CCIV Stock Price: Lucid Motors Churchill Capital IV extends falls as Lucid/Dolby news fails to impress

- CCIV shares have languished around $30 since merger confirmation.

- CCIV and Lucid will face increasing competition from legacy manufactures.

- CCIV and Lucid aiming for the luxury end of the market.

Update March 4: Churchill Capital Corp IV (NYSE: CCIV) has kicked off Thursday's trading with a drop of over 1%, sending shares to below $24, a level that was last seen in late January. It seems that the "sell the rumor" impact from the Lucid Motors merger remains the dominant driver. Churchill is shrugging off the rise in broader markets and also an upcoming announcement from Dolby and Lucid, due at South by Southwest in two weeks' time.

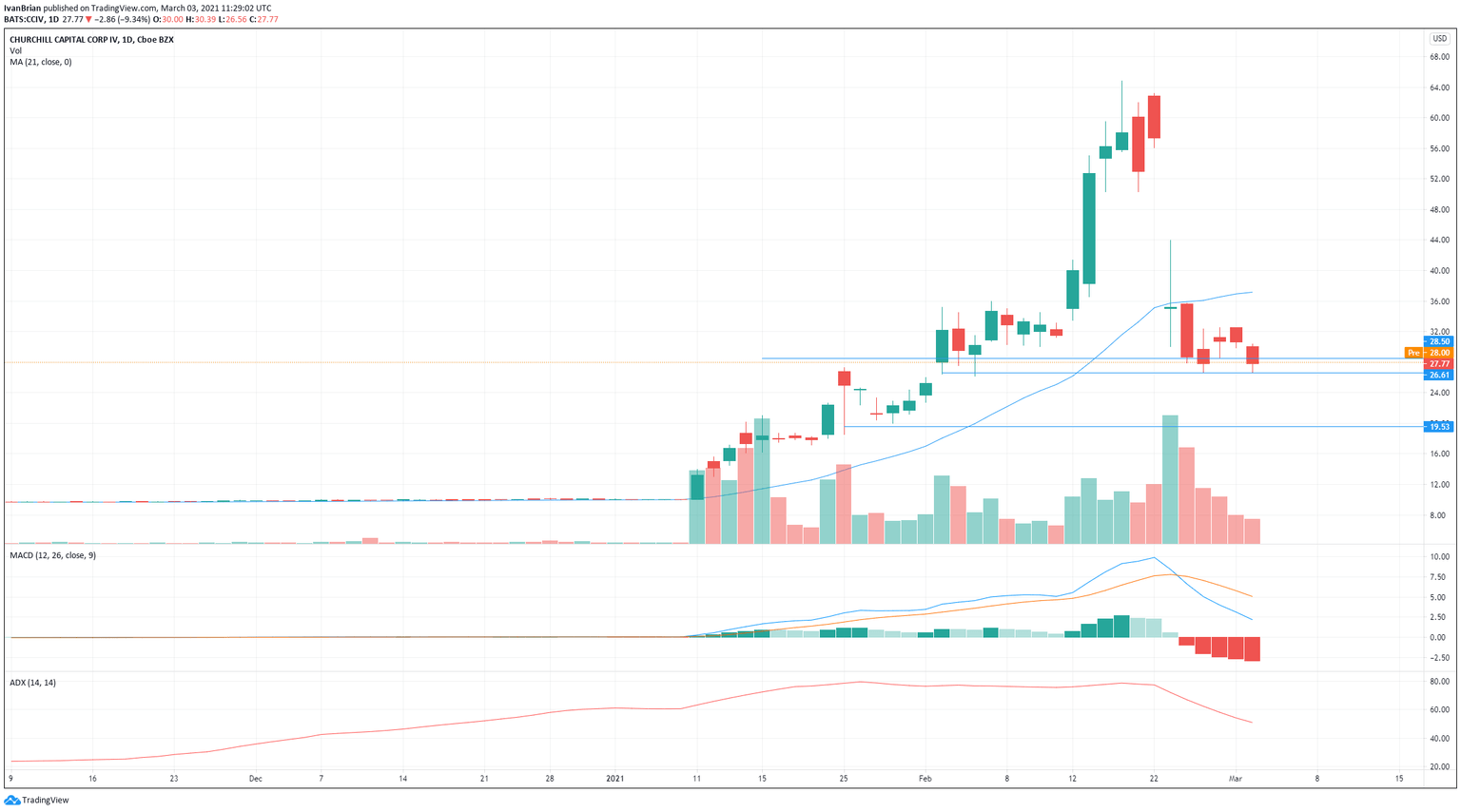

CCIV shares closed at $27.77 on Tuesday, a loss of 9%. Shares have suffered a fall of over 50% since the merger deal with Lucid Motors was confirmed.

Stay up to speed with hot stocks' news!

Lucid Motors Stock Price

Where will the share price go now that it is essentially Lucid Motors and what has led the share price here? Well CCIV shares had spiked to nearly $65 as the frenzy over the rumoured merger with Lucid reached boiling point. Social media was abuzz with talk of the Churchill Lucid merger. But what many failed to realize was that in the event of the deal progressing there was likely to be a further capital raise needed. Easy to say with hindsight but this is what duly happened, with the PIPE transaction being priced at $15. CCIV shares quickly moved to $30 once the details of the merger became clear and CCIV stock has been trading around this level since.

See latest in the electric vehicle sector

CCIV Stock forecast

From here it becomes a case of trying to value what Lucid is offering. Not an easy task, especially in the short term. What is clear given the model lineup and prices touted is that Lucid is going for the luxury sector of the vehicle market. For now, none of the mainstream auto manufactures captures the high-end electric vehicle (EV) segment and Tesla has been the standard-bearer here. Not just for the luxury end of the EV sector but for the entire EV sector. Tesla is a luxury brand but Lucid looks to be going after an even higher price point initially before branching out into lower price and SUV segments, but this will take time.

Lucid clearly has the know-how, with a former Tesla chief engineer as CEO but the EV sector is about to become just the normal auto sector as all manufacturers move to electric vehicles. So stand-alone EV companies are about to face a whole range of competitors.

