DAX (Germany) Elliott Wave technical analysis [Video]

![DAX (Germany) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DAX/dax-macro-concept-57844002_XtraLarge.jpg)

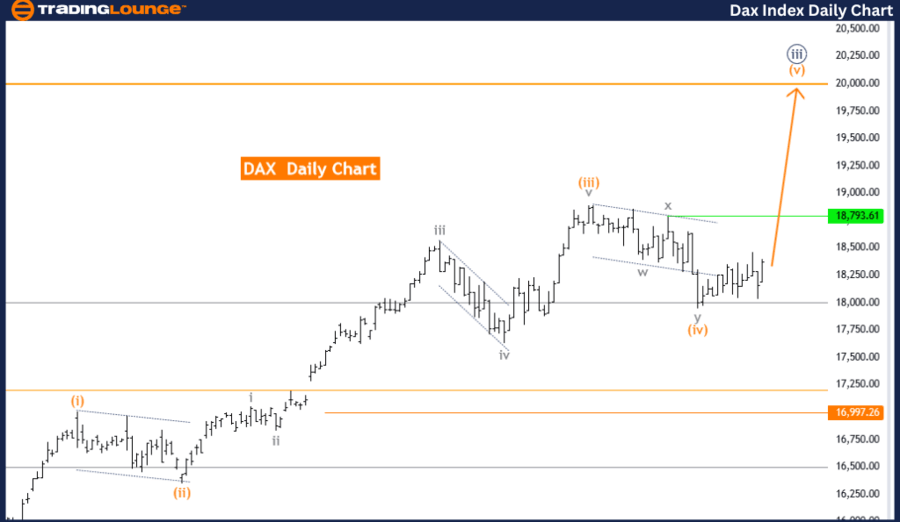

DAX (Germany) Elliott Wave technical analysis - Daily chart

Trend analysis

Function: Trend.

Mode: Impulsive.

Structure: Orange wave 5.

Position: Navy blue wave 3.

Direction next higher degrees: Orange wave 5 (started).

Current wave analysis

-

Details: Orange wave 4 of navy blue wave 3 appears completed. Now, orange wave 5 of navy blue wave 3 is in play.

-

Wave Cancel Invalid Level: 16997.96.

Analysis overview

The DAX (Germany) Elliott Wave Analysis on the daily chart provides an in-depth technical view of the market trend. This analysis identifies a clear trend direction, categorized as impulsive, indicating strong, directional movements with minimal corrections.

Wave structure

The current wave under analysis is orange wave 5, a part of the larger wave sequence within navy blue wave 3. This suggests it is a sub-wave within a broader impulsive movement.

Next higher degree direction

The analysis indicates that orange wave 5 has started, signifying that the larger wave pattern is in the final stages of its current sequence and is moving towards the completion of this impulsive phase.

Wave details

-

Completion: Orange wave 4 of navy blue wave 3 seems completed.

-

Current Activity: Orange wave 5 of navy blue wave 3 is now active, indicating an ongoing upward movement in this final sub-wave.

Critical levels

- Wave Cancel Invalid Level: 16997.96

- This level is critical as it invalidates the current wave structure if surpassed, necessitating re-evaluation and potential re-labeling of the wave counts.

Summary

The DAX (Germany) is currently in an impulsive trend mode on the daily chart, specifically within orange wave 5 of navy blue wave 3. With orange wave 4 completed, orange wave 5 of 3 is now active. The wave cancel invalid level at 16997.96 is a crucial threshold for maintaining the validity of this wave analysis. This analysis underscores the ongoing impulsive phase and the potential for a corrective phase once the current wave completes.

DAX (Germany) Elliott Wave technical analysis - Weekly chart

Trend analysis

Function: Trend.

Mode: Impulsive.

Structure: Orange wave 5.

Position: Navy blue wave 3.

Direction next lower degrees: Navy blue wave 4.

Current wave analysis

-

Details: Orange wave 4 of navy blue wave 3 appears completed. Now, orange wave 5 of navy blue wave 3 is in play.

-

Wave Cancel Invalid Level: 16997.96.

Analysis overview

The DAX (Germany) Elliott Wave Analysis on the weekly chart examines the market trend, identifying it as a persistent directional movement. The trend is impulsive, signifying strong, directional momentum with minimal corrective phases.

Wave structure

The current wave under analysis is orange wave 5, a part of the broader wave pattern within navy blue wave 3, indicating it is part of a larger impulsive wave sequence.

Next lower degree direction

The analysis points to navy blue wave 4 as the next wave direction, suggesting that after orange wave 5 concludes, the market will transition into navy blue wave 4, typically involving a corrective phase.

Wave details

-

Completion: Orange wave 4 of navy blue wave 3 seems completed.

-

Current Activity: Orange wave 5 of navy blue wave 3 is now active, indicating an ongoing upward movement in this final sub-wave.

Critical levels

- Wave Cancel Invalid Level: 16997.96

- This level is crucial as it invalidates the current wave structure if surpassed, requiring re-evaluation and potential re-labeling of the wave counts.

Summary

The DAX (Germany) is in an impulsive trend mode on the weekly chart, currently in orange wave 5 of navy blue wave 3. With orange wave 4 completed, orange wave 5 of 3 is now active. The wave cancel invalid level at 16997.96 is a critical threshold for maintaining the validity of this wave analysis. This analysis underscores the ongoing impulsive phase and the potential for a corrective phase once the current wave completes.

DAX (Germany) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.