Canadian Dollar snaps winning streak as US Dollar pares losses

- The Canadian Dollar fell on Thursday, driven lower by a mild recovery in US Dollar flows.

- Crude Oil markets faltered, reversing early gains and removing further support from the Loonie.

- US Initial Jobless Claims and Services PMI data both beat the street, keeping Fed rate cuts at bay.

Read the latest Canadian Dollar news: Canadian Dollar extends declines against US Dollar on renewed Trump tariff threats

The Canadian Dollar (CAD) faltered on Thursday, snapping a four-day winning streak and giving back ground to the US Dollar (USD). The USD/CAD pair has been bolstered back above 1.3600, and Loonie flows are reversing direction on multiple fronts, thanks to better-than-expected economic data out of the United States (US).

Canadian Retail Sales figures came in near expectations, but expectations have been geared sharply lower. Canadian consumer spending habits continue to show cracks as a slow-moving trade war with the US exacerbates recession indicators.

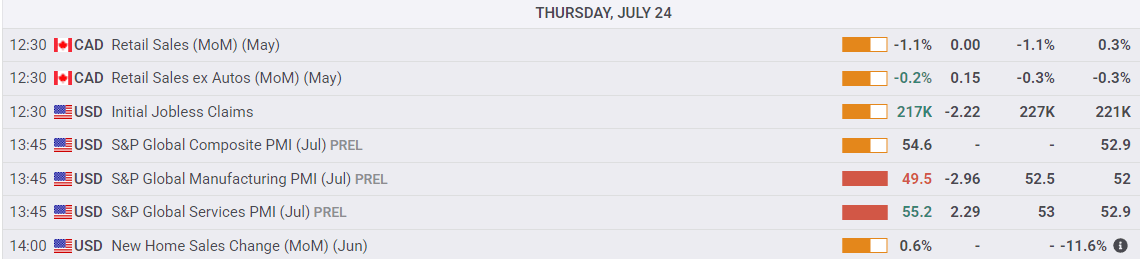

Daily digest market movers: Sharp Canadian Retail Sales contraction and falling Fed rate cut hopes drag on Loonie

- Canadian Retail Sales contracted by 1.1% in June, the largest MoM decline in 12 months.

- The Trump administration is poised to allow key US energy companies to resume Crude Oil extraction in Venezuela, hitting West Texas Intermediate (WTI) barrel prices and further pressing down on the Loonie.

- Venezuela has been locked out of the US market since sanctions were put in place in 2019, and the potential addition to already-existing supply overhang is chipping away at energy market confidence.

- US Services PMI data rebounded sharply in July, overshadowing a general decline in Manufacturing PMI figures.

- US weekly Initial Jobless Claims also fell slightly to 217K, highlighting general labor market strength that is keeping further Federal Reserve (Fed) rate cut hopes at bay.

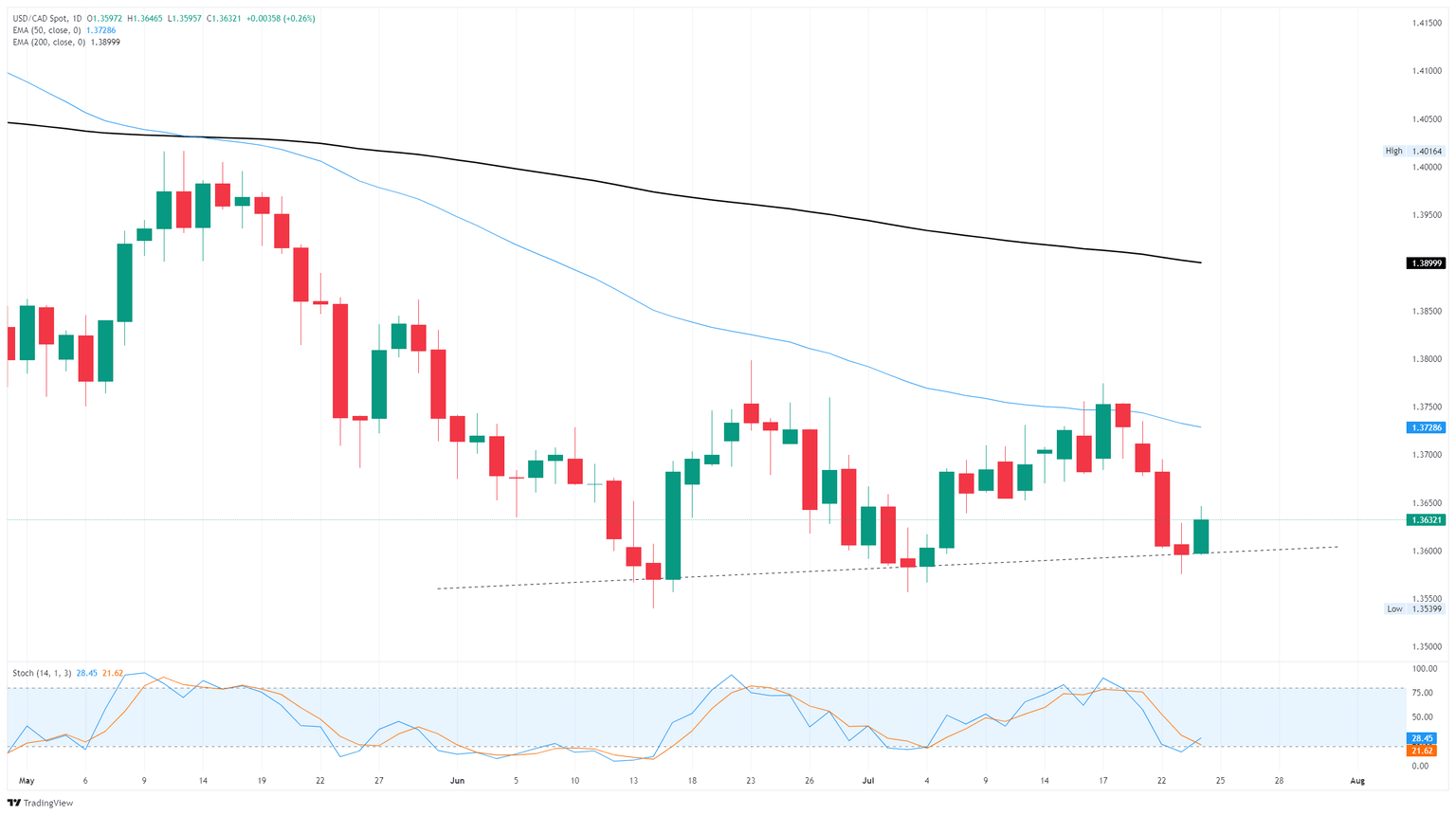

Canadian Dollar price forecast

Thursday’s general reversal in both US Dollar and Canadian Dollar flows has bumped the USD/CAD pair back above 1.3600, drawing a sharp turnaround from the key technical level. Immediate price action is poised to get caught in a chart trap between a messy support zone below 1.3600 and the 50-day Exponential Moving Average (EMA) near 1.3730, and technical oscillators are recoiling from mildly oversold conditions, implying USD/CAD is set to chalk in another leg of a consolidation range that is developing on daily candlesticks.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.