Volvo announced on Tuesday that its entire range will be fully electric by 2030. Ford announced in February that its range in Europe will be fully electric by 2030. Jaguar Landrover said its Jaguar brand will be entirely electric by 2025 and fully electric across Jaguar and Landrover by 2030.

This is a timeframe of 2025-2030 so 4-9 years. Lucid doesn't expect to be cash-flow positive until 2025 with new models coming on stream in 2022 and 2023 and plans to launch a rival to Teslas Model 3 in 2024-2025. Given competition is going to markedly ramp up from legacy automakers, this makes achieving those goals even more important, to establish market share and differentiation with customers and not be just another car brand.

It is essential for Lucid to deliver on its timeline and to scale up production and brand awareness and exclusivity. Recent details from Lucid that the Air Dream edition is virtually sold out will certainly help as will Lucid's CEO saying they are gradually ramping up production in Arizona to 400,000.

Lucid is now well funded, has a management team and CEO who knows the EV industry well. Shares may tread water until the actual launch of its first model or some other news event, launch date announcement, etc. First deliveries are due to be the second half of 2021, initially, it was hoped to be Spring 2021.

Previous updates

Update March 4: Churchill Capital Corp IV (NYSE: CCIV) has closed Wednesday's trading session with a sharp fall of 12.86% to $24.20, extending its falls from the highs. The SPAC blank-check firm is now worth less than half of what it was worth at the peak, following a "buy the rumor, sell the fact" pattern in response to the merger with Lucid Motors. However, bulls are clinging to an upcoming announcement by the electric vehicle firm and Dolby. Both are set to lay present a collaboration at the SXSW event on March 17. Will that be a breakthrough for Lucid and CCIV shares? There is still time to speculate.

Update March 3: Churchill Capital Corp IV (NYSE: CCIV) shares have kicked off Wednesday's session with a slide of over 2%, changing hands at $27.10 at the time of writing. Investors seem to continue the "buy the rumor, sell the fact" response to the announced SPAC merger with Lucid Motors. However, some analysts see a switch of patterns on the horizon – an upcoming "buy the dip" move once the dust settles.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.