Crude Oil in orbit around $70.00, looking for a weekly close above it

- Oil prices are in search to end the week on a high note by attempting to close above $70.00.

- Traders are torn in their choice between a possible short term upside against a long term bearish turnout.

- The US Dollar Index trades below 107.00 and fails to hold onto gains.

Crude Oil is making its way back above $70.00 this Friday in the US trading session with markets reluctant to dive into the rally seen earlier in the week. The OPEC+ report was a good element for Oil prices to head higher, but traders are still warning for the 2025 projections when President-elect Donald Trump will stay in the White House. Several commitments have already been put in place to drill more US Oil and become a bigger exporter in an already oversupplied market.

The US Dollar Index (DXY) – which measures the performance of the US Dollar (USD) against a basket of currencies – is holding on to gains ahead of next week’s Federal Reserve meeting. The Greenback is seeing inflow again with interest rate gaps widening between US against Chinese and European rates, fueling a stronger Greenback.

At the time of writing, Crude Oil (WTI) trades at $70.37 and Brent Crude at $73.80.

Oil news and market movers: Small upticks

- Oil producer Abu Dhabi National Oil Co., or Adnoc, has cut crude allocations to some Asian customers, according to equity and term lifters of the oil, Bloomberg reports.

- Weak fundamentals will pressure oil prices in 2025 as a looming supply glut mutes the effect of war risks, sanctions and OPEC+ cuts, Bloomberg analyst Pol Lezcano reports.

- The year-end scramble by US Oil suppliers to lower their tax bills typically spurs a December jump in crude exports. But seasonally low inventories on the Gulf Coast are set to buck that trend, analysts say, Reuters reports.

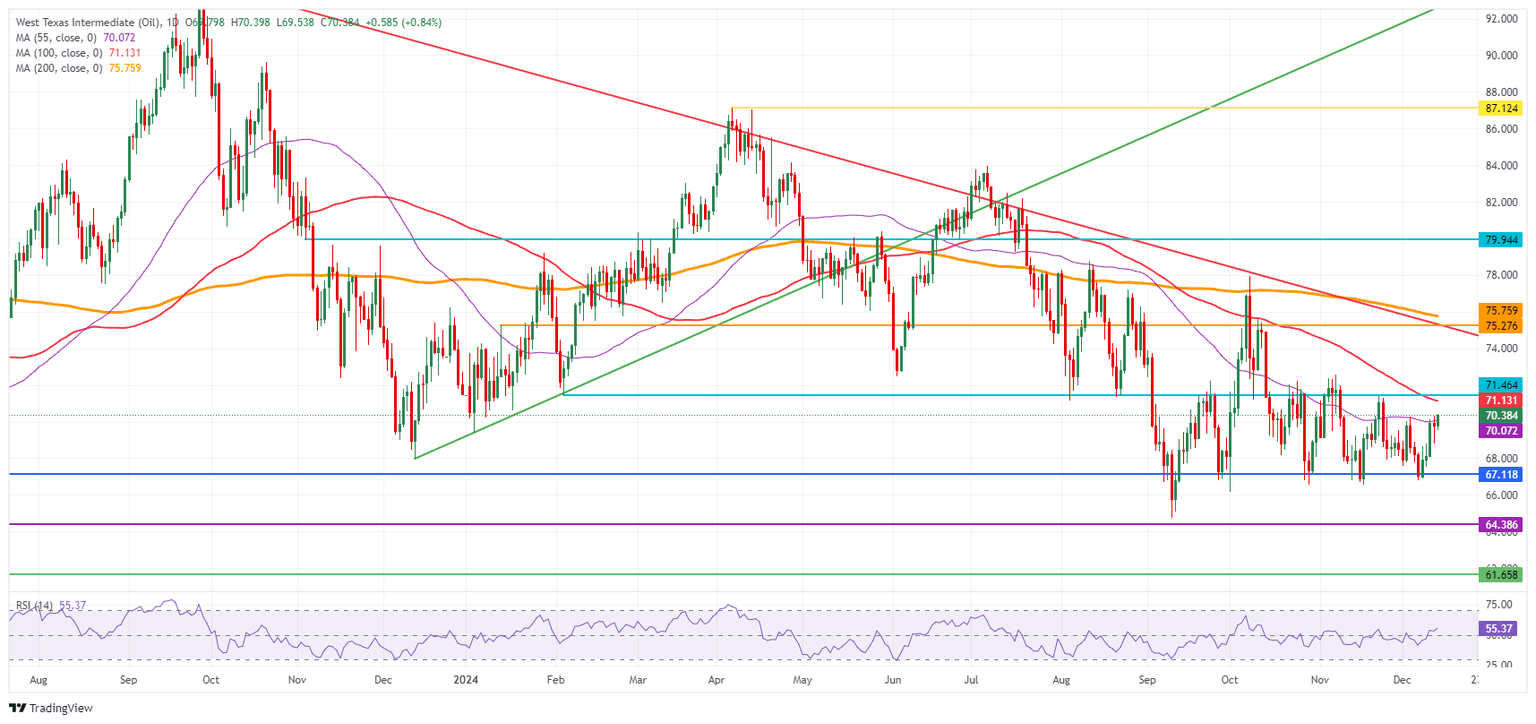

Oil Technical Analysis: Shaky end of the year

Crude Oil prices might have rallied, but traders are cautious about adding to that rally. With the year-end and the prospects of a new US President that favors drilling more Oil, any upside looks limited. Expect any uptick or leg higher to be short-lived, with profit taking bound to happen before the 2024 comes to an end.

The 55-day Simple Moving Average (SMA) at $70.06 is being tested and needs to see a hold and daily close above it in order to become support. Further up, $71.46 and the 100-day SMA at $71.12 will act as thick resistance. In case Oil traders can plough through that level, $75.27 is up next as a pivotal level.

On the downside, it is too early to see if the 55-day SMA will be reclaimed again at $70.06. That means that $67.12 – a level that held the price in May and June 2023 – is still the first solid support nearby. In case that breaks, the 2024 year-to-date low emerges at $64.75 followed by $64.38, the low from 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.