Crude Oil Price News and Forecast: WTI bulls tiring and need a further catalyst to fight off US shale production bias

WTI: Bulls capped at the 200-hour moving average

The price of a barrel of oil is topping out just below the 200-hour moving average and a prior support structure earlier in the month as traders get set for the EIA monthly report that will include an estimate for February shale oil production. West Texas Intermediate crude is currently trading at $58.51 having travelled between a low of $57.74 and $58.83.

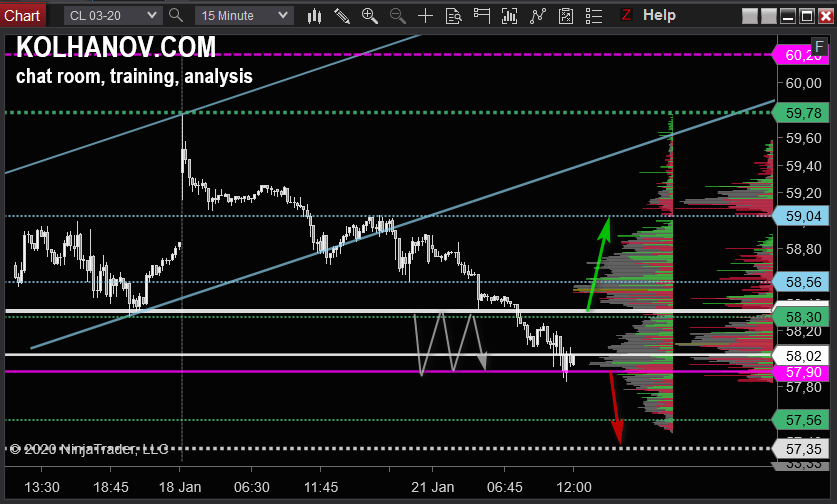

WTI Crude oil may start correction to 59.04 with break up of resistance 58.30

Uptrend

An uptrend will start as soon, as the pair rises above resistance level 58.30, which will be followed by moving up to resistance level 59.04.

Downtrend

An downtrend will start as soon, as the pair drops below support level 57.90, which will be followed by moving down to support level 57.35.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.