Crude Oil backslides after OPEC announces production increase, WTI eases to $68

- Crude Oil markets declined on Monday, sending WTI 2.5% lower.

- OPEC has announced a tentative agreement to begin increasing production.

- Challenges still lie ahead, as many OPEC members rely on high barrel prices.

West Texas Intermediate (WTI) Crude Oil prices took a tumble on Monday, falling 2.5% at the outset of the new trading week after the Organization of the Petroleum Exporting Countries (OPEC) announced a tentative agreement to begin ramping up Crude Oil production globally. OPEC has had trouble convincing its own cartel members of following through with production quotas; historically, OPEC member states are either desperate to sell more Crude Oil at any price so they can fund their government spending, or prefer to wait out low-production periods in order to bolster barrel prices, and thus raise Crude Oil prices.

According to OPEC’s announcement, the global oil cartel is due to begin a “gradual and flexible” increase of voluntary production caps in April, but with the caveat attached that this move is entirely dependent on a positive global growth outlook and “healthy market fundamentals”, which is typically code for “rising Crude Oil demand.”

US President Donald Trump has been pursuing lower Crude Oil prices as a part of his campaign platform, and OPEC appears set to throw the US President a bone. However, OPEC gave itself an out, noting that OPEC reserves the right to “pause or reverse the decision based on market conditions”.

