Dow Jones Industrial Average pares bets after overly-cautious Fed Meeting Minutes

- The Dow Jones is down slightly on Wednesday after a failed attempt to reach 42,450.

- Nvidia shares climbed in after-hours trading after a headline beat on earnings, but caution is warranted.

- The Fed’s latest Meeting Minutes show the Fed remains firmly entrenched in wait-and-see mode.

The Dow Jones Industrial Average (DJIA) is slightly lower on Wednesday, easing below 32,100 as equity traders await key earnings reports from tech heavyweight Nvidia (NVDA). The Federal Reserve’s (Fed) latest Meeting Minutes showed that the major central bank is still apprehensive about adjusting policy rates in the face of looming impacts from the Trump administration’s tariff policies. However, investors are still banking on a fresh rate-cutting cycle to kick off in September, although odds are drying up.

The Fed's latest Meeting Minutes from the Federal Open Market Committee's (FOMC) May 6-7 rate meeting revealed a deep-rooted wait-and-see approach. Policymakers noted the US Dollar's (USD) safe-haven status has weakened and warned that a "durable shift" could impact the US economy. Most FOMC members agreed that inflation risks may be more "persistent than expected." Fed staff cited tariff impacts as a key driver behind the FOMC's lowering outlook on the US economy, linking deteriorating conditions and an unclear inflation-growth outlook to the Trump administration's tariff policies.

AI tech rally monolith Nvidia (NVDA) released its latest earnings for the first quarter of 2025. Nvidia broadly beat expectations for QOQ revenue and Earnings Per Share (EPS), however the silicon-puncher noted caution for deliverables in the months to come following tightening constraints on shipments to China.

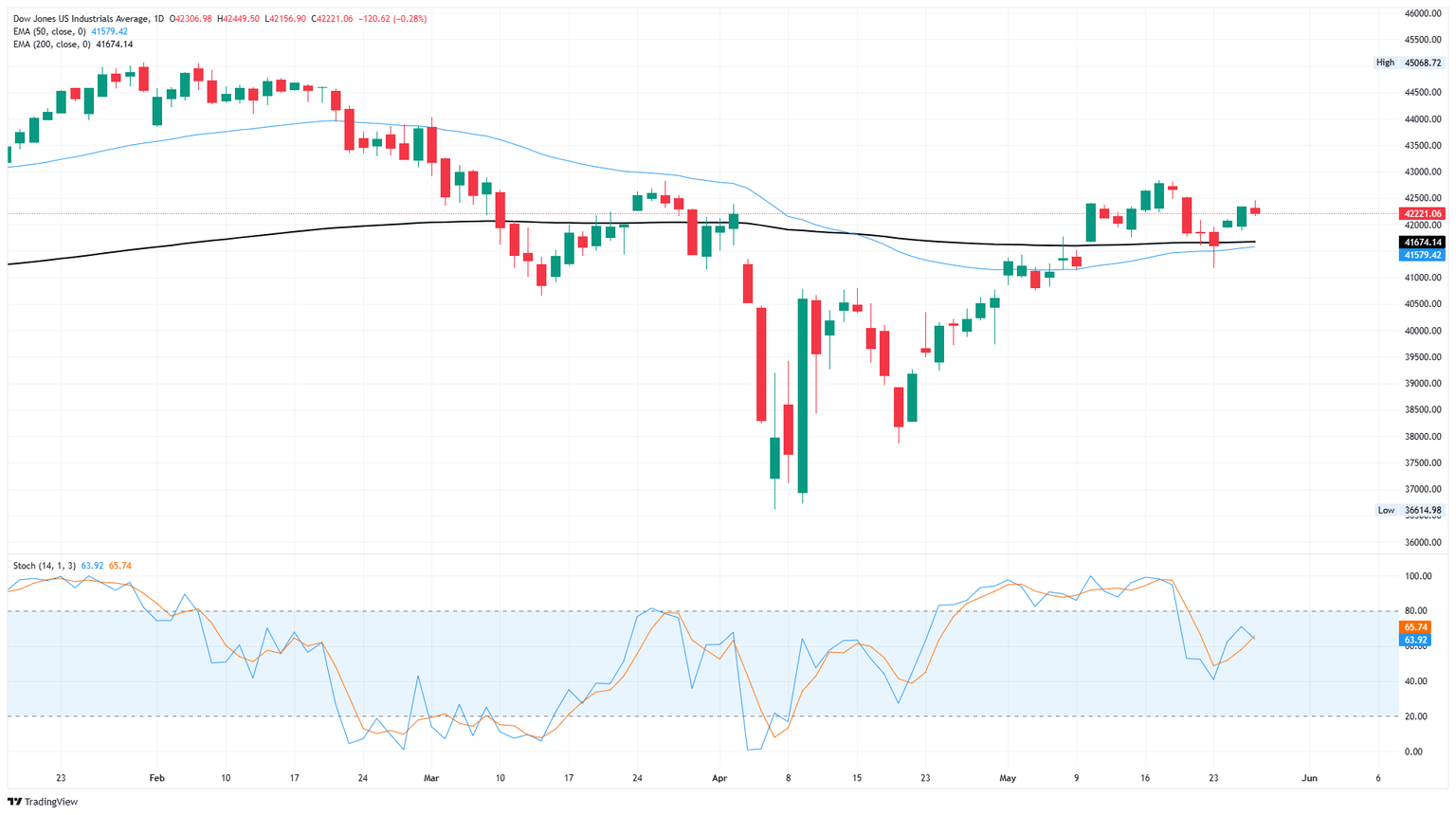

Dow Jones price forecast

Dow Jones price action remains stuck in a near-term rut; the major equity index is trapped just south of the 42,500 region, though daily candles continue to find a foothold above the 200-day Exponential Moving Average (EMA) near 41,655. Momentum still lies in favor of bullish pressure, though it’s still a long climb back to record highs above 45,000 set late last year.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.