Canadian Dollar steadies following a post-NFP reversal

- Canadian Dollar drops for second consecutive day amid higher US Dollar.

- Strong US employment data boosts US Treasury yields, US Dollar.

- In Canada, strong Ivey PMI data eases downside pressure on Canadian Dollar after disappointing labour figures.

The Canadian Dollar (CAD) has regained some ground during Friday's US trading session. The loonie tumbled on a combination of a stellar US employment report and weak Canadian labor figures to regain lost ground as the impact of the data eased.

US Nonfarm payrolls increased well beyond expectations in March, triggering a bullish reaction on US Treasury yields and the US Dollar. A closer look at the data, however, revealed that the yearly wage growth eased to its lowest rate in years. This has kept hopes of Fed rate cuts alive, despite the hawkish comments by Fed Governor, Michelle Bowman.

In Canada, net employment levels have declined against expectations in March. The negative impact, however, has been offset by the strong improvement of March’s Ivey PMI, which has given some support to the Canadian Dollar.

Daily digest market movers: USD/CAD dips further as US NFP beat expectations

- The Canadian Dollar has taken back some of the ground lost after the release of the US Nonfarm Payrolls Report although it still remains negative on the daily and weekly charts.

- US Nonfarm Payrolls increased by 303K in March from 270K in February, well above the 200K forecasted by market experts.

- Average Hourly Earnings have increased at a 0.3% monthly pace and 4.1% year on year from 0.2% and 4.3% respectively in February.

- Canadian Ivey Purchasing Managers’ Index has improved to 57.7, its best reading over the last 12 months, from 53.9 in February.

- Somewhat earlier, Canadian employment data disappointed investors with a 2.2K decline in March after a 40.7K increase in February. The market was expecting a 25K increase.

- Fed Governor Bowman warns that an additional rate hike will be needed if inflationary pressures remain high.

- On Thursday, Fed Powell reiterated that the central bank needs more time to decide on rate cuts, while Fed Kashkhari warned that there might not be any rate cut this year, which sent the USD higher.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.01% | 0.01% | 0.30% | 0.07% | 0.18% | 0.19% | 0.00% | |

| EUR | 0.01% | 0.02% | 0.30% | 0.09% | 0.18% | 0.21% | 0.01% | |

| GBP | -0.01% | -0.02% | 0.28% | 0.06% | 0.18% | 0.19% | -0.01% | |

| CAD | -0.30% | -0.31% | -0.29% | -0.23% | -0.12% | -0.10% | -0.29% | |

| AUD | -0.07% | -0.08% | -0.06% | 0.24% | 0.11% | 0.13% | -0.08% | |

| JPY | -0.18% | -0.18% | -0.17% | 0.10% | -0.12% | 0.01% | -0.19% | |

| NZD | -0.21% | -0.20% | -0.19% | 0.11% | -0.12% | -0.01% | -0.21% | |

| CHF | 0.00% | -0.01% | 0.01% | 0.29% | 0.06% | 0.19% | 0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

