DAX breaks down from a triangle [Video]

![DAX breaks down from a triangle [Video]](https://editorial.fxstreet.com/images/Markets/Equities/DAX/dax-macro-concept-57844002_XtraLarge.jpg)

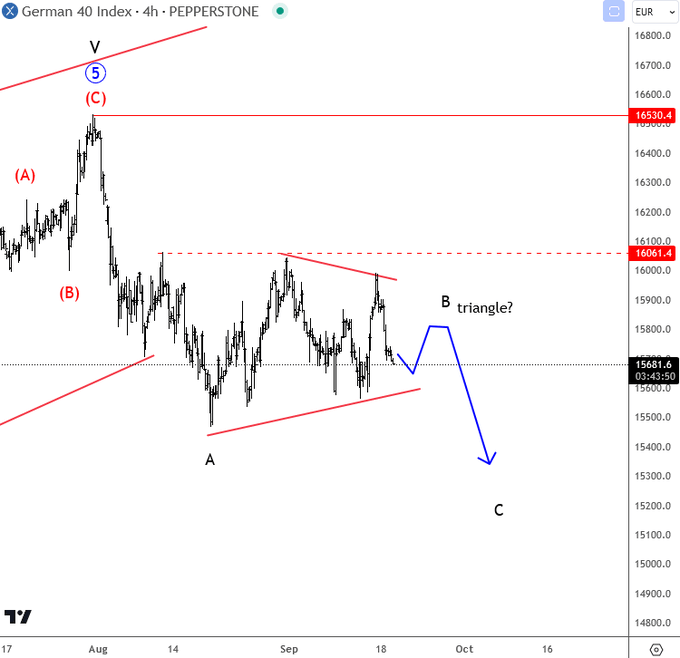

DAX is trading nicely as expected within a higher degree A-B-C correction as we have been warning our members in past updates. On September 6th we shared an article about a bearish development on DAX.

On September 19th we also shared a tweet about that deeper, higher degree A-B-C corrective decline, where we spotted a bearish triangle pattern in wave B.

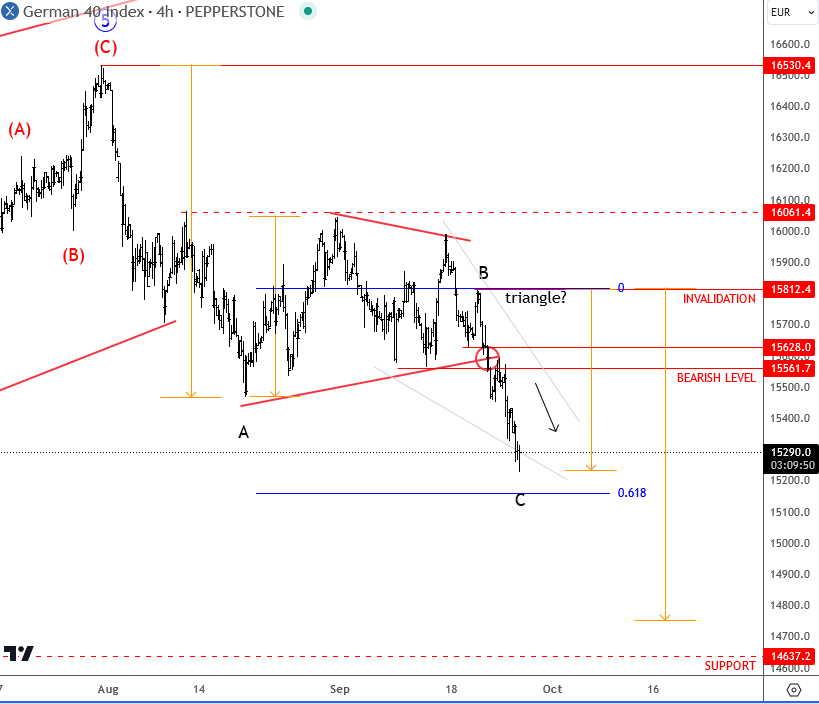

As you can see today, as expected DAX broke down out of wave B triangle into wave C, where index can be now hunting the 15k support.

DAX is bearish, now finally coming out of a triangle pattern as expected, so wave C is in play, ideally towards 15200-15000 area, index can look for some support, as higher degree correction from 16530 can come to an end down there. But of course, for any change in trend is not going to happen unless we see five subwaves up from the low. So for now, trend is down and can be looking for lower levels while 15812 swing high holds.

You can also check a quick short video about recent DAX development below:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.