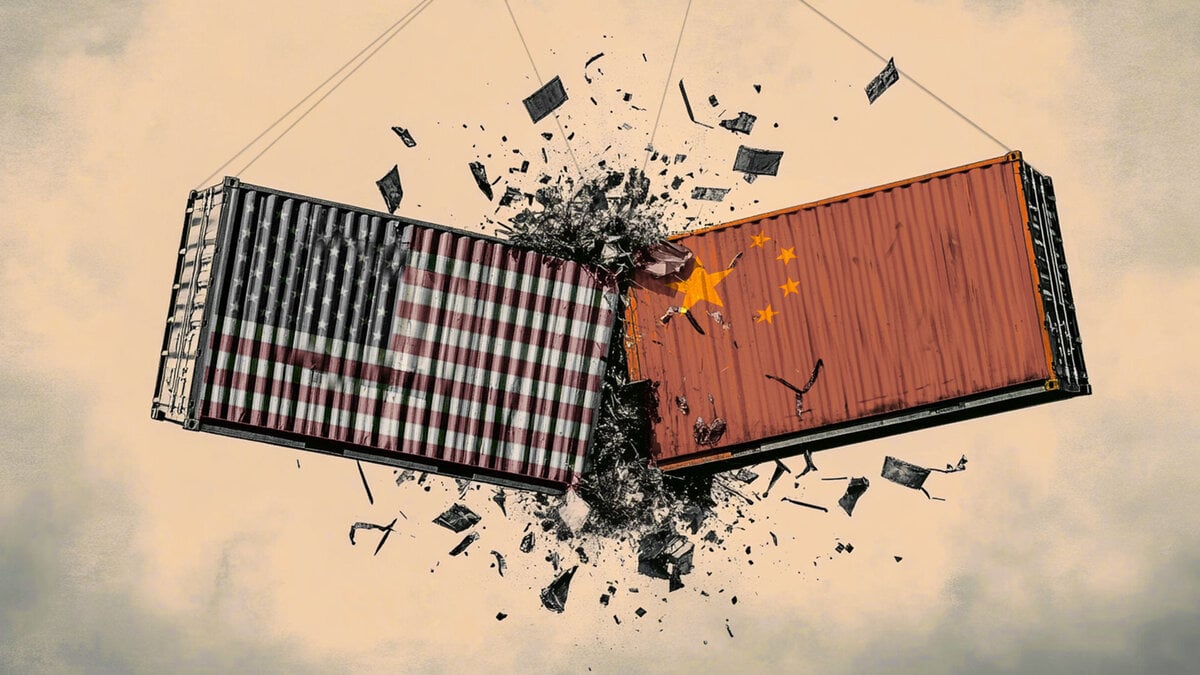

Conflict between the US and China picks up speed again – Commerzbank

US President Donald Trump seems to enjoy keeping people on their toes with his social media announcements every Friday. After causing turmoil the previous week with his threat of tariffs on EU goods, which he later backtracked on as we reported, the conflict with China resumed this Friday, Commerzbank's FX analyst Michael Pfister notes.

Trump reignites US-China trade conflict with new accusations

"First, Trump announced that China had violated the recent Geneva agreement, which had been welcomed by the market with great relief. For context, just a few weeks ago, the US and China reduced their high tariffs to a more manageable level to allow room for negotiation. Over the weekend, US Defence Secretary Pete Hegseth attended a security conference in Singapore. He appeared to be making a concerted effort to win back the support of Western and Asian partners, many of whom had become disillusioned with the US's erratic trade policy and, above all, its high reciprocal tariffs."

"This morning, the Chinese Ministry of Commerce responded in similarly strong terms, rejecting Trump's accusations and emphasising that it was the US that had violated the agreement by introducing new chip controls and cancelling Chinese student visas. It should now be clear to most market participants that, even if we see periods of short-term détente from time to time, the fundamental conflict between the two world powers cannot easily be resolved. Discussions are resuming as to whether Xi Jinping will call the US President this week to defuse the latest tensions, but this should not distract from the fact that the differences are too deep to be resolved quickly."

"Given all the contradictory statements we have heard from the US administration in recent months, I would be foolish to pretend that I know what the coming days will bring. There could be a U-turn and the announcement of further talks, but there could also be a renewed escalation, including threats of high tariffs. How the US dollar reacts to each scenario in the short term will depend heavily on its specific nature. In the long term, it will become increasingly clear that the US administration has no intention of abandoning tariffs. Even if US companies are currently holding back from passing on price increases to consumers due to the constantly changing tariffs, they will not be able to do so forever. Depending on the Fed's reaction at that point, it will be decided whether the US dollar will ultimately benefit from the tariffs."

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.