Crude Oil Futures: Scope for further pullbacks near term

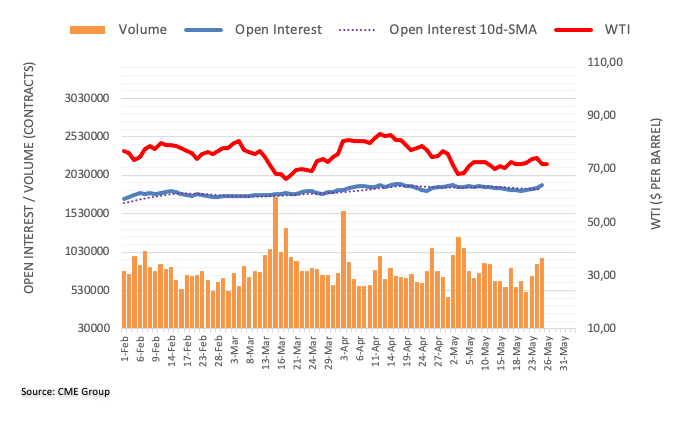

Open interest in crude oil futures markets rose for the fourth session in a row on Thursday, this time by around 38.5K contracts according to preliminary readings from CME Group. Volume followed suit and went up for the third straight day, now by more than 84K contracts.

WTI: Next on the downside comes $70.00

Thursday’s strong pullback in prices of WTI was on the back of increasing open interest and volume. That said, further losses now look likely and the commodity is expected to face the next support of note a the $70.00 mark per barrel so far.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.