Dow Jones Industrial Average waffles on softer Durable Goods

- The Dow Jones is fighting to regain its balance after getting knocked lower.

- Overall market flows are constrained with a holiday-shortened week on the cards.

- US Durable Goods Orders fell more than expected in November.

The Dow Jones Industrial Average (DJIA) weakened to kick off the Christmas trading week, falling a little over 200 points at its lowest before staging a meager recovery to -50 points on Monday. The Dow Jones is grappling with chart territory south of 43,000 following a ten-day backslide that dragged the major equity index back underneath record bids above 45,000.

US Durable Goods Orders contracted further than expected in November, declining 1.1% MoM compared to October’s revised 0.8% upswing. Investors expected a print of -0.4%. Declines in consumer durable goods were concentrated in automotive purchases, as US Durable Goods Orders excluding Transportation fell by a meager 0.1% MoM. Median markets forecasts had expected a better core Durable Goods Orders growth of 0.3% in November.

Overall market flows are constrained during the Christmas holiday-shortened trading week. Markets will be shuttered during the midweek market session, and trading volumes are set to remain constrained throughout the entire week.

Dow Jones news

The Dow Jones has moderated after snapping it’s longest losing streak since the 70s, where the index closed lower for ten consecutive trading sessions. Most of the Dow Jones is stuck on the low side of Monday’s opening bids, but firm tech gains have limited downside losses for the broader index.

Nvidia (NVDA) rallied 3.2% and crossed above $139 per share as the broad-market tech rally continues to float on the high side. On the low side, retail giant Walmart declined 2.2%, falling to $90 per share for the first time in a month. According to the Consumer Financial Protection Bureau, the federal consumer protection agency is suing Walmart after it was revealed that Walmart unlawfully requires delivery drivers to use an expensive app with one of the consumer giant’s fintech partners, Branch Messenger.

