to challenge the 42,000 key handle on Thursday, catching an early rise after US economic figures broadly beat forecasts. However, investor sentiment remains tepid overall as ongoing trade war fears continue to simmer on the back burner.

The Dow Jones is trading within one-fifth of one percent of Thursday’s opening bids near 41,950, and the Standard & Poor’s 500 (S&P 500) shed around one-quarter of one percent, falling to 5,660. The NASDAQ tech index backslid 60 points to test below 17,700.

The Philadelphia Federal Reserve (Fed) Bank’s Manufacturing Survey for March eased to 12.5 MoM, falling from the previous month’s 18.1 and declining for the second month in a row, but pulling the brakes and falling less than the median market forecast of 8.5. US weekly Initial Jobless Claims also rose slightly less than expected, clocking in at 223K net new jobless benefits seekers compared to the previous week’s 220K. Investors had expected a print of 224K. US Existing Home Sales also rose nearly a third of a million more transactions than expected, rising to 4.26 million units moved in February compared to January’s revised 4.09 million. Market watchers had expected a slight slowing to 3.95 million.

Stocks news

The majority of equity sectors are testing the low side on Thursday, with losses being led by the technology sector as the AI-fueled tech rally continues to sputter out. Energy and financial stocks rose moderately as economic data leaks back to the front of the pack over geopolitical headlines.

Darden Restaurants (DRI) bounced over 5% to around $200 per share after posting better-than-expected earnings figures ahead of Thursday’s market open. Accenture PLC (ACN) plunged nearly 8% on the day, falling below $300 per share despite beatings earnings forecasts as investors grow uneasy about flat bookings growth and a general decrease in operating margins.

Read more stock news: Home Depot stock leads Dow Jones index after Chair Powell’s ‘transitory’ optimism

Dow Jones price forecast

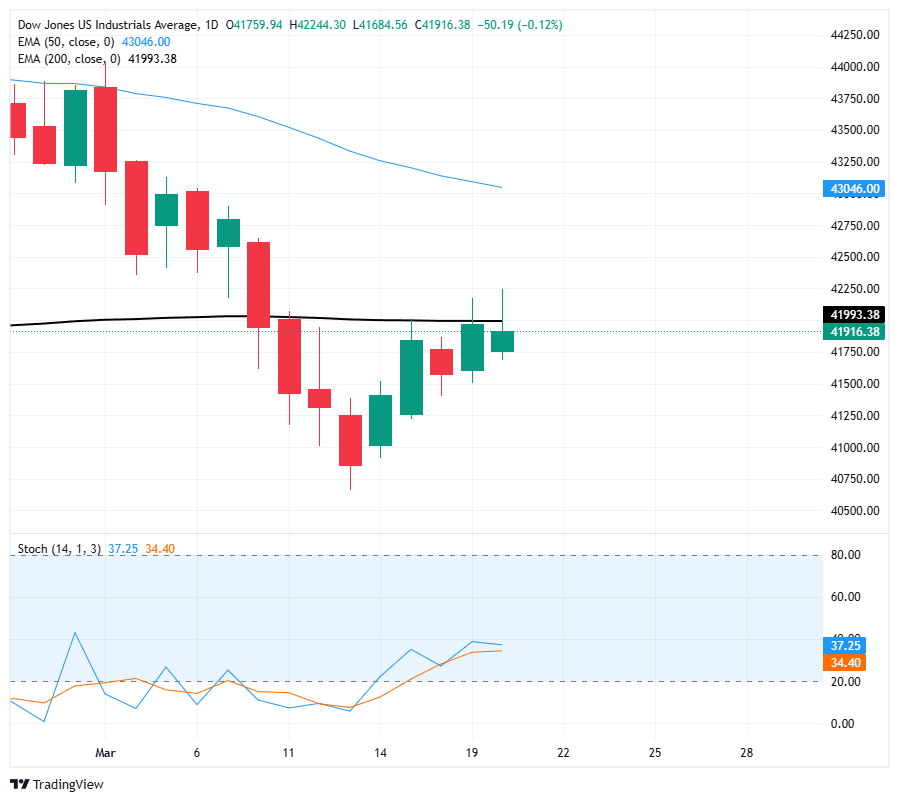

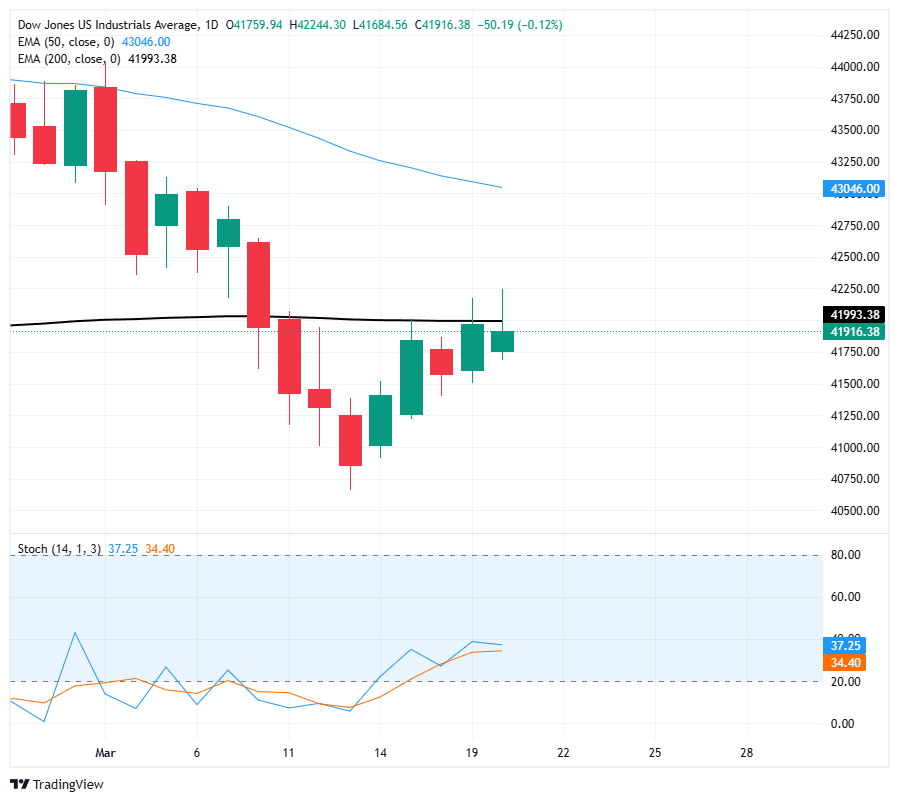

The Dow Jones continues to churn just south of key price levels, marking in several failed attempts to crack back through the 200-day Exponential Moving Average (EMA) near the 42,000 major price handle. Price action is still tilted in favor of buyers, but a lack of topside momentum is keeping bids hobbled by a new technical ceiling.

Dow Jones daily chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.