Did the S&P 500 put in a major top?

As a first in hopefully many articles and updates, we wanted to start off by sharing our insights regarding the S&P 500 (SPX). We primarily use the Elliott Wave Principle (EWP).

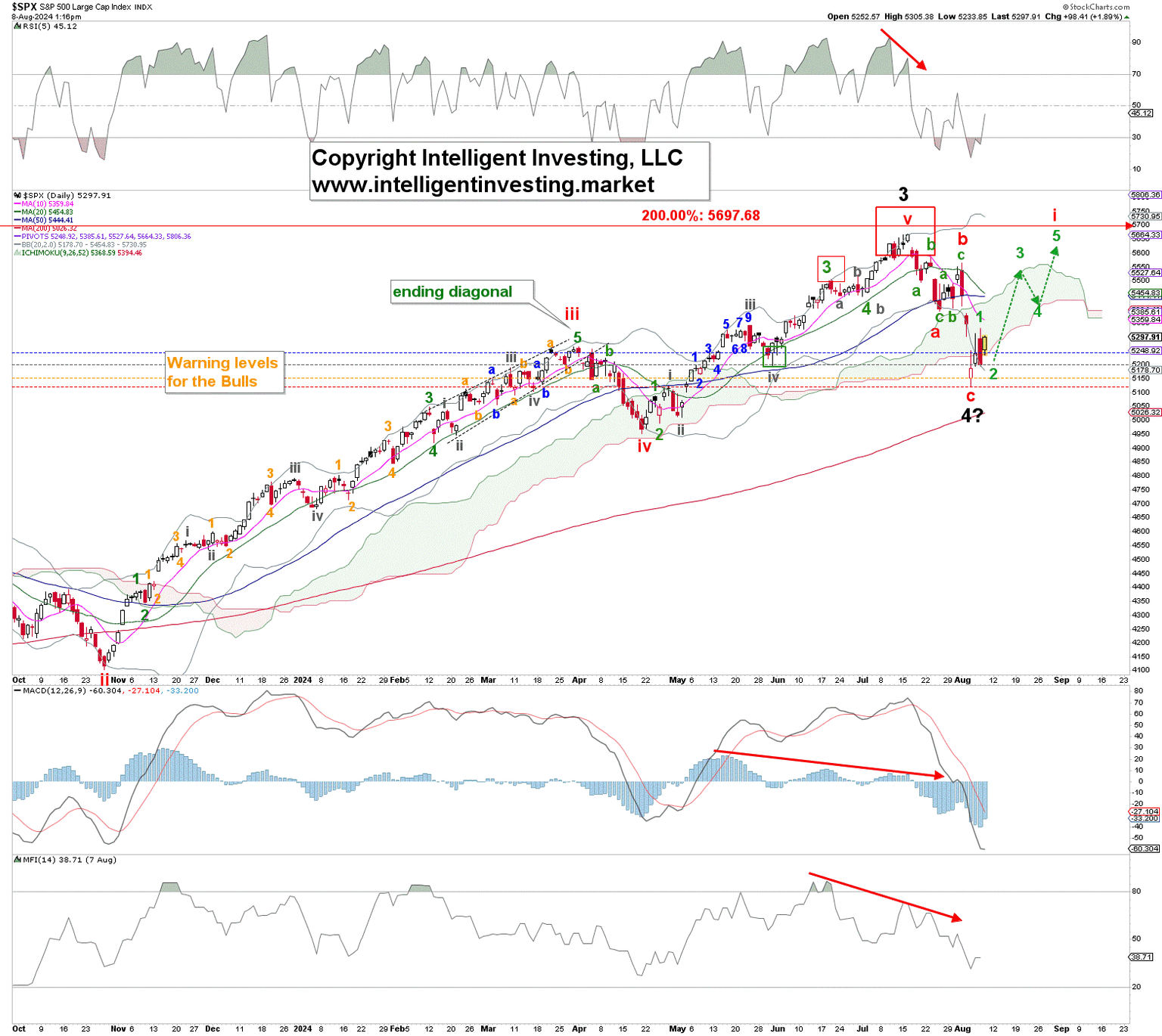

As you may be aware, the index peaked on July 16 at $5669, which fell 28p (0.5%) short of the ideal 5th wave target, the 200.00% Fibonacci extension of (Red) W-i, measured from red W-ii. See Figure 1 below. That is pretty accurate. The former wave, albeit not shown, is the rally from the March 2023 low into the July 2023 high, whereas, as shown, the red W-ii was the October 2023 low.

Then, on Monday, it dropped to as low as $5119. An almost 10% drop in less than three weeks. Thus, we must ask the question if the index put in a major top. Well, it is not all doom and gloom yet. Allow us to explain below.

Figure 1. Daily SPX chart with detailed EWP count and technical indicators

Assuming our bigger picture wave count from the October 2022 low is correct, then the index topped for the black W-3 and is now in the black W-4, which may have already bottomed out on Monday. And thanks to the EWP we know after W-4 comes W-5. Namely, the recent decline was clearly only three waves lower, with red W-a also comprising three (green) waves. Hence, corrective. Thus, the index may now work on five (green) waves back up to ideally $5650+/-50 for the red W-i of the black W-5.

