Dow Jones Industrial Average flattens after ADP Jobs misses the mark

- The Dow Jones remains hobbled near 42,550 on Wednesday.

- Investor sentiment is hamstrung after jobs preview data came in weaker than expected.

- This Friday’s upcoming NFP jobs print will take on additional importance.

The Dow Jones Industrial Average (DJIA) remained largely unchanged on Wednesday after bullish investor sentiment was stymied by a softer-than-expected ADP jobs print. Overall market momentum is cooling off as indexes hit a lull between trade war headlines.

ADP Employment Change numbers softened sharply in May, showing a net addition of just 37K jobs, well below the expected 115K upswing. ADP jobs figures are historically volatile, and have served as a poor forecast of Nonfarm Payrolls (NFP) data that follows shortly after. Regardless, this Friday’s upcoming NFP print will take on newfound significance as investors grow increasingly apprehensive about the state of the American economy’s labor sector. Businesses have been growing increasingly apprehensive about business conditions in the face of constantly changing trade policies pouring out of the White House, leading many operators to pull back on hiring and investment plans.

Jobs data uncorks bullish momentum, sentiment surveys do little to help

ISM Services Purchasing Managers' Index (PMI) survey results further dampened investor sentiment on Wednesday, showing that business operators in the services sector are growing gloomier about growth expectations. Aggregated survey results fell to a contractionary 49.9, falling to an 11-month low.

Wednesday was the deadline that the Trump administration had set for trading partners to deliver their best trade deal offers to the White House. Countries were expected to offer up their best trade offer to negotiate their way out of the reimposition of President Trump’s “reciprocal” tariffs package that was announced in April, then suspended for 90 days at the last minute. The administration has remained fairly mum on trade deals on Wednesday, suggesting that the inbox may not be stuffed as full as Trump officials had proposed earlier in the week.

Trump’s self-styled “Liberation Day” tariffs are set to take effect again in early July. However, investors are still banking on a return to form and that the White House will find a reason to again delay tariffs as the clock winds down.

Dow Jones price forecast

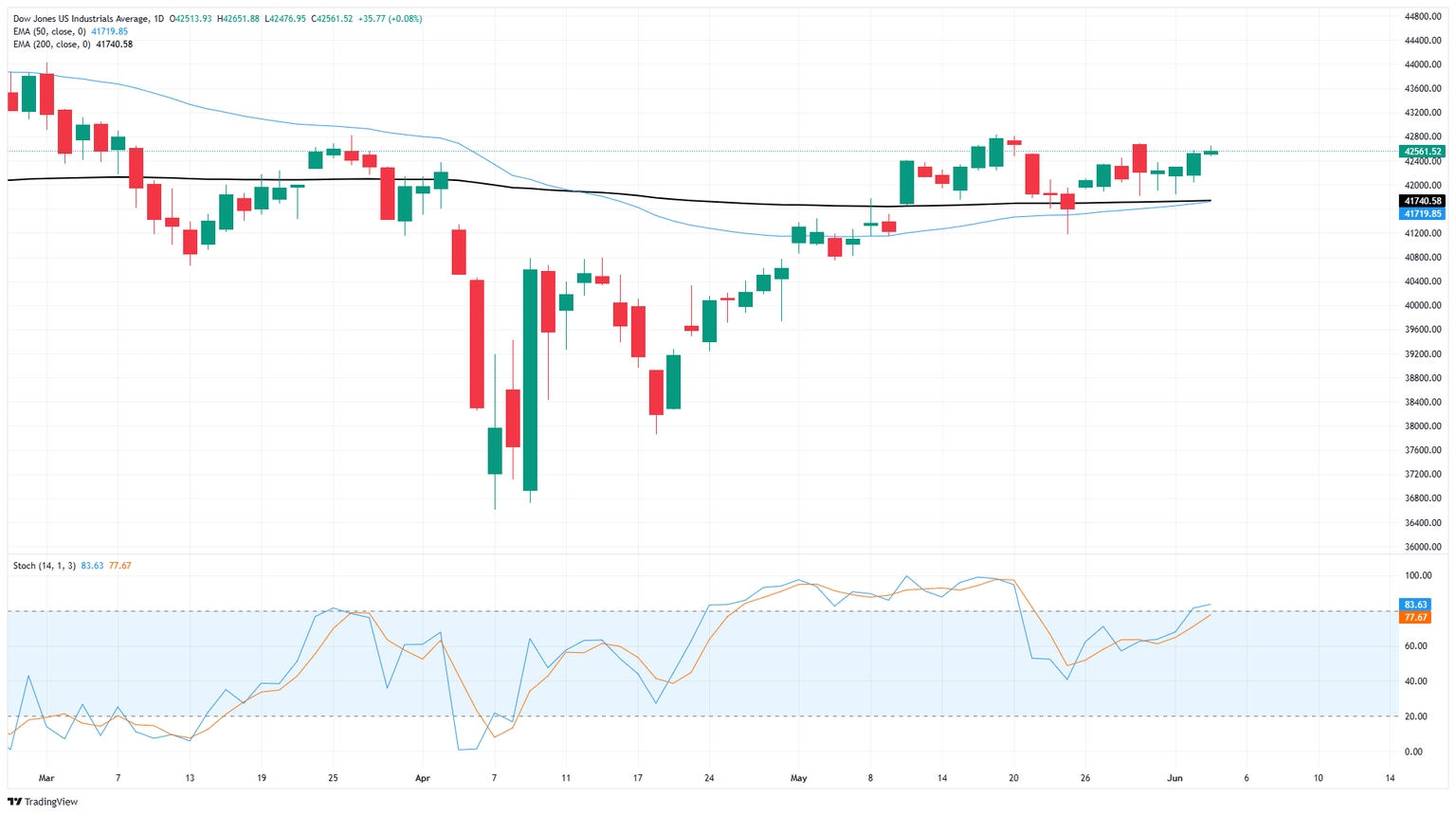

The Dow Jones Industrial Average is muddling through a consolidation phase just north of the 200-day Exponential Moving Average (EMA). Price action remains stuck in a near-term range between 42,000 and 43,000. Momentum is still tilted toward the upside, but a lack of progress coupled with technical oscillators testing into overbought territory could signal a technical pullback below long-run moving averages.

Dow Jones daily chart

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Jun 04, 2025 12:15

Frequency: Monthly

Actual: 37K

Consensus: 115K

Previous: 62K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.