Dow Jones price forecast

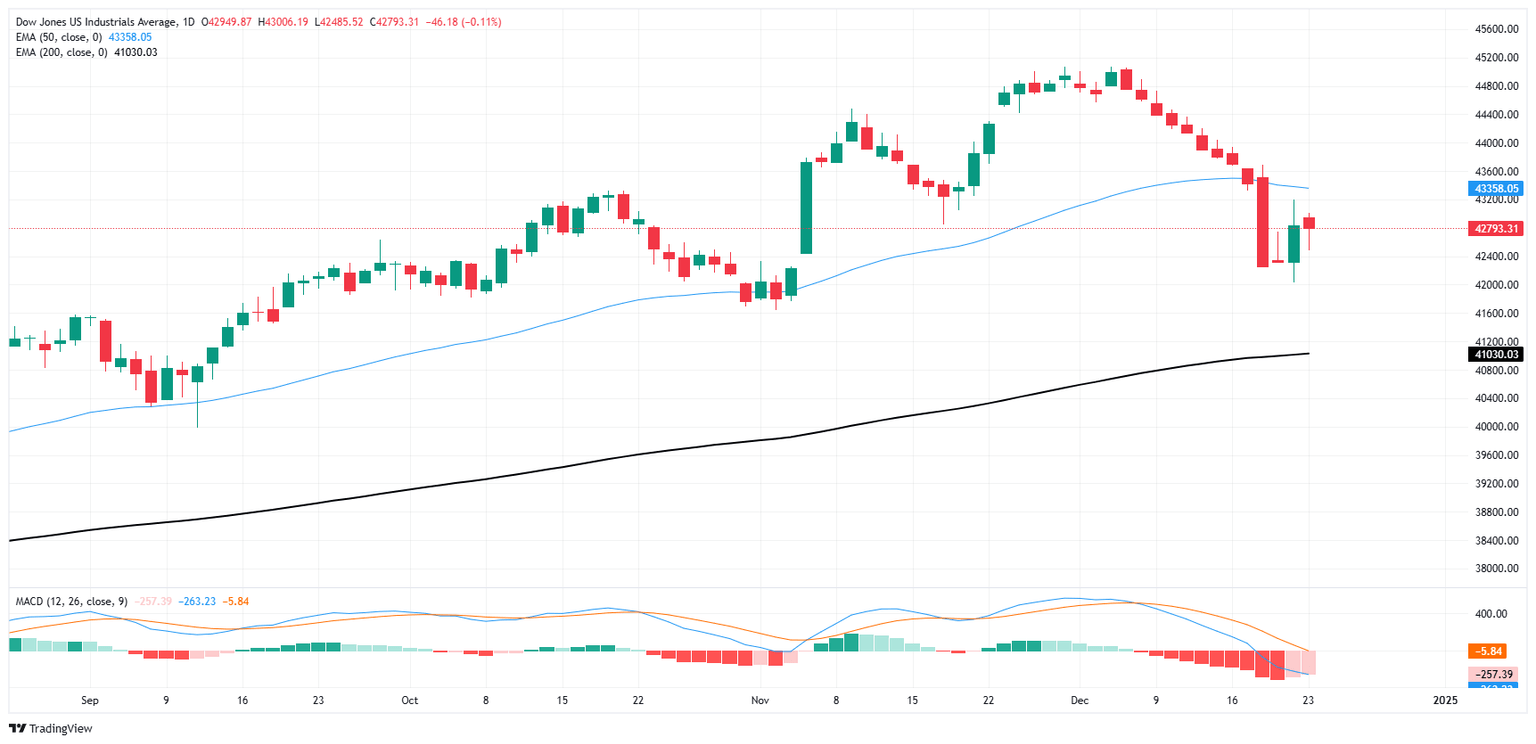

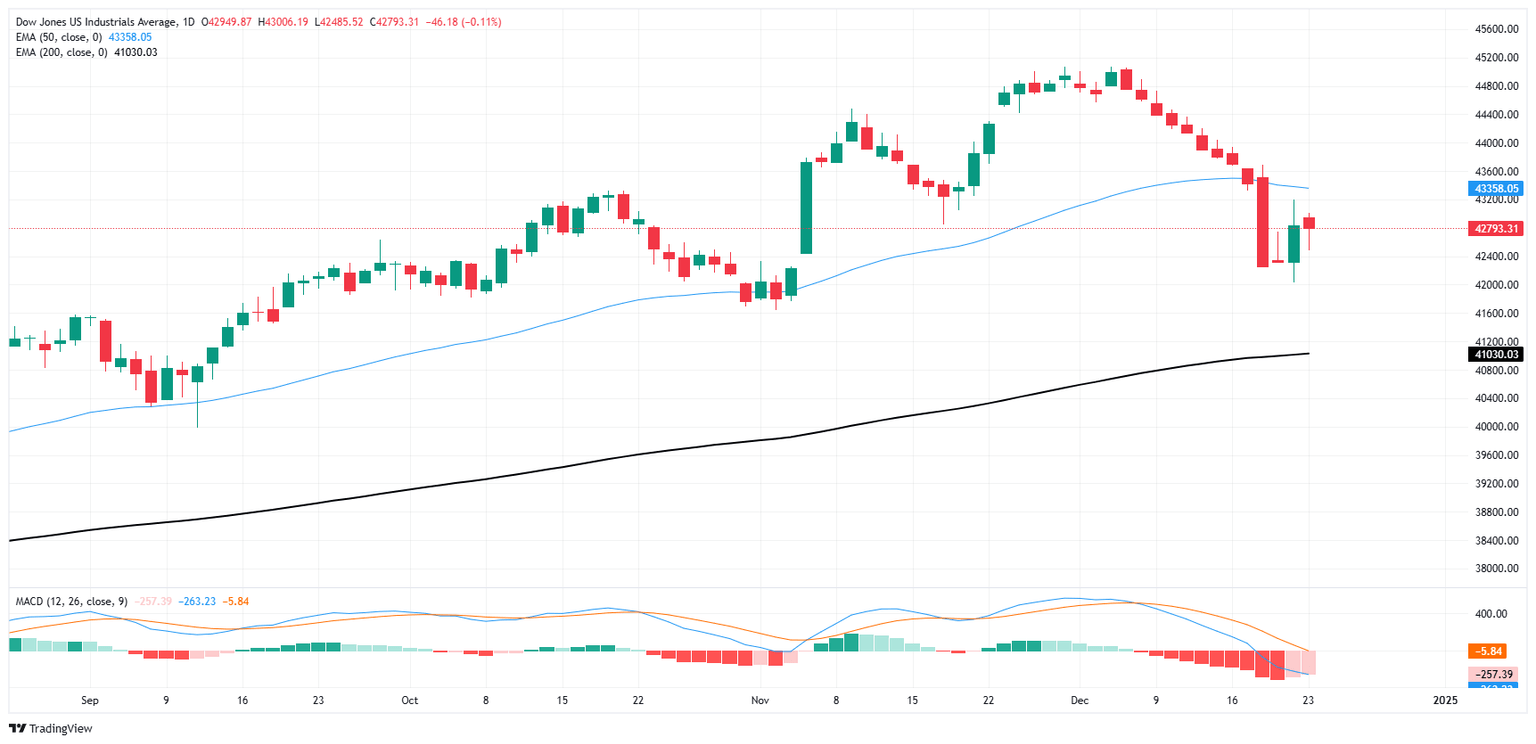

A near-term backslide has left the Dow Jones battling chart territory just south of 43,000. Price action has slipped back below the 50-day Exponential Moving Average (EMA) which is rolling over near 43,350, but a clear technical floor is getting priced in near the 42,000 handle.

Buyers will be looking for a chance to step back into another leg higher from here, though momentum traders may be waiting for a confirming close back above 43,500. On the low side, bears will be looking for a continuation to the 200-day EMA near 41,000.

Dow Jones daily chart

Economic Indicator

Durable Goods Orders

The Durable Goods Orders, released by the US Census Bureau, measures the cost of orders received by manufacturers for durable goods, which means goods planned to last for three years or more, such as motor vehicles and appliances. As those durable products often involve large investments they are sensitive to the US economic situation. The final figure shows the state of US production activity. Generally speaking, a high reading is bullish for the USD.

Read more.Last release: Mon Dec 23, 2024 13:30

Frequency: Monthly

Actual: -1.1%

Consensus: -0.4%

Previous: 0.2%

Source: US Census Bureau

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.