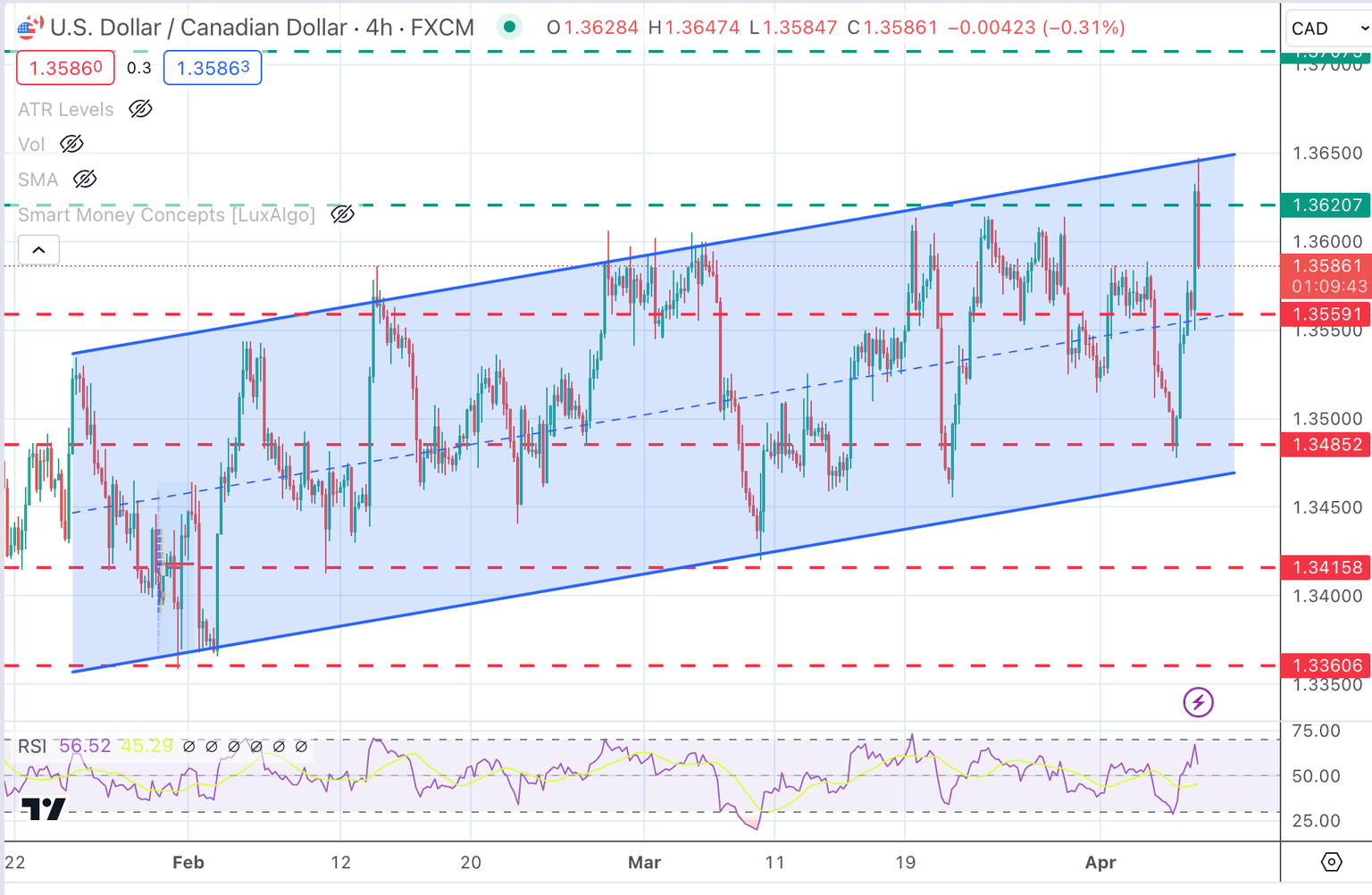

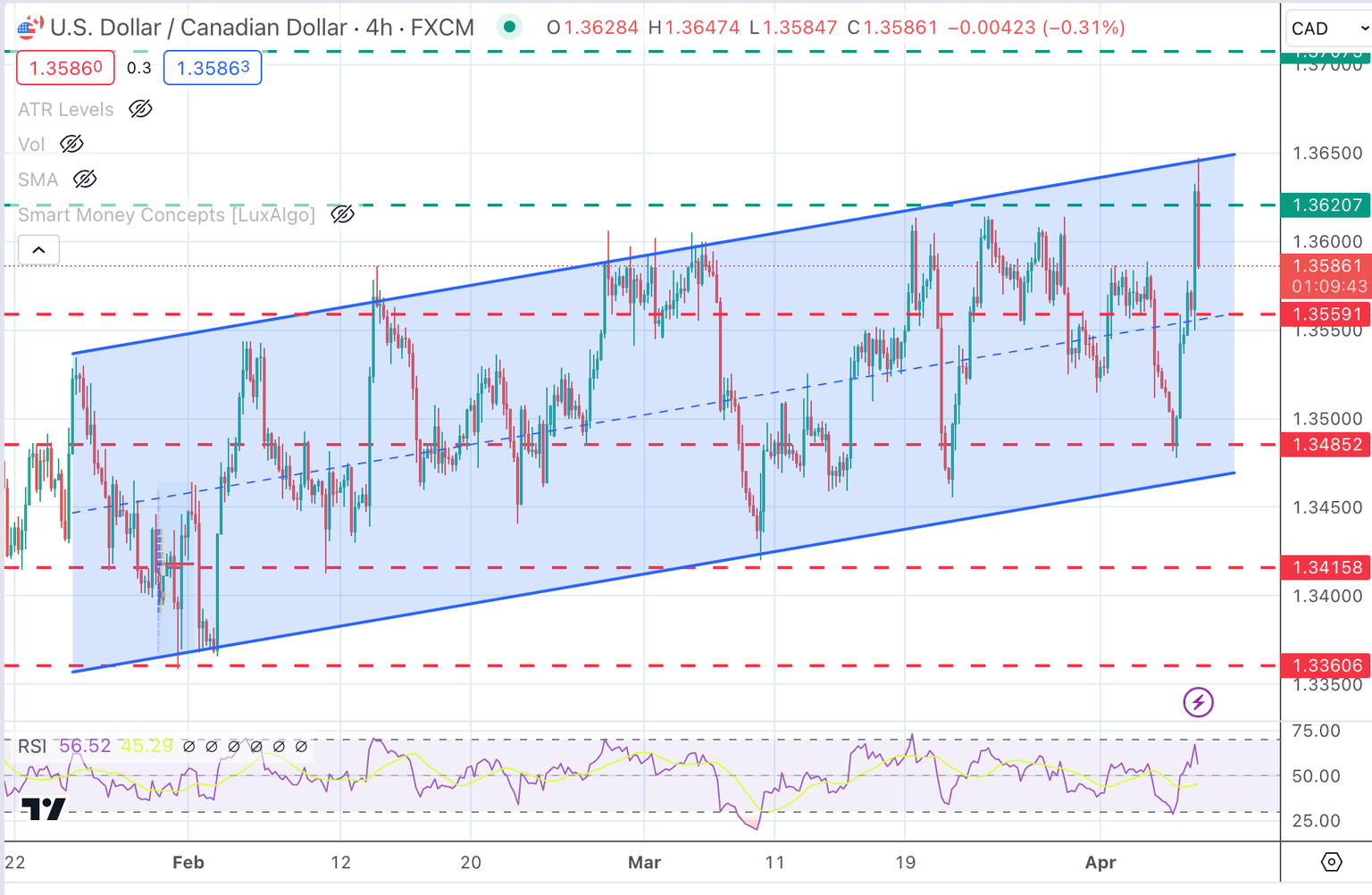

Technical analysis: USD/CAD fails to break resistance at the 1.3640 area

The strong US employment data has sent the USD/CAD to test an important resistance area above 1.3620, which so far remains intact, as positive Canadian PMI data has eased bullish pressure on the pair.

The overall picture shows the US Dollar trading back and forth within an ascending channel with price action capped below trendline resistance at 1.3640. Above here, the next targets are 2.3710 and 1.3770. The channel’s measured target is 1.3845. Support levels are 1.3560 and 1.3485.

USD/CAD 4-Hour Chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.