Copper Price Analysis: Sinks almost 3%, eyeing a fall towards $3.2505 ahead of YTD lows

- Copper futures are nosediving due to fears of a worldwide economic slowdown, weighed by China’s PMI and other lockdowns in a 21.1 million city.

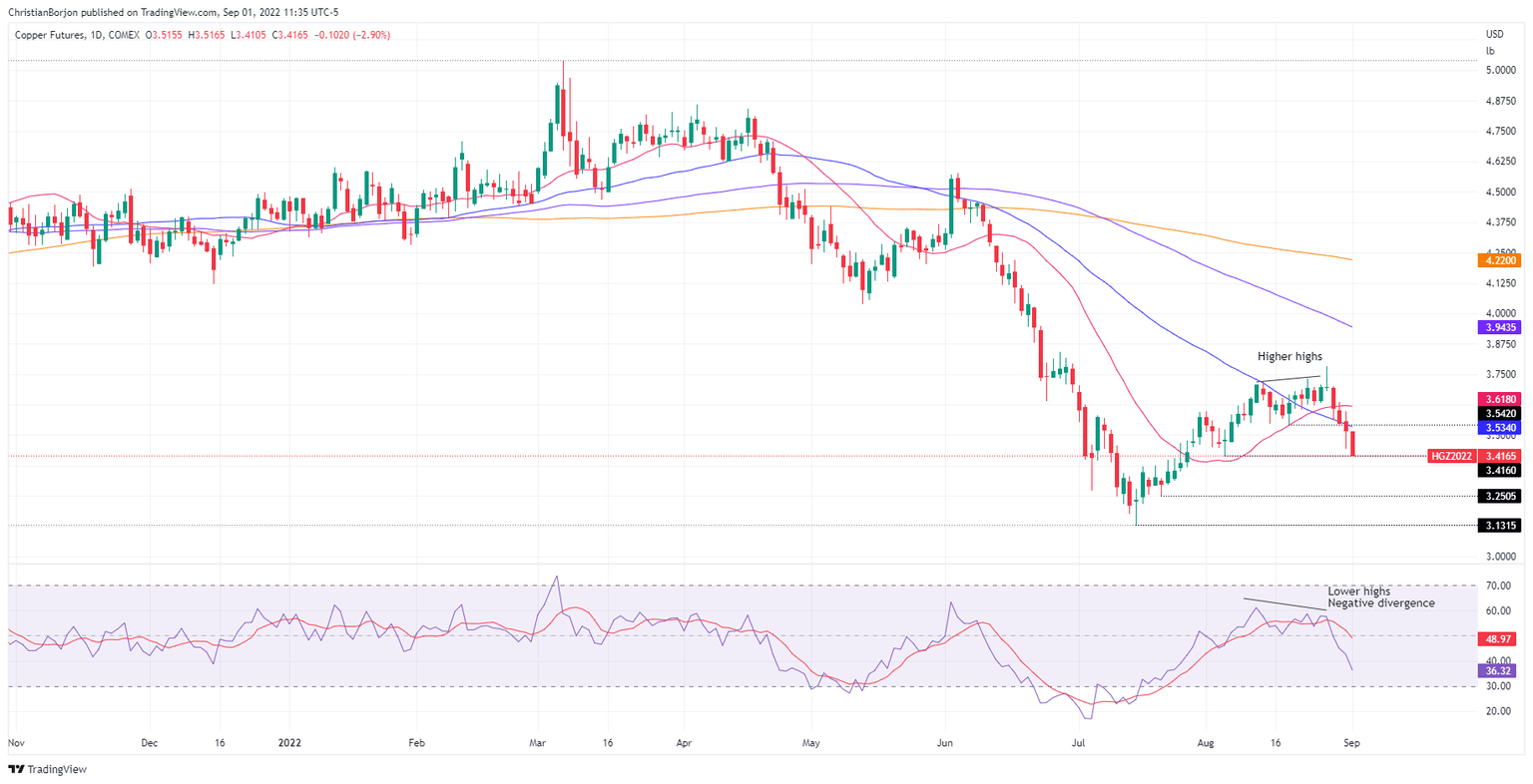

- Negative divergence in Copper’s daily chart, alongside fundamental, sent prices below the 20 and 50-DMA.

Copper futures are dropping to two-month lows at $3.4165, down almost 3%, on fears that China’s manufacturing activity contracted for the first time in three months, alongside expectations of a US economic deceleration prompted by the US Federal Reserve tightening monetary policy conditions.

Additionally, broad US dollar strength, alongside newswires that China’s Chengdu announced a lockdown of its 21.2 million residents, is a headwind for the red metal.

Also read: Copper drops from two-month highs due to global economic slowdown, speculators’ shorts

Copper Price Analysis: Technical outlook

The Copper daily chart depicts the pair as neutral-to-downward biased. It’s worth noting that the last copper article that I wrote noted that “the Relative Strength Index (RSI) recorded a successive series of lower highs, contrary to price action, meaning that prices are about to edge lower.” Since then, Copper tumbled below the 20 and 50-day EMAs, from around $3.6970. to $3.4105.

If Copper achieves a daily close below the August 4 daily low at 3.4160, it could send the red metal towards the July 21 swing low at $3.2505, followed by the YTD low at $3.1315. On the flip side, if Copper buyers reclaim the 50-day EMA at $3.6340, a re-test of the 20-day EMA at $3.6175 is on the cards.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.