Crude Oil dips lower with traders ignoring geopolitical unrest

- Crude Oil set to enter this Monday's trading session with negative numbers.

- Geopolitical tensions are on the forefront with intensified attacks in Lebanon over the weekend.

- The US Dollar Index holds near yearly lows ahead of Fed Chairman Powell’s speech later on Monday.

Crude Oil slides lower at the start of the week with traders writing off recent events as no game changer for the global Oil market. Overall, expectations are that Oil prices should get a lift this week, with Chinese measures boosting the demand for Oil in the region. On Sunday, additional measures were introduced by The People's Bank of China (PBoC) and the National Financial Regulatory Administration, with lower mortgage rates set to boost the housing sector.

The US Dollar Index (DXY), which tracks the performance of the Greenback against six other currencies, gears up for a week full of economic indicators on manufacturing and services activity and employment, ending with the monthly US Nonfarm Payroll release on Friday, although geopolitical tensions are the main theme. Tensions have been building up in Lebanon, where Israel kept bombing several parts of the country and might see Iran starting to get involved in the conflict.

At the time of writing, Crude Oil (WTI) trades at $67.68 and Brent Crude at $71.26

Oil news and market movers: Risk remains hanging over

- After Israel launched airstrikes against Houthi targets in Yemen and Hezbollah targets in Lebanon, the risk of a broad war in the Middle East is starting to pick up, The Wall Street Journal reports.

- On Monday, Bloomberg reported that the amount of crude oil held around the world on tankers that have been stationary for at least seven days rose to 60.76 million barrels as of September 27, which is 27% lower than a year ago and could point to a pickup in demand.

- Russia is stepping up its attacks on Ukraine’s key energy grid and power plants, with even the nuclear power plant at Zaporizhzhia being under attack, Reuters reports.

- Warren Patterson, head of commodities strategy at ING Groep NV in Singapore, has issued concerns about more upside for the Oil market. “The oil market has become increasingly numb to developments in the Middle East,” said Patterson, underlining the lack of impact on supply, Bloomberg reports.

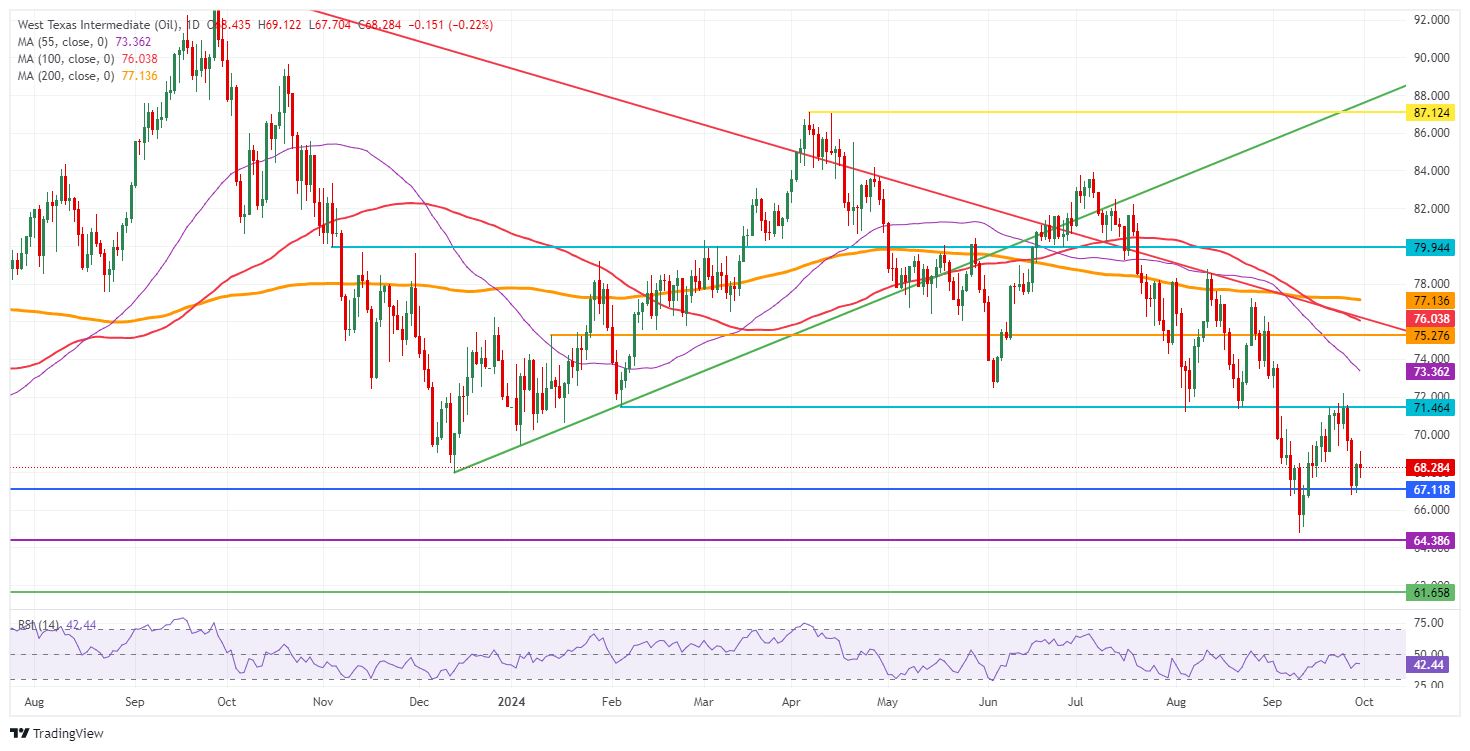

Oil Technical Analysis: Levels are risky

Crude Oil prices could still spiral higher, should geopolitical tensions start to spill over and trigger a proxy war in the Middle East. If Iran and Egypt would be pulled into the conflict, it would not take long before several emirate states would start to send military forces to the region as well. In that case, another risk premium would be needed to be priced in with prices set to rally back to $80.00 or higher.

At current levels, $71.46 remains in focus after a brief false break last week. If a supportive catalyst remains present, a return to $75.27 (the January 12 high) could play out. Along the way towards that level, the 55-day Simple Moving Average (SMA) at $73.36 could ease the rally a bit. Once above $75.27, the first resistance to follow is $76.03, with the 100-day SMA in play.

On the downside, $67.11, a triple bottom in the summer of 2023, should support any downturns and trigger a bounce. Further down, the next level is $64.38, the low from March and May 2023.

US WTI Crude Oil: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.