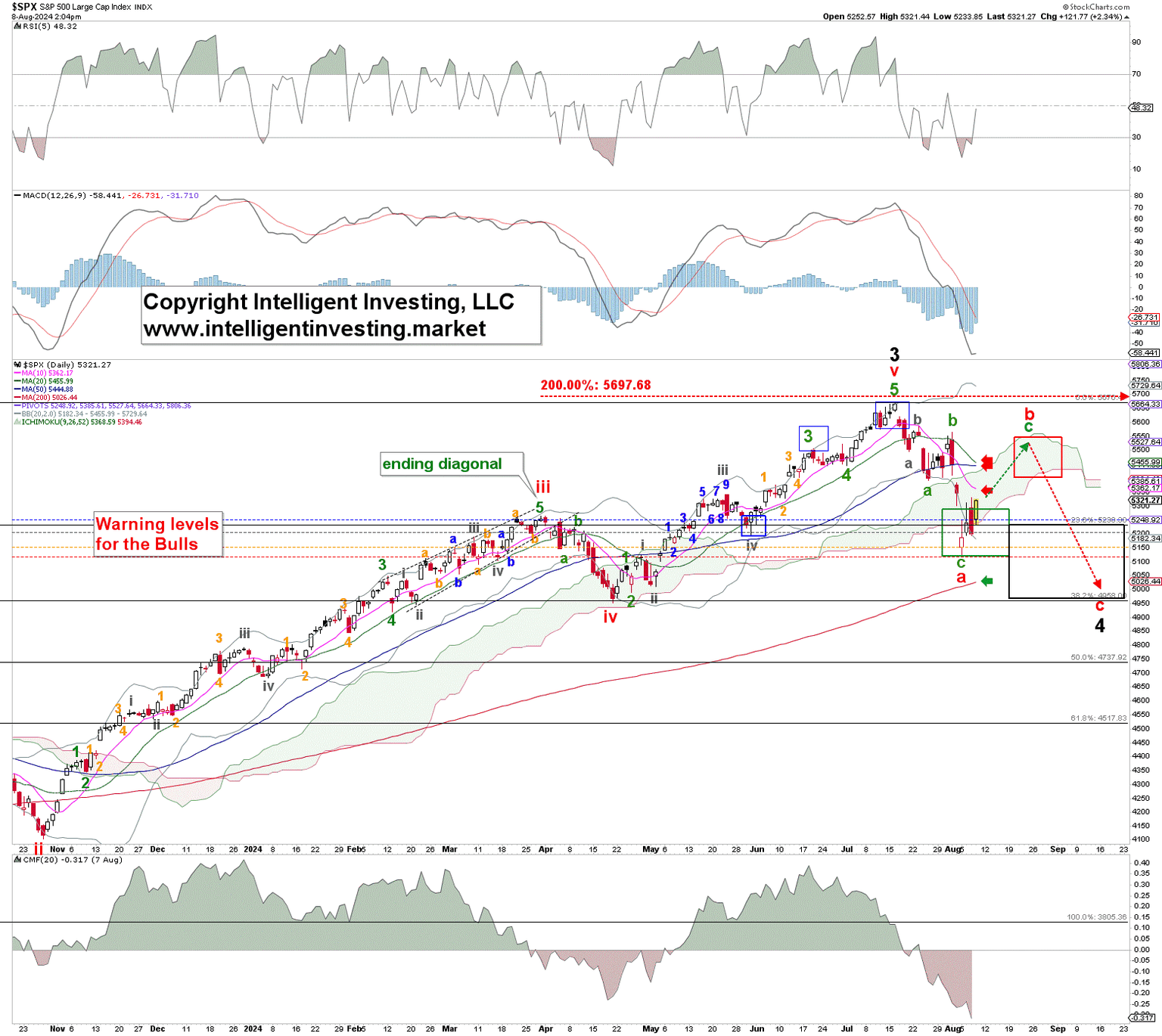

The latter will consist of five red waves (i, ii, iii, iv, and v; not shown) and will eventually reach new ATHs. However, after three waves down, we must always expect at least three waves back up, and thus, the black W-4 may not be done just yet. See Figure 2 below.

Figure 2. Daily SPX chart with detailed EWP count and technical indicators

It could be that the W-4 becomes more protracted, and the current rally from Monday’s low is only a bounce -the red W-b- back to around $5550+/-50 before the red W-c back down to ideally the 38.20% retracement of the W-3 at around $4950+/-25 kicks in.

We must acknowledge that we cannot look around more than two corners at once, so we simply don’t know which of the two EWP options is operable. Regardless, both options are currently pointing higher if the Bulls can keep the index’s price above the colored warning levels, and a major top may not be in just yet.

Author

Dr. Arnout Ter Schure

Intelligent Investing, LLC

After having worked for over ten years within the field of energy and the environment, Dr.