China CPI 0.9% YoY vs expected 1.0% / PPI 6.8% YoY vs the expected 6.5%

China inflation figures for April arrived as follows:

Consumer Price Index 0.9% YoY (vs the expected 1.0%) & PPI 6.8% YoY( vs the expected 6.5%).

The markets have not reacted with AUD/USD holding at the hourly DM pivot point near 0.7830.

AUD/USD technical analysis

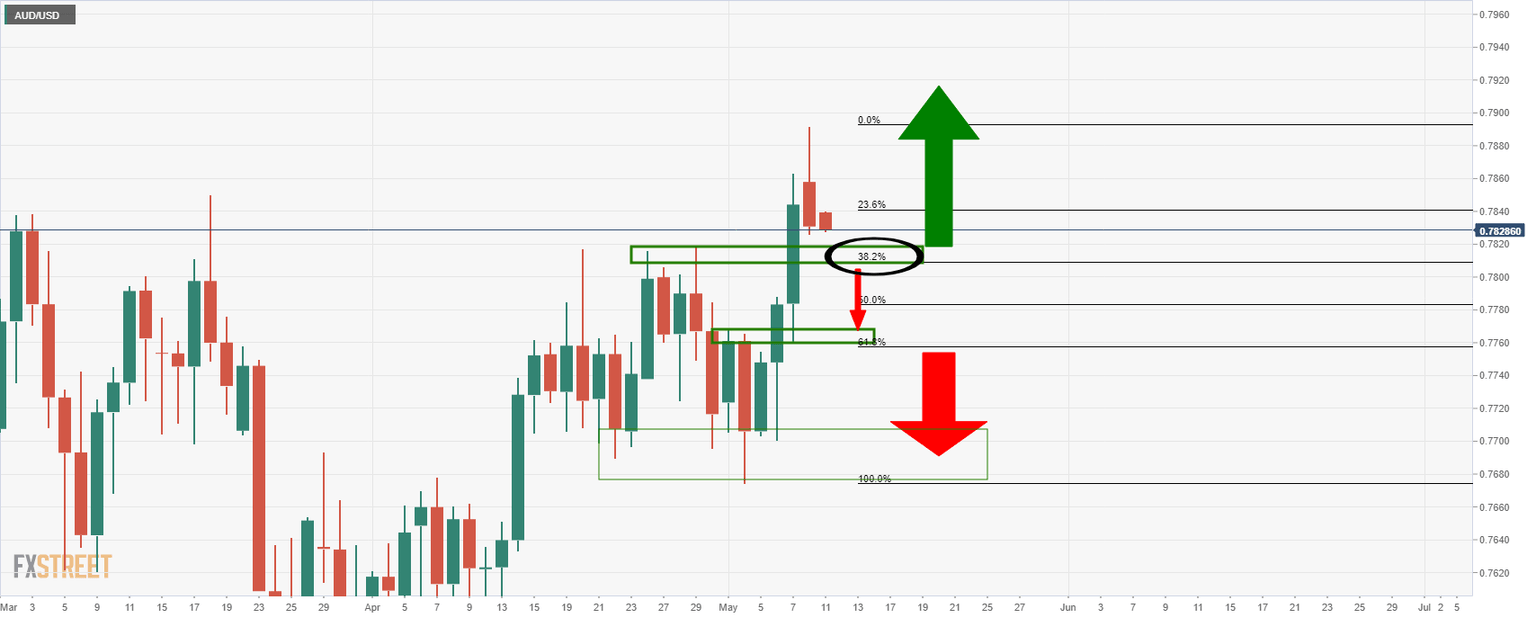

AUD/USD Price Analysis: Bears seeking a deep correction

A per the prior analysis from earlier in the day, ''AUD/USD has given back a sizeable amount of the bullish impulse over these past few sessions and the bulls need to commit to the purpose above a critical 38.2% Fibonacci retracement of the daily impulse.

The following illustrates the market structure on both a daily and 30-min time frame.''

Daily chart

Description

The Consumer Price Index is released by the National Bureau of Statistics of China. It is a measure of retail price variations within a representative basket of goods and services. The result is a comprehensive summary of the results extracted from the urban consumer price index and rural consumer price index.

The purchase power of the CNY is dragged down by inflation.

The CPI is a key indicator to measure inflation and changes in purchasing trends. A substantial consumer price index increase would indicate that inflation has become a destabilizing factor in the economy, potentially prompting The People’s Bank of China to tighten monetary policy and fiscal policy risk.

Generally speaking, a high reading is seen as positive (or bullish) for the CNY, while a low reading is seen as negative (or Bearish) for the CNY.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.