Canadian Dollar gains ground as tariff complexity deepens

- The Canadian Dollar rose against the US Dollar on Thursday.

- President Trump’s tariffs have been knocked down by federal courts, at least for now.

- Canadian Current Account figures came in higher than expected ahead of key Canadian GDP and US inflation figures.

The Canadian Dollar (CAD) found some room to the high side on Thursday, gaining ground against the US Dollar (USD) as broad-market flows pull away from the Greenback. United States (US) President Donald Trump’s long-running trade approach, which involved threatening and then mostly canceling tariffs, hit a hard wall on Wednesday. Federal judges in the US Court of International Trade (USCIT) struck down the Trump administration’s misuse of the International Emergency Economic Powers Act (IEEPA) to impose sweeping import taxes globally.

The Canadian Current Account trade balance fell less than expected in the first quarter, with a widening of the goods and services trade deficit offset by more direct investment than analysts had expected. Much of Canadian trade saw a flurry of money flowing in both directions as firms spent the first quarter stockpiling resources or selling off excess inventory ahead of the Trump administration’s “reciprocal” tariff package, unveiled on April 2.

Daily digest market movers: Canadian Dollar catches a bid on Greenback weakness

- The Canadian Dollar gained one-quarter of one percent against the US Dollar on Thursday, but remains firmly within near-term technical ranges.

- US federal judges knocked down the Trump administration’s use of the IEEPA to impose across-the-board tariffs, stating that the White House’s interpretation of the law runs afoul of its bounds.

- The Trump administration is expected to rush the appeals process to bring the case before the Supreme Court, which has a history of ruling in favor of President Trump.

- Ongoing political turmoil has investors balking at the prospect of continued uncertainty regarding trade policy. Markets are also waiting to see what legal mechanisms the Trump administration will attempt to deploy to circumvent the USCIT ruling.

- Canada’s Q1 Current Account shrank by just $2.1B in Q1 2025 versus the expected $3.25B contraction.

- According to StatsCan, direct investment inflows helped to offset some of the goods and services trade balance:

- Physical imports rose 5.3% QoQ, hitting a record quarterly high of $212B, much of it focused on automotive vehicles, auto parts, and industrial machinery.

- Physical exports also rose 5.3% QoQ, concentrated in automotives and parts, energy, and industrial equipment.

- Imports and exports of services both declined as firms spent the first quarter focused on getting ahead of the Trump administration’s tariffs.

- An overall widening of the trade deficit was offset by record foreign investment, with Canadian investors picking up over $36.5B in foreign bonds and equities.

- Canadian Q1 Gross Domestic Product (GDP), slated to release on Friday, is expected to show that economic growth slowed to just 1.7% on an annualized basis versus the previous quarter's 2.6%.

- US Personal Consumption Expenditure Price Index (PCE) inflation for April is also due on Friday. US PCE is expected to dip slightly to 2.5% YoY from 2.6%, while the MoM figure is forecast to tick up to 0.1% from March's flat 0.0%.

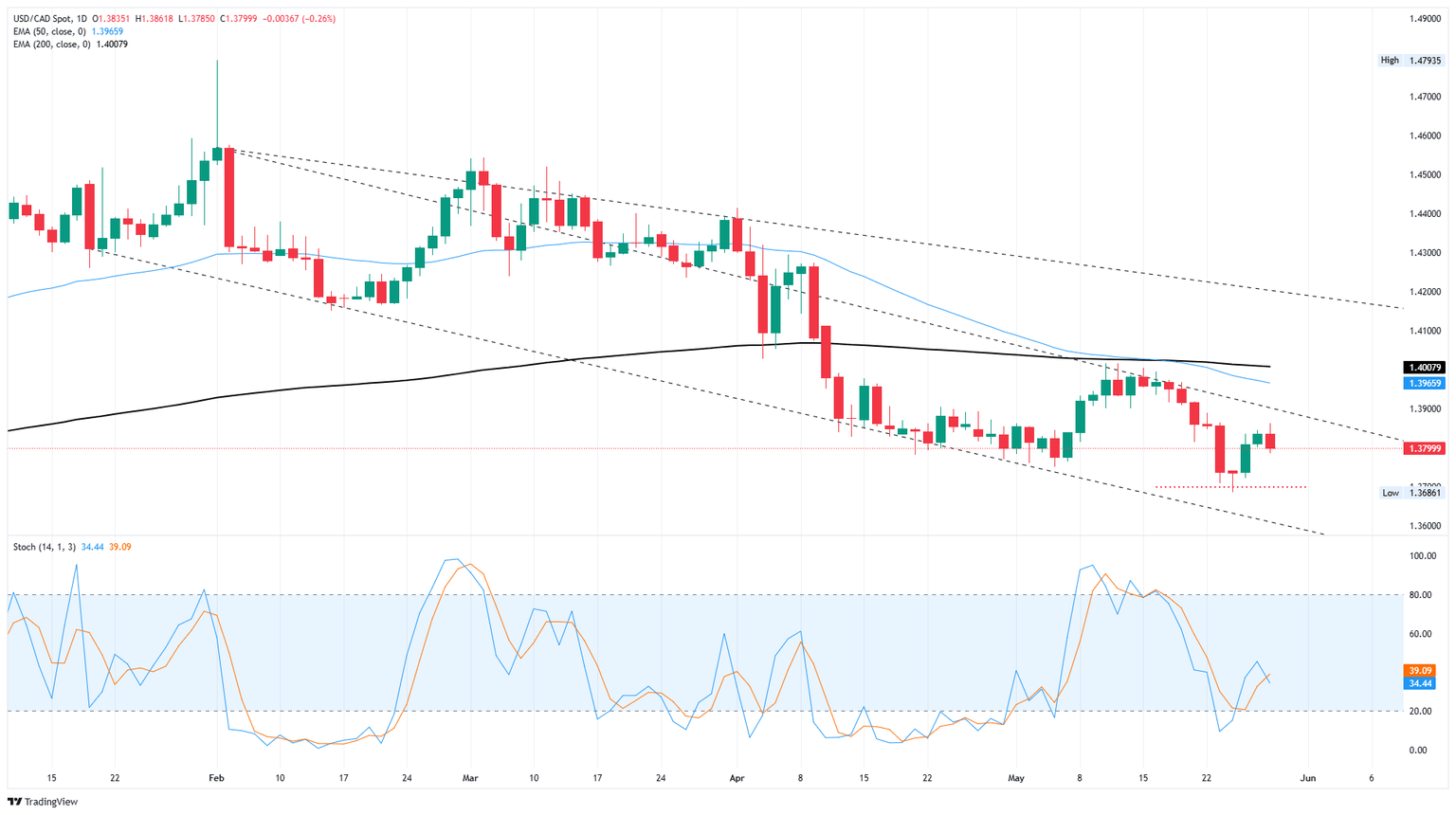

Canadian Dollar price forecast

The Canadian Dollar caught an intraday bid against the Greenback on Thursday, but the Loonie remains caught on the wrong end of a near-term pullback against the US Dollar. The USD/CAD pair remains trapped in a back-and-forth spin cycle around the 1.3800 handle. However, the pair is still following a downward channel as the US Dollar steadily loses ground against the Loonie from two-decade highs posted in February.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.