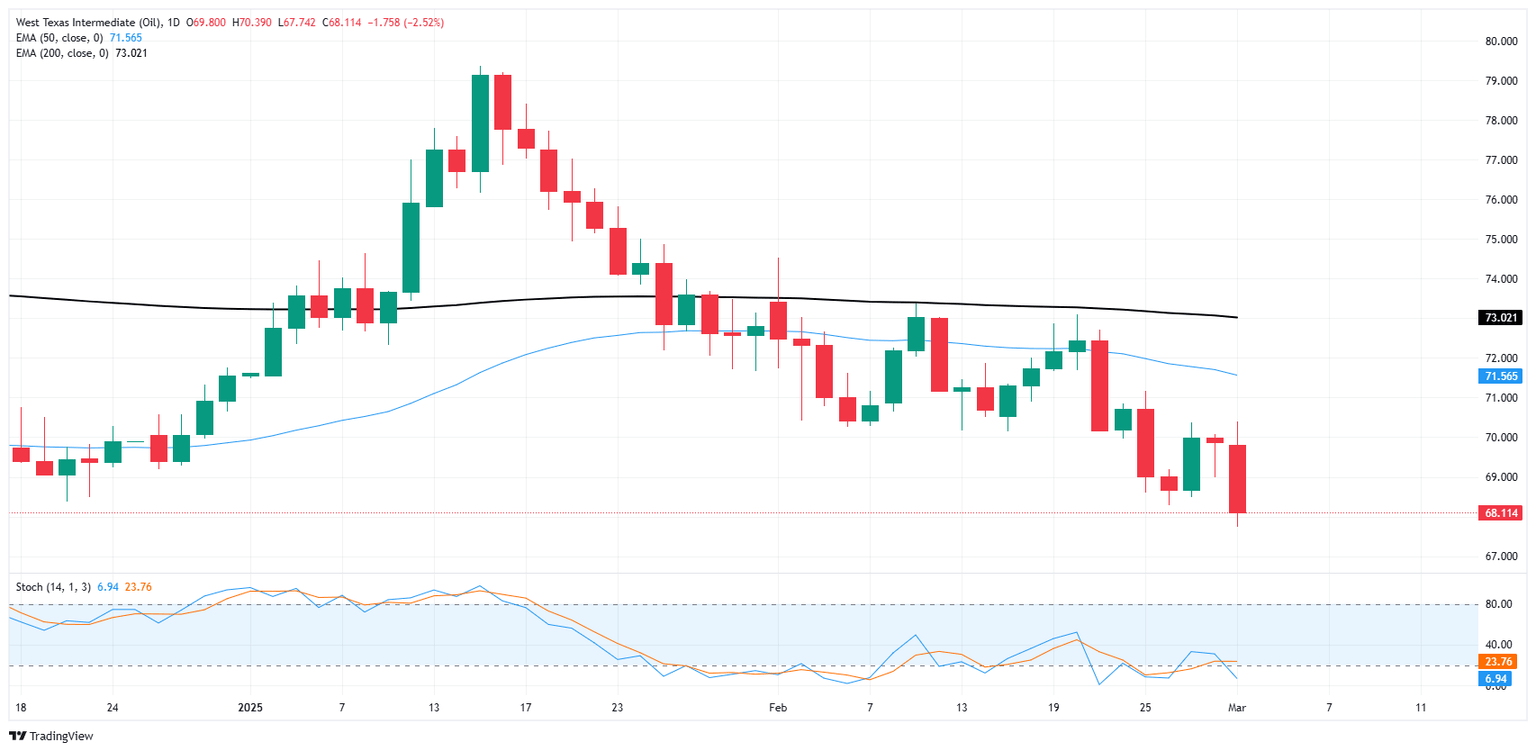

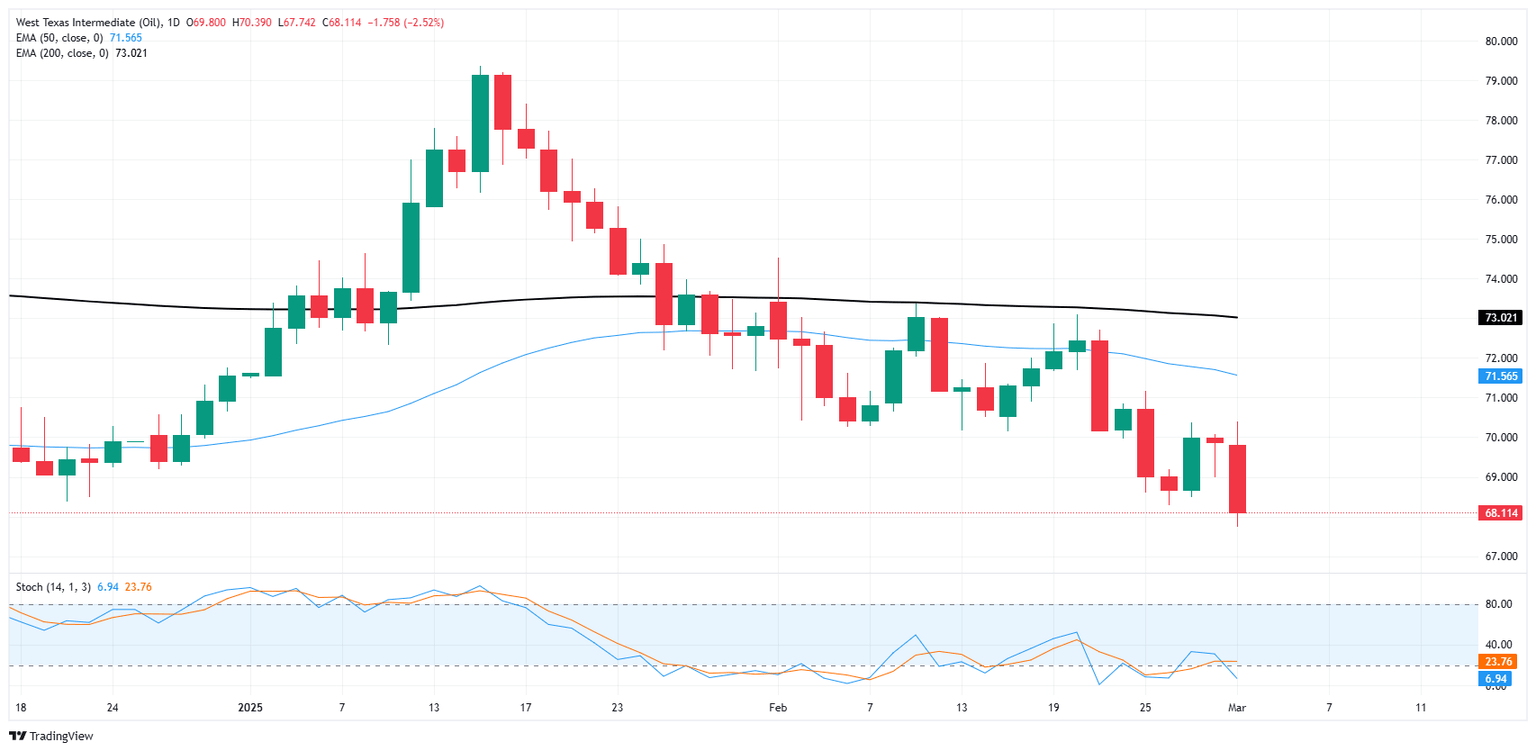

WTI price forecast

Monday’s sharp decline in WTI prices has pushed US Crude Oil barrel bids into fresh 12-week lows near $68.25. WTI has declined for the past six straight weeks, and Monday’s early declines put US Crude Oil prices on pace for a seventh week of weakness.

WTI bids are reeling following a technical rejection from the 50-day Exponential Moving Average (EMA) near $71.50, and January’s bullish push back above the 200-day EMA at the 73.00 handle has fizzled into a fresh bearish trend.

WTI daily chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.